YNH aborts sale of Segambut land, appoints Chin Hin Group Property to develop it instead

- Chin Hin is to develop a 2,434-unit serviced apartment on the plot, which it estimated will cost about RM575 million. In return, Chin Hin will be entitled to a sum of RM633 million, plus 84.5% of the GDV if it exceeds RM685 million.

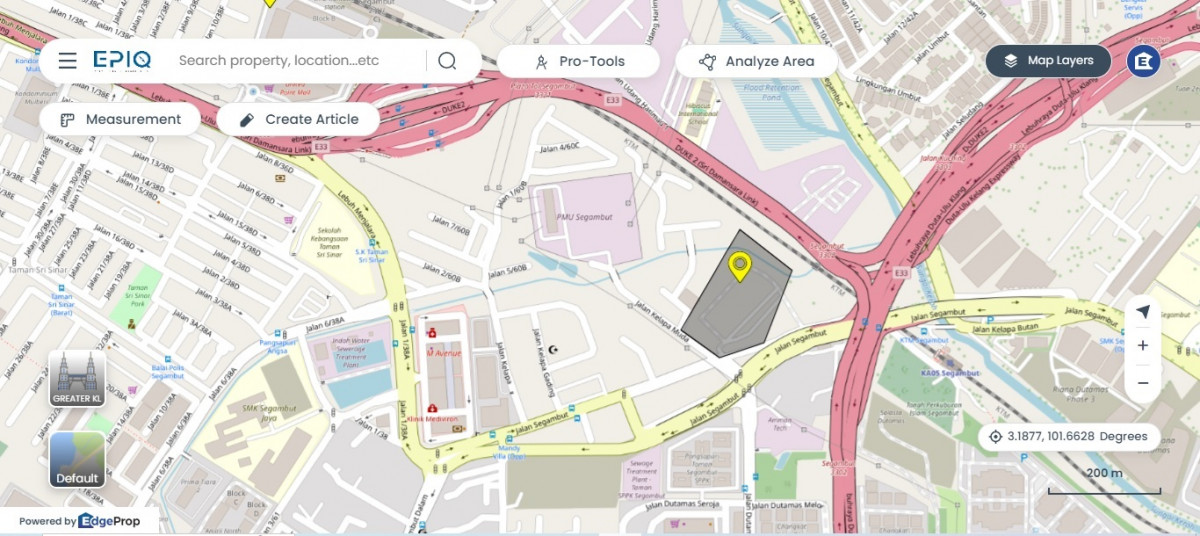

KUALA LUMPUR (April 25): YNH Property Bhd is aborting the sale of a 6.49-acre land in Segambut, and has appointed Chin Hin Group Property Bhd to develop the plot for a serviced apartment project that carries a potential gross development value (GDV) of RM685.1 million.

According to a bourse filing by Chin Hin on Wednesday, YNH's wholly-owned Kar Sin Bhd, together with New York Empire Sdn Bhd (NYESB), had inked a development agreement with Chin Hin's unit, Chin Hin Property (Segambut) Sdn Bhd, for the project. Kar Sin is the beneficiary owner of the plot, while NYESB — 80%-owned by Ding Chee Ling and 20% by Lim Leong Wouh — is the registered proprietor.

Chin Hin is to develop a 2,434-unit serviced apartment on the plot, which it estimated will cost about RM575 million. In return, Chin Hin will be entitled to a sum of RM633 million, plus 84.5% of the GDV if it exceeds RM685 million.

Kar Sin, as the beneficiary owner, will get at least RM52 million from Chin Hin, even if the GDV of the project is less than RM685 million. If the estimated GDV is met, it will get an "additional" but unspecified entitlement.

Chin Hin will pay the RM52 million as security deposit within three months after the agreement gets all the necessary approvals. Of the sum, Chin Hin will pay RM24 million to Frazel Group Sdn Bhd on behalf of Kar Sin.

According to Chin Hin, Frazel had inked a sale and purchase agreement (SPA) with Kar Sin on Sept 6 last year to buy the land. But the SPA had been revoked by the parties on Wednesday.

YNH, however, did not announce either the SPA or the revocation of the deal.

Meanwhile, part of the deposit will go towards paying the redemption sum of a financing provided by RHB Bank, to whom the Segambut land is currently charged. The balance, net of the redemption sum, will be paid to Kar Sin.

