JLL: The beginning of a new PROPERTY cycle

It is no secret that the real estate market has been deeply affected due to the Covid-19 pandemic. In Asia Pacific, JLL foresees a new cycle appearing as a result of the hampering from the Covid-19 pandemic.

With optimistic news on the distribution of the Covid-19 vaccine, the real estate market is expected to rebound and see investments trending upwards.

According to the real estate consultancyfirm’s report “Beyond the Rebound: The New Asia Pacific Real Estate Cycle”, which was released in Dec 2020, one of the defining themes of the region is the expected rise by 15% to 20% in real estate investment volume.

Cross-border transactions will also undergo a mild recovery as intra-Asia Pacific borders open to allow transnational investments to resume.

Nevertheless, investors will remain cautious as risks from economic instability from the pandemic still linger.

Office as a place to nurture culture

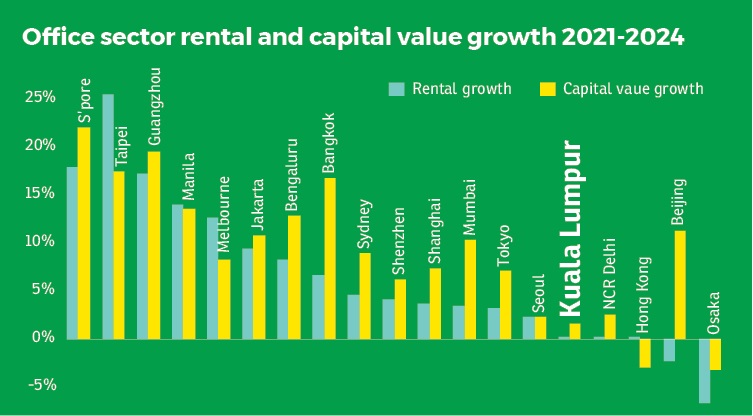

The market for office space has been disappointing in 2020 as the pandemic forced the working culture to enter the online realm. This resulted in a decrease of 25% on gross office leasing volume compared to 2019.

However, the decline of the leasing volume does not signal the death of the office. Instead, “it will further be reinvented and offices of the future will likely have more collaboration space as people ‘work from anywhere’,” says the report.

JLL predicts that leasing volume will see an improvement this year even with the de-densification of office space from 90 to 80 desks per 100 employees.

Furthermore, the ability of the business to expand and innovate will affect the rental recovery growth as financial and business services evolve to sectors centred on the digital economy in this new Asia Pacific cycle.

Opportunity in enhancement and value-add of assets and space will also be a defining feature together with the demand for experience as “in essence, the office will serve to nurture culture rather than purely host work”.

Retailers to adopt omnichannel strategies

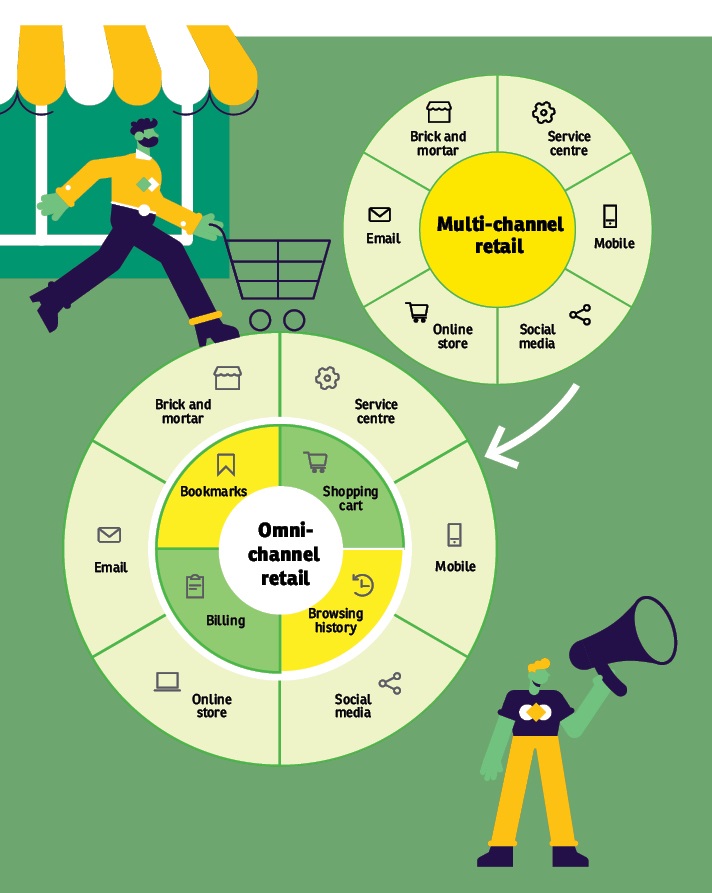

In the retail sector, other than non-discretionary retailers which have remained strong in holding their forts, others saw a challenging year in 2020 with a change of consumer trends and the shifts to online shopping.

The biggest challenge for the retail sector would be the rent prospect as some businesses would grow moderately and others would further decline with the economic instability.

To become resilient during these trying times, retailers need to utilise omnichannel strategies and use technology to ensure a resilient business model while reinventing the buying experience to incorporate elements of e-commerce.

The only winner: Logistics

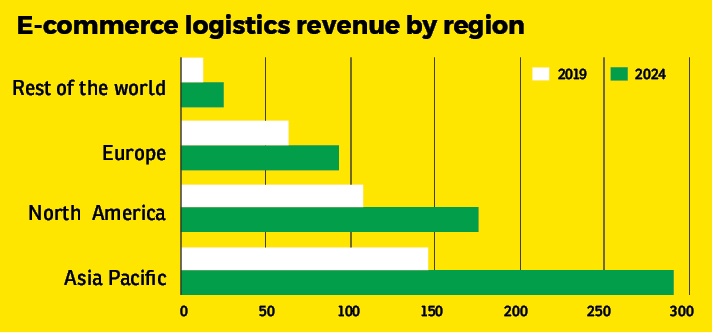

One winner is the logistics sector as the pandemic has only accelerated the push for long-term investments in logistics.

JLL believes that the Asia Pacific logistics market will continue to be appealing and remain strong despite the ongoing pandemic.

According to the real estate consultancy firm, 81% of the investors who participated in the survey have expressed their interest to increase their exposure in the logistics industry this year.

“Efficiency and evolution will drive the future of logistics assets, such as new cutting-edge logistics facilities driven by robotics and ultimately drone deliveries.

“Scarcity of land in key locations is another important factor, to locate last-mile logistics and also logistics centres that are still close to cities, which is likely to see repurposing of obsolete spaces. Further automation and multi-storey facilities to allow more intensive use of sites is a further opportunity for value-add investors,” states the report.

Growing markets

Besides that, there are other alternatives of the real estate market which might draw investors’ attention such as data centres, life sciences and multi-family funds.

These markets have continued to thrive over the years with data centres increasingly receiving over 40% of global data traffic.

Meanwhile, the property market for life sciences has become increasingly significant as healthcare spending in the region accounts for 40% of the global growth in the next decade.

This story first appeared in the EdgeProp.my e-Pub on Jan 8, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.