JAKS 1QFY19 profit above expectations

JAKS Resources Bhd (May 10, 78 sen)

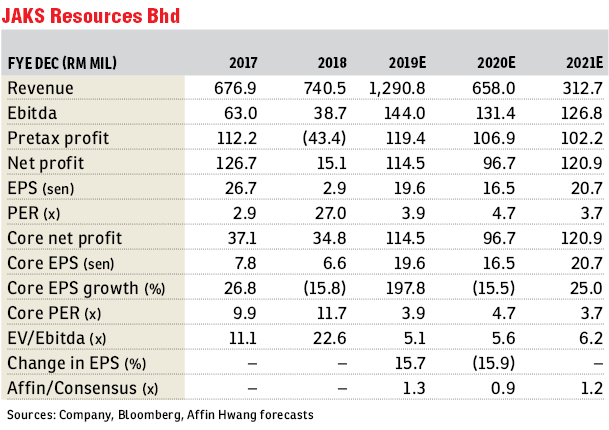

Maintain buy with an unchanged target price (TP) of RM1: JAKS Resources reported a very good set of first quarter of financial year 2019 (1QFY19) numbers — core profit after tax and minority interests of RM38.7 million (+202% quarter-on-quarter [q-o-q], 117% year-on-year [y-o-y]) beat both our and consensus forecasts, delivering 39% and 43% of the respective full-year forecasts.

The stronger-than-expected performance was mainly driven by higher revenue recognition of its Vietnam engineering, procurement and construction (EPC) project, as work progress started to catch up.

It is completing the Vietnam power plant ahead of time. The power plant was 56% completed as of end-March, and based on the current progress rate, we believe that there is a high possibility that the power plant would be completed ahead of schedule (before mid-2020).

Progress for JAKS’ EPC portion was also higher in 1QFY19 as it sped up its work to match the progress of the power plant. We have revised our completion target for this year to 83% from 77% to factor in the higher revenue recognised during the quarter, which is the main driver of the earnings forecast revisions for FY19-FY20.

The continuation of losses from the property segment is within our expectations, due to the liquidated ascertained damages for its Pacific Star project and losses from its mall operation.

Management believes that the company is still on track to deliver the project by the end of the year, and is likely to hand over The Star Tower within the next few months.

We believe that handing over the building would also improve investor sentiment, which had been affected by lawsuits on the “late” completion of the building. — Affin Hwang Capital, May 10

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.