Mitrajaya Holdings Bhd (Oct 16, 94.5 sen)

Maintain market perform with a lower target price of RM1.10: Last Friday, Mitrajaya Holdings Bhd proposed a one-for-five rights issue of up to 157.5 million rights shares, indicatively priced at 68 sen, a 25.27% discount to the theoretical ex-all price of 91 sen calculated based on five-day weighted average market price to raise proceeds of RM94 million to RM107 million. Additionally, for every two rights shares subscribed, there will be one free warrant (indicative exercise price of RM1.15) and one bonus share. We believe the exercise will raise close to the minimum of RM94 million as we exclude further dilution of the current share base from existing employees’ share option scheme and Warrants-D given that their exercise price is above the current market price. Post rights and bonus, the enlarged share base will increase to 896 million from 689 million. The proposals are expected to be completed by the first quarter of financial year 2018 (1QFY18).

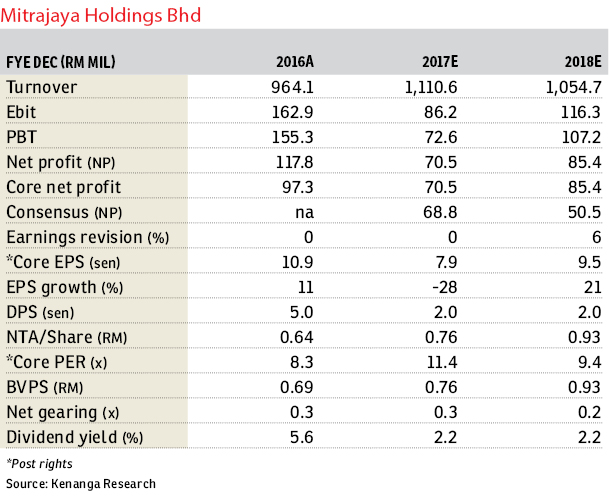

We were negatively surprised by the rights issue given that it would be dilutive for estimated FY18 earnings per share and return on equity (by 6% and 7% respectively) and the rationale of using the rights proceeds to pare down debts despite the manageable current net gearing level of 0.34 times (as of 2QFY17), while there are no clear expansion plans. We note that the last time Mitrajaya did a cash call (via a rights issue) was in 2000 when the proceeds were used for working capital purposes. We note that net gearing for small- and mid-cap contractors under our universe can go as high as 0.8 times but the typical comfortable level is below 0.5 times. Post-rights issue, we expect its net gearing position to decrease to 0.18 times (from 0.34 times as of 2QFY17). We believe its lighter balance sheet would serve the working capital needs for its current outstanding order book of RM1.8 billion and we do not expect any major landbanking activity in the near future. Meanwhile, its estimated FY18 price-earnings ratio (PER) is also expected to expand by 7% based on an “ex-all” basis to 9.4 times (from 8.8 times).

Year to date (YTD), Mitrajaya has secured RM787 million new contracts (versus our target of RM800 million) and its outstanding order book stands at about RM1.8 billion, providing earnings visibility for about two years. The current five-year-high steel price could cause margin compression for ongoing projects secured back in FY16. However, we have already factored in higher cost assumptions into our estimated FY17 to FY18 earnings. For its property arm, unbilled sales stood at RM233 million (mostly from Wangsa 9 residency and Puchong Prima affordable homes), providing about two-year visibility to the group. We note that management plans to launch its Wangsa 9 Phase 3 by November 2017 (gross domestic value of RM300 million). Meanwhile, its South African division will see unbilled sales of 45 million rand (RM14.22 million) recognised progressively upon completion of the transfer of ownership in FY17 and early FY18. — Kenanga Research, Oct 16

This article first appeared in The Edge Financial Daily, on Oct 17, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Kinrara Residence

Bandar Kinrara Puchong, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor

The Zest @ Kinrara 9

Bandar Kinrara Puchong, Selangor

Taman Damai Utama

Bandar Kinrara Puchong, Selangor

Bandar Kinrara @ Puchong

Bandar Kinrara Puchong, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor