Gabungan AQRS 1Q Patmi in line on higher project recognition

Gabungan AQRS Bhd (May 15, 88 sen)

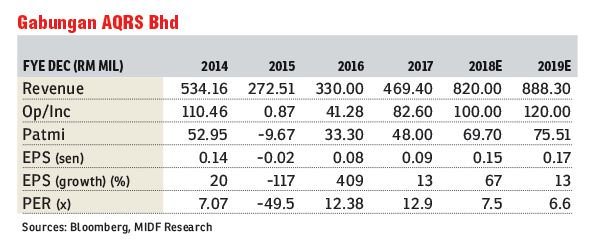

Maintain buy with a target price (TP) of RM2.30: Despite a sharp drop in share price, Gabungan AQRS Bhd’s first quarter of financial year 2018 (1QFY18) profit after tax and minority interest (Patmi) came in line with our expectations with earnings accounting for RM23.4 million (+8% year-on-year [y-o-y]), amounting to 23.5% of our estimates and 22.3% of the street’s. The results reflected a weaker revenue of RM127.4 million (-20% y-o-y), comparably deriving from a higher recognition of projects, but a lower contribution from the property segment.

Generally, Patmi was positive, attributable to revenue of the construction segment of RM109.8 million, accounting for 86.1% of total revenue, while the property segment contributed RM14.8 million in revenue, accounting for 11.6% of total revenue on the back of an improved margin of 12.9% (+2.8 percentage points). Management has indicated the commitment to cost efficiency, hence for the next quarter, we can expect a better marginal profile through a better revenue-stream mix. Gabungan AQRS has made an admirable progress in projects such as light rail transit 3, the Sungai Besi-Ulu Kelang Elevated Expressway and Pusat Pentadbiran Sultan Ahmad Shah.

The property segment has posted losses amounting to RM1.4 million due to the recognition of two land sales in the previous quarter, located in Selangor. We expect a pickup in revenue recognition as Gabungan AQRS is launching it new E’Island Residence development in Puchong, Selangor. The project is slated to sell affordable apartments at the price range of RM290,000 to RM380,000. E’Island would potentially contribute about RM28 million/RM43 million/RM42 million in FY19/FY20/FY21 on the back of an 8% profit before tax margin based on its gross development value of RM491 million.

Gabungan AQRS’ FY18 earnings trajectory remains intact, supported by its strong order book and management’s commitment to reduce gearing and increase its operating margin. So far, its outstanding order book remains at RM2.7 billion, with the expectation of clinching another RM1.5 billion worth of projects from the Kota SAS development and Pan Borneo Highway Sabah packages.

We reiterate our “buy” recommendation with a TP of RM2.30. Our assessment of the sector has shifted from “positive” to “neutral” following the shift in government’s policy to review big-ticket projects. We surmised that construction stocks will be affected by negative sentiments pending announcements of project status. — MIDF Research, May 15

This article first appeared in The Edge Financial Daily, on May 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.