Ayala Land to proceed with MGO

MCT Bhd (Jan 8, 88.5 sen)

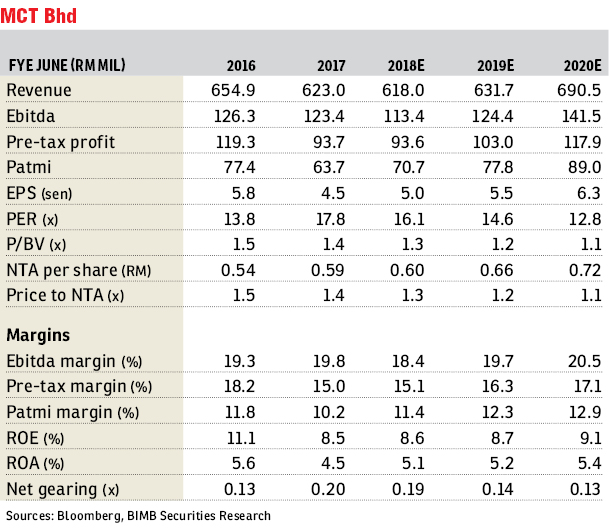

Maintain hold with lower target price (TP) of 81 sen: Ayala Land’s sales & purchase agreement (SPA) to purchase Barry Goh’s 17.24% stake turned unconditional on Jan 5 this year after receiving Bursa Malaysia’s waiver to pay the 51% of cash consideration in

tranches.

Consequently, Ayala Land is obliged to extend the offer to the remaining shareholders at the same price of 88 sen per share. However, it expressed its intention to retain MCT’s listing status. It also noted that should the mandatory general offer’s valid acceptance exceed 90%, it has no plans to acquire the remaining share compulsorily from the remaining shareholders (this is in accordance with the provision under Section 222(1) of CMSA).

This acquisition marks Ayala Land’s growing presence in MCT after it acquired 9% in April 2015 before increasing this to 33% in October 2015 (after exercising a call option). While Ayala’s increased stake clearly underlines MCT’s potential (it is an integrated developer with an in-house precast and ready-mix concrete plant), we are cautious about MCT’s prospects in view of the dulling landscape of Malaysia’s property sector. MCT sits on an undeveloped land bank of about 500 acres (202.34ha) with 209.9 acres already touted for a project with an RM8 billion gross development value (GDV).

While Ayala has no plans to delist MCT, we believe the MGO makes a good opportunity for investors to exit the stock. This is in view of the weak property market and MCT’s limited brand presence amid the competitive property market. We have a “hold” recommendation on the stock. Our 81 sen TP is arrived based on the mid-cap property stock’s blended historical price-earnings ratio and price-to-book value of 12 times and 1.2 times respectively for financial year ending June 30, 2018. — BIMB Securities Research, Jan 8

This article first appeared in The Edge Financial Daily, on Jan 9, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.