Sunway continues expanding land bank

Sunway Bhd (Aug 17, RM4.19)

Maintain buy with an unchanged target price of RM5.14: Sunway Bhd has entered into a joint venture (JV) agreement with Huatland Development Sdn Bhd with a 55% stake to form a JV company. The JV company will acquire a 4.34-acre (1.76ha) parcel of freehold land in Wangsa Maju, Kuala Lumpur, from Setapak Heights Development Sdn Bhd (which has common shareholders with Huatland) for RM51.1 million. The proposed mixed development (with target launch in the second half of financial year 2018) comprises serviced apartments and lifestyle retail units with a combined gross development value (GDV) of RM500 million, to be developed over a five-year period. The purchase is expected to be funded via debt and internally generated funds with target completion by the fourth quarter of financial year 2017.

The implied land cost is about RM270 per sq ft or RM54 per sq ft of allowable gross floor area at a plot ratio of five times. The cost of land is deemed competitive at about 10.2% of the estimated GDV. Based on the 55% stake, the estimated effective GDV is about RM275 million. It will increase the group’s effective GDV by 0.8% to RM36.2 billion and total GDV will grow by 0.9% to RM54 billion. Assuming a profit before tax margin of 22%, the estimated net present value will mildly increase our estimated revalued net asset valuation (RNAV) for property segment by 0.1%.

We are mildly positive about the above RNAV-accretive acquisition given the continued expansion in the group’s land bank at a competitive land cost. The proposed development allows Sunway to venture into more affordable segment with an average selling pricing of RM550,000. Besides, Sunway will leverage the experience and know-how of the JV partner in the development within the vicinity and yield a better return. The proposed development is also strategically located less than 8km away from Kuala Lumpur City Centre and within 1.5km of amenities like Wangsa Walk Mall and Aeon Big Wangsa Maju with easy access via major highways like Duta–Ulu Klang Expressway, Ampang–Kuala Lumpur Elevated Highway and Kuala Lumpur Middle Ring Road 2. Meanwhile, the Sri Rampai light rail transit station is only 850m away.

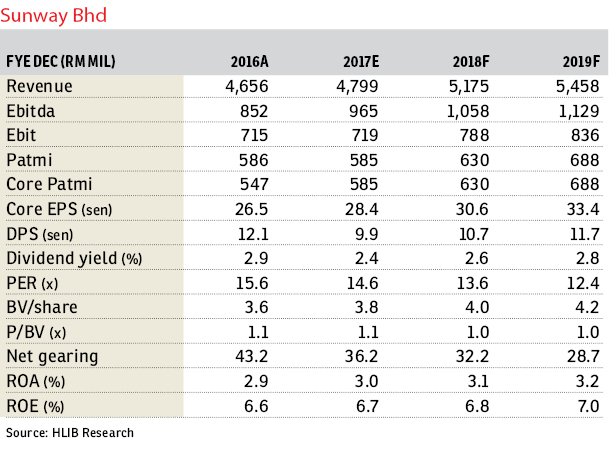

Sunway is our top pick within the sector as we believe it should be rerated and traded closer to its peers such as IJM Corp Bhd and Gamuda Bhd given its diversified income stream and declassification from the property sector. At a price-earnings ratio of 13.6 times, we opine that it represents a deep value stock with mature investment properties and the underappreciated trading and healthcare segment. — Hong Leong Investment Bank Research, Aug 17

This article first appeared in The Edge Financial Daily, on Aug 18, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.