Long-term prospects for Pintaras Jaya seen to improve under new govt policy

Pintaras Jaya Bhd (Aug 7, RM2.69)

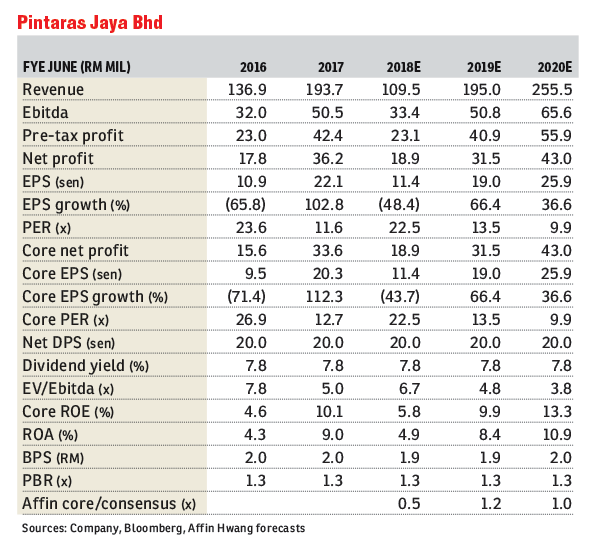

Maintain hold with a reduced target price of RM2.46: Pintaras Jaya Bhd secured RM150 million of new contracts in the financial year ended June 30, 2018 (FY18), higher than the RM20 million to RM30 million in new contract wins in FY17. The largest contract secured in FY18 was the one for RM68.5 million to provide piling and substructure works for the Riveria Sentral office and serviced apartment.

Its order book was RM100 million as at June 30, 2018, which is about 0.9 times our FY18 revenue. We assume Pintaras Jaya will secure new contracts worth RM150 million in FY18, RM200 million in FY19 and RM250 million in FY20 in our earnings forecasts.

Its tender book has declined to RM700 million from RM1.1 billion a few months ago. This is after losing a few tenders for new projects. There were fewer new contract tenders after the 14th general election as several large-scale infrastructure projects were cancelled or suspended, for example, the East Coast Rail Link, Kuala Lumpur-Singapore high-speed rail and mass rapid transit Line 3 (MRT3).

Pintaras Jaya is exploring prospects to lease some of its 30 bore piling machines in Singapore as its capacity utilisation has dropped to below 50%. The margins are low for leasing contracts in Singapore but this is mainly to cover the depreciation cost. It is also exploring the potential acquisition of a piling company to penetrate the Singapore market.

Long-term prospects for Pintaras Jaya should improve under the new government’s policy to exclude foreign contractors from tenders for public-sector projects if there is local expertise. Chinese piling companies bidded aggressively for the MRT2 and light rail transit Line 3 contracts, which previously posed stiff competition to local companies such as Pintaras Jaya.

Although the pie could be smaller due to the government’s plan to reduce the cost of infrastructure and building projects, we believe that efficient piling companies like Pintaras Jaya will remain competitive with a level playing field.

There will also be opportunities for Pintaras Jaya to bid for the government’s affordable housing projects, which are expected to be awarded on an open tender basis in the future. Most of these projects had been awarded on a negotiated basis in the past to politically-linked companies.

There are opportunities to expand its business via acquisitions given the depressed valuations of piling companies in the current challenging market environment. Pintaras Jaya is setting its sights on potential acquisitions in Singapore to expand its business abroad. The demand for piling services is likely to be sustained by the Singapore government’s plan to continue building Housing and Development Board flats to meet the rising demand for affordable housing. — Affin Hwang Capital, Aug 7

This article first appeared in The Edge Financial Daily, on Aug 8, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.