Landserve expects Johor landed house prices to drop a maximum of 30%

He told TheEdgeProperty.com after his presentation at the 10th Malaysian Property Summit 2017 that landed residential property prices are on the downtrend.

“Landed property prices in new prime areas, such as Nusajaya, have been declining in the past two years at an average pace of 15% to 20%. I don’t think the dust has settled yet but many things could happen. However, considering the downtrend, landed property prices in Johor may see a maximum 30% dip,” Wee said. He sees this as a ““market self-adjustment”.

“Properties there were so hot and selling at quite a high price so even if landed residential property prices drop another 20%, [I] think the market would still be healthy,” Wee noted.

He said about 13,000 landed housing units are coming into the market in 2017/2018. “Although landed homes are still in demand, the absorption speed can’t beat the incoming supply.”

Nonetheless, he remains optimistic about new projects with units priced around RM400,000 to RM600,000.

Wee was one of the speakers at the summit organised by the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia held yesterday at the Sime Darby Convention Centre, Kuala Lumpur.

The market will be even tougher for the non-landed residential segment.

“There are about 25,000 units flooding the market this year, next year will be another 24,000 units. The oversupply issue is not only causing stagnant sales, it has also affected the prices of existing stock, he said during his presentation on the “Southern region market performance and outlook”’at the summit.

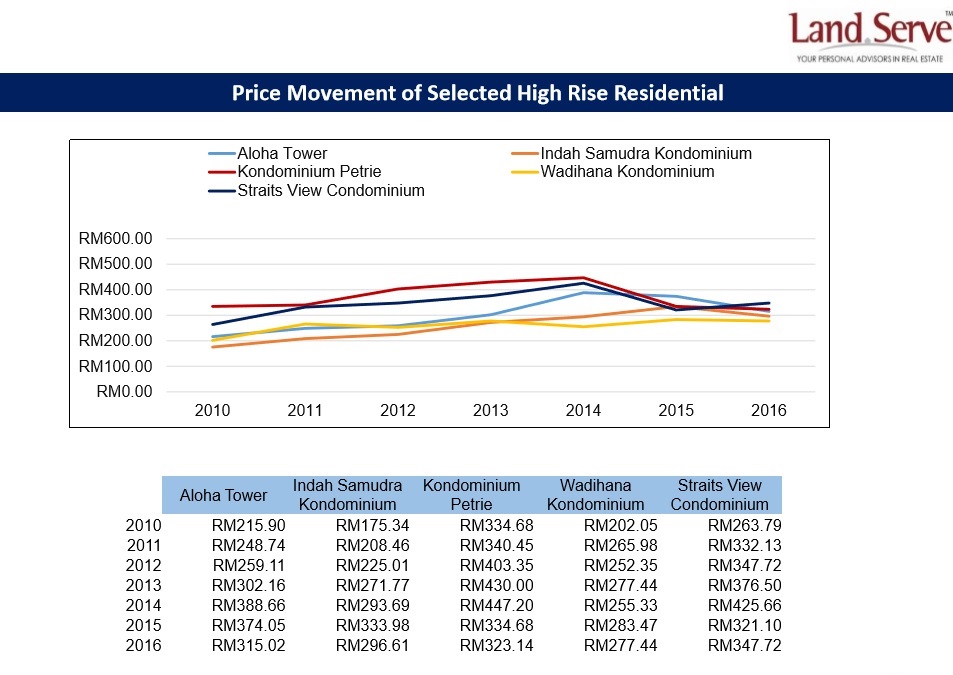

His data showed that five of the most established high-rise residential projects in Johor have experienced price drops since 2014.

“For example, Aloha Tower which used to sell at RM215.90 psf in 2010 and peaked at RM388.66 psf in 2014 was selling at RM315.02 psf last year. And Aloha Tower is not the only victim.” (See chart below.)

Meanwhile, the industrial property segment in Johor is also seeing poor occupancy. As at 3Q2016, there were some 11,578 existing stock in Johor Bahru and Kulaijaya.

“As you pass by the industrial areas in Johor, you will see many for sale or to let stickers on the properties, and I think we are going to see more because there will be more incoming supply,” he said.

However, there are some exceptional cases such as I-Park @ Senai Airport City. “The key success factors are build-and-sell or build-and-lease-type properties. I think this is the way to go, at least for the next two years.”

Other than that, he held a positive view on the much-talked-about Forest City project by China developer Country Garden.

“It is a project that targets foreign buyers so it will not have a direct impact on other local projects. Moreover, it is a good way to promote Johor and Malaysia internationally and it does create a lot of job opportunities. Personally, I have a positive view on the project,” Wee concluded.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.