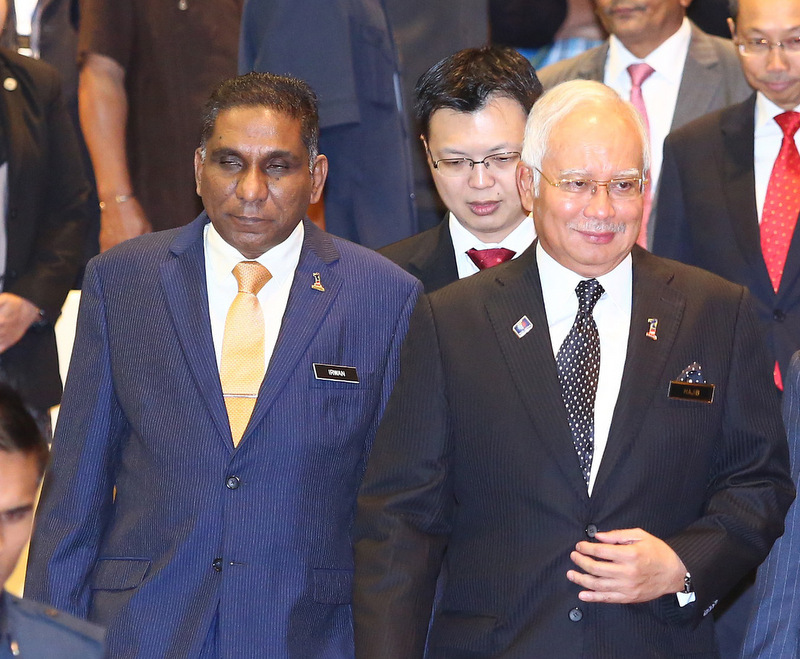

Najib, Irwan Serigar to be charged for misusing govt funds to bail out 1MDB

KUALA LUMPUR (Oct 23): Former prime minister Datuk Seri Najib Razak and former Treasury secretary-general Tan Sri Dr Mohd Irwan Serigar Abdullah will be hauled to court tomorrow to face charges for misusing government funds to bail out 1Malaysia Development Bhd (1MDB), following a settlement agreement it inked with Abu Dhabi’s International Petroleum Investment Co (IPIC) in 2017.

Under the settlement 1MDB inked with IPIC in April 2017, 1MDB had to repay US$1.2 billion (RM4.99 billion) loaned from IPIC, while the ministry of finance gave an undertaking that 1MDB would fulfil all future payments of interest and principal sums related to US$3.5 billion bonds. The agreement freed IPIC of its obligations as a guarantor for the bonds arranged by Goldman Sachs for 1MDB.

At the time, 1MDB announced it had settled the payment with proceeds raised from asset sales, but did not provide details.

The Edge Financial Daily has learnt that the duo will now be jointly charged for misusing funds from Bantuan Rakyat 1Malaysia (BR1M), as well as the federal government’s Consolidated Fund, to repay IPIC. It is unknown at this juncture how much was allegedly taken from either account.

Since its implementation in 2012, the previous administration had spent a total of RM25.7 billion as BR1M handouts.

Finance Minister Lim Guan Eng, meanwhile, claimed in September that Najib left the Treasury with only RM450 million to finance its operating expenses under its Consolidated Revenue Account. The Consolidated Revenue Account is one of three accounts under the Consolidated Fund. The other two accounts are Consolidated Loan Account and Consolidated Trust Account. Guan Eng also revealed the Consolidated Fund’s position as at Dec 31, 2017 stood at RM42.18 billion (audited), which fell to RM35.5 billion (unaudited) as at April 30 this year.

Najib and Mohd Irwan Serigar have been summoned by the Malaysian Anti-Corruption Commission to present themselves at its headquarters in Putrajaya at 2pm today to facilitate in investigations into 1MDB’s debt settlement with IPIC. According to MalaysiaKini, investigations into the matter saw progress following information obtained from a person with the title “Datuk”, who was appointed by Najib as an intermediary between the two companies.

IPIC, Abu Dhabi’s sovereign wealth fund, was a co-guarantor of two 1MDB bonds totalling US$3.5 billion.

In relation to the bonds, between 2012 and 2014, 1MDB paid US$3.5 billion to Aabar BVI — a company registered in the British Virgin Islands with the same name as a subisidiary of IPIC, which 1MDB was supposed to have passed the funds to.

IPIC later claimed it had not received the funds, as Aabar BVI is not its subsidiary. However, Aabar BVI’s two shareholders were also directors of the real IPIC unit Aabar.

Meanwhile, IPIC lent 1MDB US$1.2 billion in May 2015, so the latter could pay its debts — including interests over the US$3.5 billion bonds which IPIC co-guaranteed.

But speaking in Parliament yesterday, Najib called on the government to reclaim the US$3.5 billion from IPIC.

“IPIC agreed to pay back US$3.5 billion to us,” he said. “I wanted to work on this after the 14th general election. That is why we conducted the settlement agreement, and they are obliged to pay us.”

The former prime minister also called for the settlement agreement to be made public.

“I call for the Pakatan Harapan government to present the settlement agreement to the public. Let the public know the real matter; there is nothing for us to hide,” he said.

Najib said he had worked out a solution with the Crown Prince of Abu Dhabi to maintain the diplomatic ties between the United Arab Emirates and Malaysia.

He described the 1MDB-IPIC deals as “swapping assets with debts” and said 1MDB will obtain US$6 billion in total from the series of agreements. He did not elaborate on this.

“I call for the Pakatan Harapan government to carry on the settlement agreement,” Najib said.

“They also need to interview the people there [in Abu Dhabi]. If they lied to us, it doesn’t matter who took the money; we have to claim it back. Do not let them go,” he said.

“I hope in the 1MDB issue, we are not caught up in politics. We want to ensure every ringgit is returned to Malaysians,” he added.

Najib was chairman of 1MDB’s board of advisers until the fund was dissolved in May 2016 and its assets taken over by the finance ministry.

Najib has so far been slapped with 32 charges of power abuse and money laundering linked to 1MDB, of which seven charges are over 1MDB’s former subsidiary SRC International Sdn Bhd.

This article first appeared in The Edge Financial Daily, on Oct 24, 2018.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.