EWI warrants continue climb on potential tie-up with GuocoLand

KUALA LUMPUR (April 5): Warrants of Eco World International Bhd (EWI-WA) rose for a second day yesterday as investors looked forward to more good news coming from the potential tie-up between the property developer and its strategic shareholder GuocoLand Ltd.

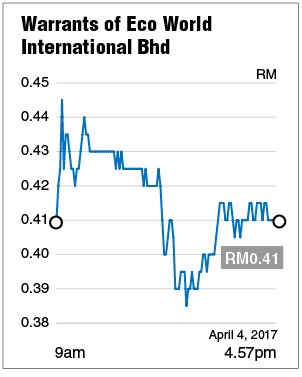

KUALA LUMPUR (April 5): Warrants of Eco World International Bhd (EWI-WA) rose for a second day yesterday as investors looked forward to more good news coming from the potential tie-up between the property developer and its strategic shareholder GuocoLand Ltd.The stock warrants climbed 10.5 sen or 34.43% higher to close at 41 sen yesterday. EWI-WA was trading between the range of 45 sen and 36.5 sen. They were the most actively traded counter on Bursa Malaysia, with 137.06 million shares done.

On Monday, EWI president and chief executive officer Datuk Teow Leong Seng was reported as saying that the terms of the proposed strategic partnership between newly listed EWI and Singapore’s Guoco Group Ltd, the parent company of GuocoLand, which may potentially include the redevelopment of Guoco’s properties in London, were still under discussion. GuocoLand holds a 27% stake in EWI.

When contacted, AllianceDBS Research analyst Quah He Wei told The Edge Financial Daily that investors may be attracted by the potential value that could be unleashed by a possible partnership between EWI and GuocoLand.

“Investors may be banking on some potential deals with GuocoLand, but the price (of EWI-WA) is already premium to its mother share (EWI), and [even] Eco World Development Group Bhd (EcoWorld) is cheaper,” he said.

EcoWorld owns another 27% of EWI shares.

EWI-WA was listed along with EWI’s RM2.58 billion initial public offering (IPO) on Monday. Upon EWI warrants’ debut listing on Monday, EWI-WA jumped 61 times or 30 sen to reach a limit up of 30.5 sen.

The five-year-tenure free warrant, which comes in two units for every five EWI shares subscribed by investors during the IPO, has a reference price of 0.5 sen. EWI-WA’s exercise price is RM1.45 per EWI share.

EWI shares closed down one sen or 0.78% to RM1.27 yesterday, with 27.37 million shares changing hands, giving it a market capitalisation of RM3.05 billion.

This article first appeared in The Edge Financial Daily, on April 5, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.