Chin Hin’s disclosure showed that NYESB had in June 2008 sold the land to Kar Sin. It is unclear whether the title of the freehold land has been transferred to Kar Sin, as NYESB is still listed as the registered proprietor of the land.

Kar Sin had in August 2016 rented the land to Nation Drive Wilayah Sdn Bhd, but the length of the tenure was not disclosed.

Chin Hin said the project is expected to commence in July next year and estimated to be completed in June 2030. The project will be funded by external borrowing and internally generated funds, it said.

Chin Hin said taking on the development is in line with its strategy to source new landbank, and given the land’s strategic location, it is confident that it will contribute positively to its future earnings.

Chin Hin appointed to develop Dutamas land caveated by MACC

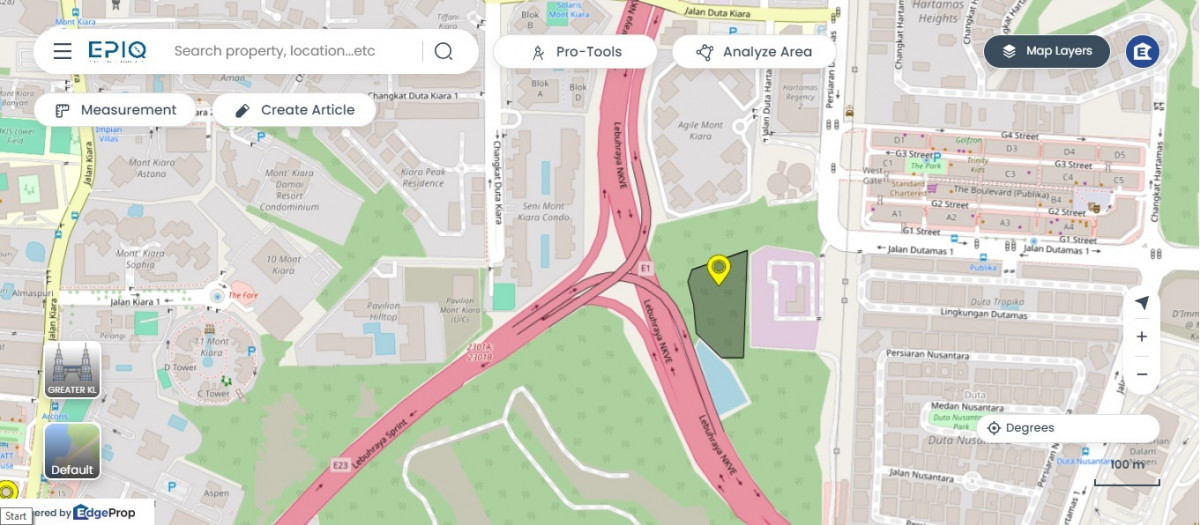

Separately, Chin Hin announced it has been appointed to develop a 2.67-acre freehold land in Dutamas, Mukim Batu, into a 974-unit serviced apartment, with a GDV of RM395.51 million, costing RM323.2 million to build between May 2025 to April 2030.

The land, however, is caveated by the Malaysian Anti-Corruption Commission, and is currently charged to United Overseas Bank (M) Bhd’s Ipoh branch.

For this development, Chin Hin was appointed by Archmill Sdn Bhd and Suasa Sentosa Sdn Bhd.

Archmill, the registered proprietor to the land, is controlled by Yew Hock Ming and Manogaran A/L PA Devanathan; while Suasa Sentosa, as beneficiary owner, is equally owned by Lau Sheng Ming and Yu Teong Wei.

All four names were involved in a series of joint ventures with YNH for lands in the vicinity of the Sri Hartamas area.

For this Dutamas land, Chin Hin will be paying Suasa Sentosa RM42 million as security deposit.

Chin Hin will be entitled to the sum of RM353 million “plus 81% of the GDV which exceeds RM395 million”, while Suasa Sentosa is entitled to a sum equivalent to 19% of the GDV.

Within the next 12 months, the parties involved have to discharge the land from existing charge, free it from MACC’s caveat, and terminate a turnkey construction agreement entered between Suasa Sentosa and Kar Sin in January 2011 to jointly develop the land.

Shares of Chin Hin, which has more than doubled year-to-date, closed two sen or 1.1% higher at RM1.85, giving it a market capitalisation of RM1.22 billion.

YNH, on the other hand, closed half sen or 1.1% lower at 45 sen, valuing it at RM238.05 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.