Govt halts exorbitant fees by MDI-appointed agents

- The exploitation by private liquidators – making a fortune from homebuyers’ misfortune – is a double whammy for the victims who are already facing the complications from their defunct property developers.

- We hope all agents and liquidators will comply with the decisions of MDI working in collaboration with Pemudah. It all boils down to strict compliance now. Those agents or liquidators who are unable to take on the task at that pricing should gracefully decline appointment.

The issue of “fair and reasonable fee” was deliberated at the Special Task Force to Facilitate Business, known by its acronym: Pemudah www.pemudah.gov.my, and an excellent decision was announced by minister in the Prime Minister’s Department (Economy) Datuk Seri Mustapa Mohamed, co-chaired by Dr Ir Andy Seo, inter-alia:

PEMUDAH meeting on 26th September, 2022 has decided that the fees imposed by those Agent(s) appointed by the Malaysian Department of Insolvency (MDI) is fixed at RM500.00 for transfer of property only for strata/grant titles that have been issued, subjected to all documents submitted being complete and in order. This agreement is not retrospective.

The Agents are, however, allowed to charge additional costs and other expenses incurred by the Agents in situation of lost strata/grant titles.

Curbing exorbitant charges

When a property developer is wound up before completion of its duties and contractual obligations, a liquidator fills the void and takes on the duties of the former, such as completing the construction of the buildings or facilities left by the defunct developer, delivering vacant possession, applying for individual or strata titles and subsequently to distribute the title deeds to the purchasers, so as not to leave the purchasers in a lurch. This is applicable to both housing and commercial properties.

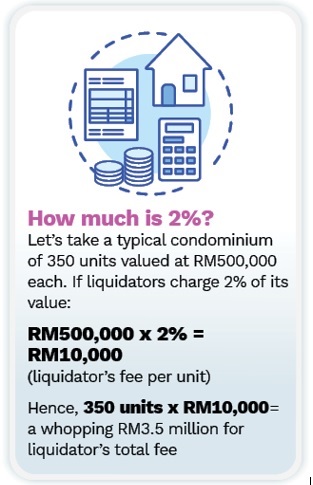

However, the MDI, or Jabatan Insolvensi Malaysia (JIM), have received numerous complaints against errant private liquidators who had imposed exorbitant charges for purported “administration fees” of between 1%-3% of the original purchase price or the sub-sale price. These liquidators had been appointed to manage the affairs of defunct property developers, especially in applying, distributing, transferring and “signing off” of individual and strata titles to their rightful purchasers (referred to as “the last mile”) for the purchasers’ ownership papers.

In some cases, there are also additional charges tagged as “vetting fees” for the liquidators’ appointed solicitors to vet the forms and documents. The liquidators will even make the owners pay for the former’s legal fees too. The exploitation by private liquidators – making a fortune from homebuyers’ misfortune – is a double whammy for the victims who are already facing the complications from their defunct property developers.

The unhealthy practice of liquidators imposing such exorbitant administrative fees for executing the transfer of individual titles to purchasers has now become a norm.

The fee is purportedly used to cover the liquidator’s costs in retrieving the related documents which have been purportedly destroyed or misplaced by the original developer and in verifying the same with the purchase proofs provided by purchasers. Consequently, a straightforward perfection of transfer becomes a costly affair.

Unilateral impositions of such fees by liquidators are devoid of any legal basis. Furthermore, the sum imposed is ridiculously high and is far more than enough to cover the reasonable administrative costs involved.

This casts doubt on the motive of collecting such fees and raises the question of whether the liquidators are unjustly enriching themselves at the expense of bona fide purchasers who are already in precarious positions without their individual titles.

Liquidators are officers of the court and appointed to carry out their duties judiciously, especially those appointed by MDI as agents under Section 433 of the Companies Act 2016 to perform the function of the “last mile”.

Additional charges must be transparent

The National House Buyers Association (HBA) would like to thank Pemudah for the excellent decision for MDI to rein in the agents appointed by MDI, that from henceforth, the fees shall be pegged at RM500 only for functions that relate to the undertaking of the last mile. The appointed agents are, however, allowed to charge additional charges and expenses for cost incurred eg in situations where the master title/s has been lost, and consequently for lodgement of police report, making of statutory declaration for replacement of title/s and application for its new issuance and whatever related thereto. Such additional charges must be reasonable and transparent. This is in line with MDI’s current gaji pelikuidasi (liquidator’s wage) set at RM500.

Hence, we hope all agents and liquidators will comply with the decisions of MDI working in collaboration with Pemudah. It all boils down to strict compliance now. Those agents or liquidators who are unable to take on the task at that pricing should gracefully decline appointment.

Regulate liquidators under Act 118

The HBA has time and again reminded the housing minister and those under the ministry’s charge on the need to rein in the conduct of those so-called court-appointed officers, namely liquidators.

This is legally possible as the definition of a housing developer and a licensed housing developer under the Housing Development (Control & Licensing), 1966 (Act 118) does include a liquidator. Therefore a liquidator is already a “de facto developer” under Act 118 since the amendment of the definition years ago. With this, the housing ministry should not use the “lack of mechanism” as an excuse for not regulating liquidators.

The National Housing Department (JPN), under the auspices of the Ministry of Housing and Local Government, have received numerous complaints against errant liquidators, receivers and managers (R&M) and judicial managers.

JPN has assured HBA that a new set of regulations will be formulated to cover the scope, role and remuneration scale. The aim is to regulate the conduct of liquidators, judicial managers and R&M with an emphasis on curbing dysfunctional acts, penalties for non-compliance, investigation, enquiries and criminal prosecution, among others.

This regulation should be expeditiously formulated and enforced to prevent purchasers and owners from being affected by irresponsible liquidators.

In the context of an abandoned housing project, a liquidator should step into the shoes of a wound-up developer as a de facto developer and revive the project within the legal provisions stated in Act 118 and its regulations to protect the interests of the purchasers.

It is clear under Act 118 that the liquidator can play an important role. As we have stated, Act 118 was amended to include a liquidator into the definition of a housing developer in the event the housing developer is in liquidation. The underlying rationale is for liquidators to attempt a revival of the abandoned project.

Nonetheless, we may require further legislation to clarify the duties and powers of the liquidator under Act 118.

This article is written by Datuk Chang Kim Loong, Hon Sec-Gen of the National House Buyers Association (HBA), which is a non-government and not-for-profit organisation manned wholly by volunteers.

HBA could be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.