Founder’s takeover offer for TA Global deemed ‘not fair but reasonable’, says BDO Capital

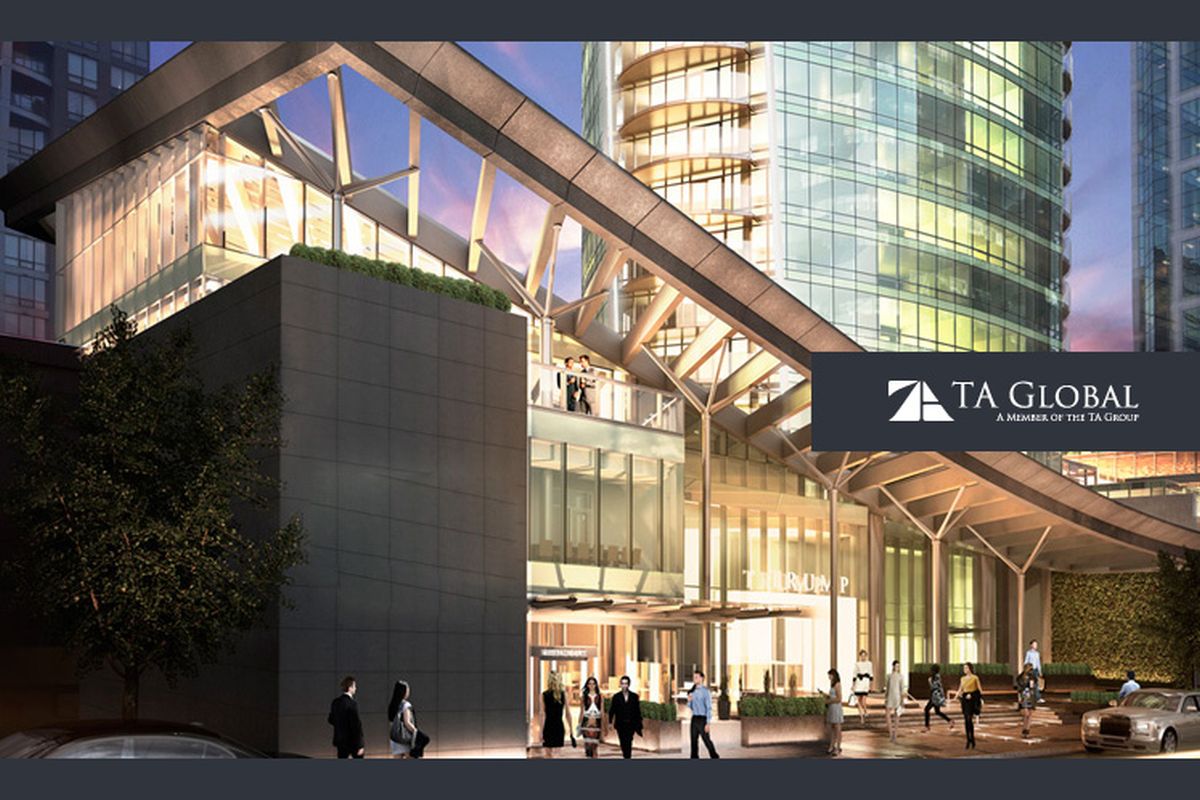

KUALA LUMPUR (Nov 23): TA Enterprise Bhd’s (TAE) substantial shareholder and co-founder Datuk Tony Tiah’s takeover offer to acquire a 39.83% stake, which the company does not already own, in his flagship’s listed property arm TA Global Bhd is "not fair but reasonable".

This was the advice of independent adviser BDO Capital Consultants Sdn Bhd to the minority shareholders on the takeover offer of 28 sen a share.

Between the cash option and share exchange option, the independent adviser is of the view that the share exchange option is more favourable as the implied offer price of TA Global of 94.9 sen to 95.2 sen represents a discount of approximately 2.96% to 3.26% to the fair value per TA Global share.

“Accordingly, we advise and recommend that holders ‘accept’ the offer by electing the share exchange option. Holders who elect this option, while being able to continue participating in TAG Group (TA Global) via TAE’s interest in TAG, should also be aware that they will be exposed to broking and financial services, investment holdings as well as credit and lending business and the risk of low liquidity of TAE shares,” it said in a filing with Bursa Malaysia today.

However, the independent adviser highlighted that TA Global’s hotel operations for the financial year ending Dec 31, 2020 (FY20) are expected to be negatively impacted by Covid-19.

“Due to uncertainty in the aftermath of the Covid-19 pandemic, the estimated impact of the pandemic on TAG Group’s hotel operations remains uncertain.

"Notwithstanding this, given time, TAG Group’s hotels will recover their lost ground and start contributing effectively to TAG Group’s future financial performance after economies and international borders start to open up,” it said.

As the Covid-19 pandemic is still ongoing, the independent adviser has also recommended holders to accept the cash option.

“Holders who do not wish to be exposed to current business risks of TAE in light of the current Covid-19 situation may ‘accept’ the cash option,” it said.

On Feb 12, TAE announced to make a conditional voluntary offer to buy out 2.12 billion shares, which are equivalent to a 39.83% stake in TA Global it does not already own.

To finance the cash offer, TAE will place out one block of 550.54 million new shares to its founder-cum-controlling shareholder Tiah at 66.5 sen each.

Get the latest news @ www.EdgeProp.my

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.