One-year earnings visibility for Mitrajaya’s order book with hotel job

Mitrajaya Holdings Bhd (June 24, 35 sen)

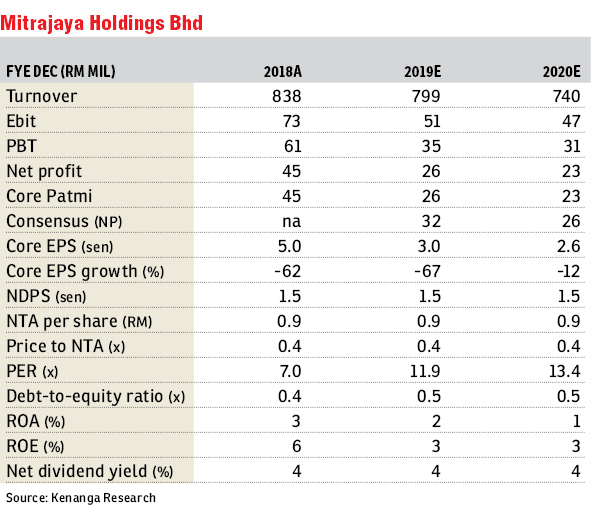

Maintain underperform with an unchanged target price (TP) of 20 sen: Last Friday, Mitrajaya Holdings Bhd announced that they bagged a hotel refurbishment work from Idaman Putrajaya Sdn Bhd for a total consideration of RM89.9 million and is expected to complete in 38 weeks.

No changes to financial year 2019 estimated earnings (FY19E) to FY20E earnings as the job replenishment is still within our expectations. Maintain “underperform” with an unchanged sum-of-parts-driven TP of 20 sen.

This would be Mitrajaya’s first job replenishment in FY19. However, we are “neutral” on the win as it is within our replenishment assumptions of RM300 million for FY19E. Assuming a pre-tax margin of 8%, the project is expected to contribute an aggregate net profit of around RM5.4 million.

Post win, Mitrajaya’s outstanding order book stands around RM1 billion with a year visibility, and still actively tendering for projects in the local market. However, we opine the local job flows to be slow as we only expect mega projects to kick-start earliest by year-end. As for its property development division, its unbilled sales stand at RM110 million, also a year visibility.

Implying a FD FY20E price-earnings ratio (PER) of eight times versus ascribed valuation range of six times to 11 times applied on small-mid cap contractors under coverage, which reflects the following considerations: i) uncertainty in terms of order book replenishment; ii) declining margins; and iii) five consecutive quarters of disappointment.

Upside risks for our call are: i) higher-than-expected margins; ii) better-than-expected billings from construction works and property segment; iii) greater-than-expected contract wins. — Kenanga Research, June 24

This article first appeared in The Edge Financial Daily, on June 25, 2019.

Click here for more property stories.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.