WCT’s job wins exceed expectations

WCT Holdings Bhd (Dec 11, RM1.48)

Maintain buy call with an unchanged target price of RM2.29: WCT Holdings Bhd recently announced that it has been awarded a RM211.5 million road contract from Dewan Bandaraya Kuala Lumpur. The job involves the construction of an elevated access road from Jalan Maarof to Jalan Semantan along the SPRINT Highway and rectifying the road entrance to Pusat Bandar Damansara. The contract duration is for 30 months.

With this contract in the bag, WCT’s year-to-date (YTD) job wins now stand at RM1.9 billion. This is close to its management’s full-year guidance of RM2 billion. We estimate its order book to now stand at a new high of RM5.9 billion, translating into a cover of four times financial year 2016 (FY16) construction revenue.

In the near term, WCT is hopeful of securing a building job within the Tun Razak Exchange area. For FY18, its management guides for an order book replenishment of RM2 billion on the back of existing tenders of RM5 billion. Potential jobs include the East Coast Rail Link, Pan-Borneo Highway in Sabah and developments from sister companies Malton Bhd and the Pavilion Group (RM1.5 billion).

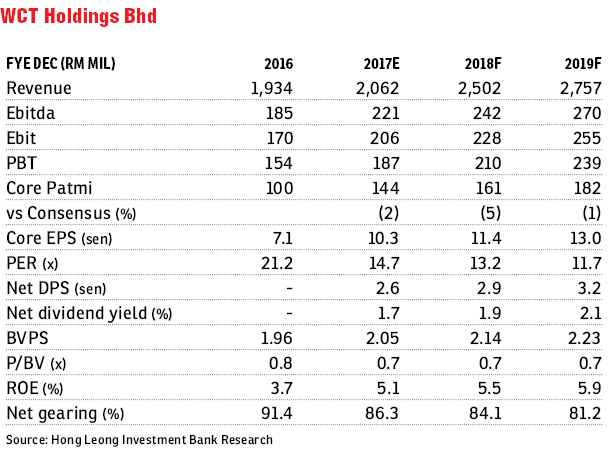

Although the YTD job wins of RM1.9 billion has exceeded our full-year assumption of RM1.6 billion, we leave our forecast unchanged as we take a conservative stance.

Albeit with a cautious stance, we are turning positive on WCT given its results recovery and de-gearing plans that has been laid out by its new top management. — Hong Leong Investment Bank Research, Dec 11

This article first appeared in The Edge Financial Daily, on Dec 12, 2017.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.