JAKS seen making good progress in identifying new projects

JAKS Resources Bhd (June 7, RM1.44)

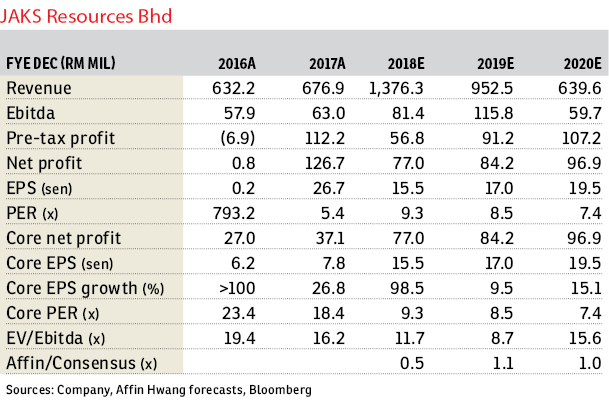

Maintain buy with an unchanged target price (TP) of RM1.90: JAKS Resources Bhd has announced that it will be issuing a renounceable right issue of up to 278 million warrants, with an indicative price or 25 sen per warrant, on the basis of one warrant for every two existing shares. Based on the current price indication, the cost of the new shares in JAKS Resources Bhd is at RM1.25 (25 sen for the subscription and RM1 for the conversion of the warrants), which is at a 15% discount to the current share price. Given the sharp discount, there is a high likelihood that most of the rights will be subscribed, in our view. The warrants will expire in five years from the date of issuance, and can be converted from the second anniversary date of the issuance. The total immediate fund raised from the subscription is RM68.2 million to RM69.5 million, with an additional RM278 million from the conversion of warrants at a later date.

The bulk of the money raised from the subscription will be utilised for the Vietnam power plant project, as the additional funding (RM45 million to RM46 million) is needed to expedite the current progress of its engineering, procurement, construction and commissioning (EPCC) contract. We believe the allocation of RM10 million to renewable energy projects is a good indicator that management is making progress in identifying new projects that will help replenish the earnings shortfall from the completion of the Vietnam EPCC contract in 2020. The funds from the warrant conversion could be used as equity if the new projects do materialise or take up the option to acquire an additional stake in the current Vietnam power plant project.

We maintain our revalued net asset valuation-based TP at RM1.90 and “buy” call as the company’s fundamentals remain unchanged, and there is no dilution impact on the current shareholders. A rerating catalyst for the stock will be the progress of its Vietnam power plant project. Downside risks to our call are widening losses from its property segment, and slower recognition from its Vietnam engineering, procurement and construction contract. — Affin Hwang Capital, June 7

This article first appeared in The Edge Financial Daily, on June 8, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.