Slew of new launches likely to boost Titijaya revenue

Titijaya Land Bhd (June 25, 38 sen)

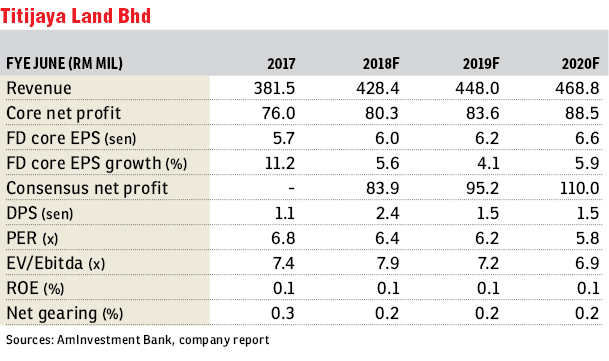

Maintain buy with a fair value (FV) of 50 sen: We revised our financial year 2018 forecast (FY18F) to FY20F forecasts downwards by 2.6%, 15.7% and 19.2% respectively and reduced our FV by 31% to 50 sen (from 73 sen) based on a 40% discount to its revalued net asset valuation. At present, Titijaya Land Bhd is trading at an undemanding forward FY18F to FY20F price-earnings ratio of below seven times. Despite a lower FV, the stock offers potential upside of more than 30%, hence, we are maintaining our “buy” recommendation.

We are imputing a lower revenue growth due to a higher loan rejection rate and weaker take-up rates amid the prolonged slowdown in the local property market. We expect Titijaya to register net earnings of RM80.3 million, RM83.6 million and RM88.5 million for FY18 to FY20F respectively.

At present, Titijaya has five ongoing projects, namely H20 @ Ara Damansara (mixed development — gross development value [GDV]: RM916 million), 3rdNvenue Phase 1 @ Embassy Row, KL (service suite — GDV: RM514 million), The Shore @ Kota Kinabalu, Sabah (mixed development — GDV: RM534 million), Taman Seri Residensi Phase 2B @ Klang (landed residential — GDV: RM41 million), and Park Residency Phase 1 @ Cheras (landed residential — GDV: RM85 million).

Meanwhile, the unbilled sales of RM360 million to RM370 million together with a slew of new launches in FY18 and FY19 will boost its revenue in the near term.

Overall, Titijaya has lined up RM826 million of new launches (high-rise residential) over the immediate term, with the key selling points being: i) affordability for units in phase 1 of Damai Suria @ Bukit Subang at RM300,000 to RM450,000 (GDV: RM168 million); and ii) premium locations for units in Riveria, KL Sentral at RM300,000 to RM500,000 (GDV: RM320 million), and phase 2 of 3rdNvenue at RM450,000 to RM1 million (GDV: RM338 million).

Currently, Titijaya has a total land bank of 208 acres (84.2ha), located mainly in the Klang Valley with GDV of RM12.4 billion, which provides good earnings visibility and will drive the company’s growth going forward.

Nonetheless, we remain cautious about the property sector due to the generally still elevated home prices, the low loan-to-value offered by banks, and house buyers’ inability to qualify for a home mortgage due to their already high debt service ratios. In addition, the still subdued consumer sentiment against a backdrop of rising cost of living and elevated household debts is holding consumers back from committing themselves to the purchase of big-ticket items like a house. However, we do see a bright spot in the affordable segment.

Titijaya is finalising land swap deals with the education ministry and Lembaga Getah Malaysia for the development of two property projects in Kuala Lumpur city centre. Should these deals materialis, they will provide better earnings visibility and enhance the company’s GDV. — AmInvestment Bank, June 25

This article first appeared in The Edge Financial Daily, on June 26, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.