Kimlun’s outlook seen to be buoyed by affordable housing projects

Kimlun Corp Bhd (June 7, RM1.59)

Upgrade to outperform with a target price (TP) of RM1.80: On Wednesday, Kimlun Corp Bhd announced that it had secured two contracts with a total value of RM225 million. The first project worth RM144.1 million is a design and build project for roads and an interchange in Johor Bahru from Focus Ace Sdn Bhd, slated for completion by October 2020. The second contract is a manufacturing contract from M+W Singapore Pte Ltd worth S$27 million (RM81 million) to supply and deliver pre-cast building components by December 2018.

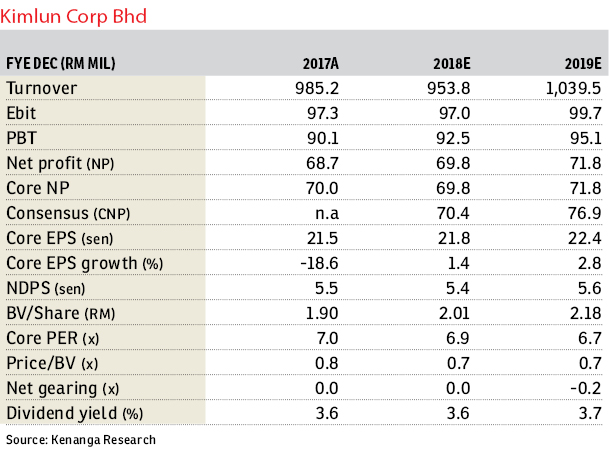

We remain neutral on the wins as Kimlun’s year-to-date (YTD) contract replenishments of RM265 million (construction: RM184 million; manufacturing: RM81 million) are still within our financial year ending Dec 31, 2018 estimated (FY18E) targeted replenishment of RM820 million (construction target: RM700 million; manufacturing target: RM120 million). Assuming profit before tax margins of 8% for the road project and 15% for pre-cast supplies, these contracts are expected to contribute about RM12.7 million to Kimlun’s bottom line per annum.

Despite the lack of major infrastructure projects moving forward, we believe the near- to mid-term outlook for Kimlun is buoyed by affordable housing projects, in line with Pakatan Harapan’s manifesto to build one million affordable homes (within two terms). Given Kimlun’s pioneer status as an industrialised building system (IBS) manufacturer, coupled with its vast experience in building affordable homes, we believe Kimlun will stand to benefit from both the construction and manufacturing fronts. Currently, Kimlun’s outstanding order book stands at RM2.17 billion (construction: RM1.72 billion; manufacturing: RM440 million), providing two-year visibility.

Post contracts, we keep our FY18/FY19 earnings estimates unchanged on: i) our FY18-FY19E construction replenishment of RM700 million; and ii) FY18-FY19E manufacturing replenishments of RM120 million/RM150 million.

We upgrade our call to “outperform” from “market perform”, with an unchanged TP of RM1.80, based on an unchanged FY19E price-earnings ratio of eight times. We think our upgrade is fair as we find the recent selldown overdone (-33% YTD), given that Kimlun is backed by a healthy order book, which can last for two years, and it also stands a good chance to benefit from Pakatan’s affordable housing initiatives. Upside catalysts for the stock include: i) further wins from Singapore to showcase that Kimlun’s manufacturing arm is not overly reliant on local contracts, such as mass rapid transit; ii) affordable home contract wins; and iii) the Pakatan government’s endorsement of IBS implementation in projects. — Kenanga Research, June 7

This article first appeared in The Edge Financial Daily, on June 8, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.