Sunway’s unbilled sales seen to provide good earnings visibility

Sunway Bhd (March 1, RM1.65)

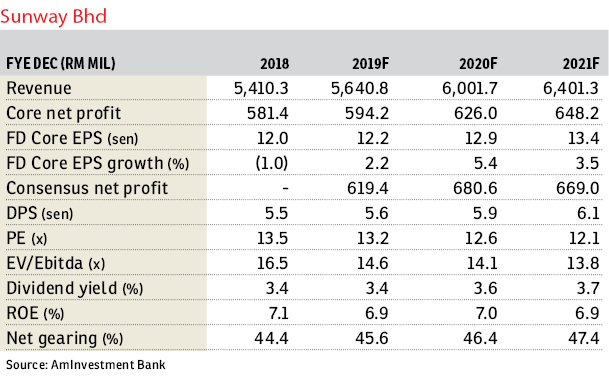

Maintain buy with a fair value (FV) of RM1.73: We maintain our “buy” call on Sunway Bhd (Sunway) with an unchanged fair value of RM1.73 per share based on sum-of-parts (SOP) valuation. We made no changes to our financial years 2019-20 (FY19-20) numbers while introducing FY21 earnings forecast at RM648.2 million.

Sunway reported its FY18 revenue and core profit after tax and minority interest (Patmi) of RM5,410.3 million (+3.3% year-on-year [y-o-y]) and RM581.4 million (-1.0% y-o-y) respectively. Core Patmi of RM581.4 million is within our and consensus full-year estimates.

The group’s property development division reported an FY18 revenue of RM619.6 million (-31.8% y-o-y) and profit before tax (PBT) of RM158.6 million (-32.6%) mainly due to the adoption of the Malaysian Financial Reporting Standards (MFRS) 15 whereby profits of property development projects in Singapore and China can only be recognised upon completion. Nonetheless, Sunway reported strong new sales of RM1.88 billion (+50% y-o-y) while unbilled sales of RM2.1billion will provide good earnings visibility in short to mid-term.

The property investment segment reported FY18 revenue of RM818.4 million (+3.9% y-o-y) and PBT of RM291.4 million (+14.1% y-o-y) mainly due to additional contribution from new properties such as Sunway Velocity Hotel and Sunway Geo in Sunway South Quay in Bandar Sunway, Selangor, as well as from the opening of additional room inventory at The Banjaran Hotsprings Retreat & Spa in Ipoh, Perak.

The construction segment’s FY18 PBT grew 1.4% y-o-y to RM190.1 million driven by higher construction profits (arising from the Parcel F building job in Putrajaya, Package V201 of the Mass Rapid Transit [MRT] 2 and International School of Kuala Lumpur building contract in Ampang, Selangor), partially offset by lower precast profits (due to the completion of several projects coupled with higher rebar prices). Year to date, Sunway Construction has secured new jobs worth a total of RM1.55bil while its outstanding construction order book stands at RM5.2 billion.

Management declared a second interim dividend of two sen per share, bringing the total dividend payout to 5.5 sen for FY18, representing a payout ratio of 50%.

We believe the outlook for Sunway remains positive premised on its unbilled sales of RM2.1 billion, strong income contribution from property investment and a robust outstanding order book of RM5.2 billion. — AmInvestment Bank, March 1

This article first appeared in The Edge Financial Daily, on March 4, 2019.

Click here for more property stories.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.