MBSB 9M profit within estimates

Malaysia Building Society Bhd (Nov 14, 99 sen)

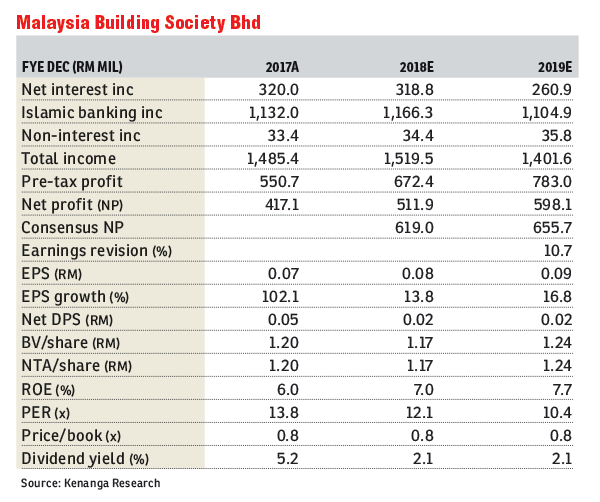

Maintain outperform with a lower target price (TP) of RM1.25: Malaysia Building Society Bhd’s (MBSB) core net profit (CNP) for the nine months ended Sept 30, 2018 (9MFY18) of RM369 million is in line with estimates, accounting for 72% of our and 60% of consensus full-year estimates. The 9MFY18 CNP has been adjusted for write-back of impairment allowances on loans and financing amounting to RM155.4 million in the first quarter of FY18 (1QFY18).

9MFY18 earnings surged 79% underpinned by lower impairment allowances falling by 94% to RM29 million, as top line fell 5% to RM1.05 billion. The falling top line was dragged down by declining fund-based income, down by 15% to RM177 million while Islamic banking income fell 5% to RM828 million. Loans saw a slight drag mostly coming from a decline in personal financing (PF) while corporate loans and financing surged ahead to RM9.2 billion. Net interest margin (NIM) compression of 20 basis points (bps) to 3.2% was higher than our expectation of 3bps. On a positive note, asset quality improved by 3.5 percentage points to 5.5% with credit costs at 0.11% due to improving economic variables.

Quarter-on-quarter, earnings improved 42%, again underpinned by falling impairment allowances to RM122 million as top line fell 5% to RM341.5 million, dragged down by falling Islamic banking income to RM265 million. Loans and financing continued to decelerate, moderating at 1%, dragged down by PF and mortgages. NIM continued its downtrend with asset quality stable as gross impaired loans (GIL) maintained at 5.5% with credit costs at 0.7%.

Despite the falling loans and financing, we maintain our 3% to 4% growth for FY18 estimate (FY18E) driven by corporate loans and financing as another RM950 million is expected to be disbursed in 4QFY18. Going forward into 2019, we believe management will be selective on loans and financing, especially from PF and mortgages, mindful of preserving asset quality ahead. Loans and financing will be driven by corporates as unutilised corporate financing stood at RM7 billion (as of 3QFY18) with management striving for a 30%/70% portfolio mix (from the current 25%/75% corporate/retail). NIM compression is expected to persist into 2019 due to competition for corporate financing, and decline in higher yielding PF.

Post results, we maintain our FY18E earnings but revised FY19E by +11% to RM598 million on account of lower NIM, lower credit costs and slower loans.

Our TP is revised to RM1.25 from RM1.45 as we ascribed a lower FY19E price-to-book ratio and price-earnings ratio of one times and 13 times. These figures are based on its five-year mean with a 0.5 standard deviation to reflect our concerns about challenging loans and potential uptick in deterioration in asset quality with the impending slowdown ahead. — Kenanga Research, Nov 14

This article first appeared in The Edge Financial Daily, on Nov 15, 2018.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

We thought you might like...

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.