Rising waters, falling prices? Impact of floods on Selangor's property prices

- As these natural disasters become more frequent and severe, a crucial question arises: how does the threat of flooding impact property values, especially in Selangor, which boasts the largest population by state?

KUALA LUMPUR (Oct 21): The escalating frequency of floods in Malaysia has become a pressing concern for both residents and policymakers.

Deputy Prime Minister and Minister of Rural and Regional Development, Datuk Seri Dr Ahmad Zahid Hamidi, stated that the Northeast Monsoon season is anticipated to arrive earlier than previously predicted because of climate change, reported The Star recently. It is now expected to start in the fourth week of October instead of early November.

As these natural disasters become more frequent and severe, a crucial question arises: how does the threat of flooding impact property values, especially in Selangor, which boasts the largest population by state?

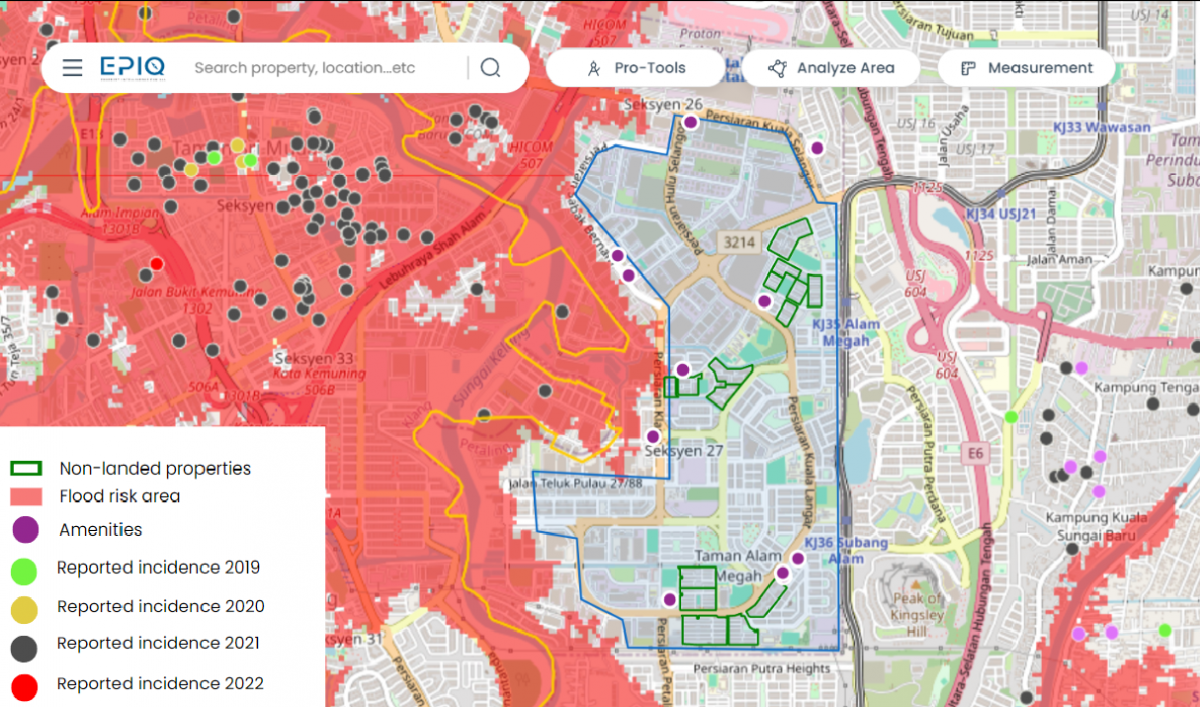

To answer this question, we’ve conducted a desktop research using the EdgeProp EPIQ platform to understand which areas in Selangor are being impacted, and how flooding risks have affected property prices over the years.

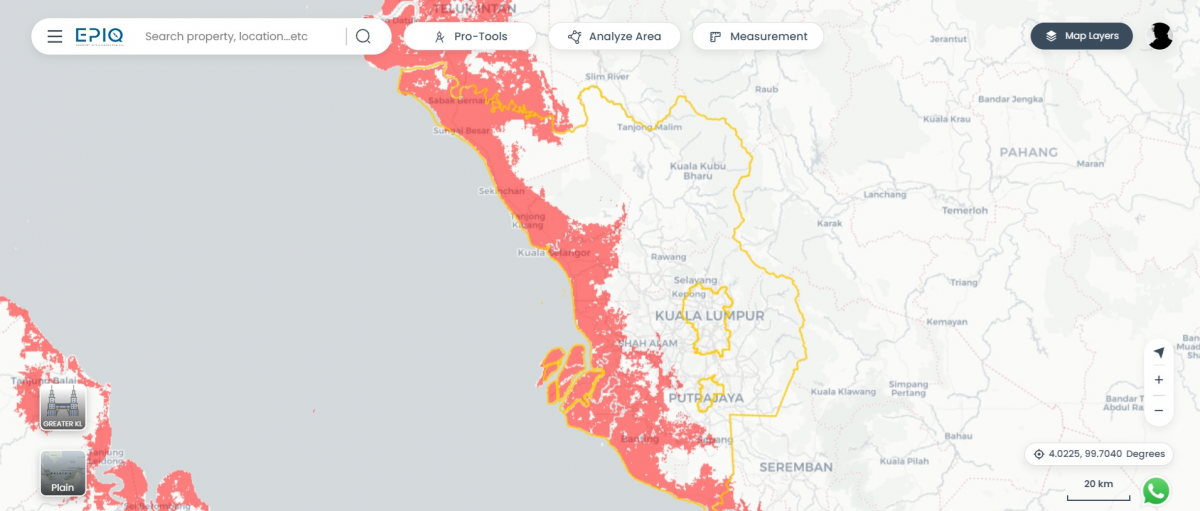

Selangor’s coastal regions are prone to flooding because of its geographical location and weather patterns. The Intergovernmental Panel on Climate Change (IPCC) has evaluated the vulnerability of its coastal regions to climate change, considering mid-range sea level projections. This assessment is based on the current trajectory, which is anticipated to result in approximately 3.6°C of warming above pre-industrial levels by the year 2100.

High-risk areas in Selangor: A closer look

According to IPCC’s projection, several areas in Selangor are at high risk of flooding, including Sabak Bernam, Sungai Besar, Sekinchan, Tanjong Karang, Kuala Selangor, Kapar, Klang, Port Klang, Teluk Panglima Garang, Jenjarom, Banting and Sepang.

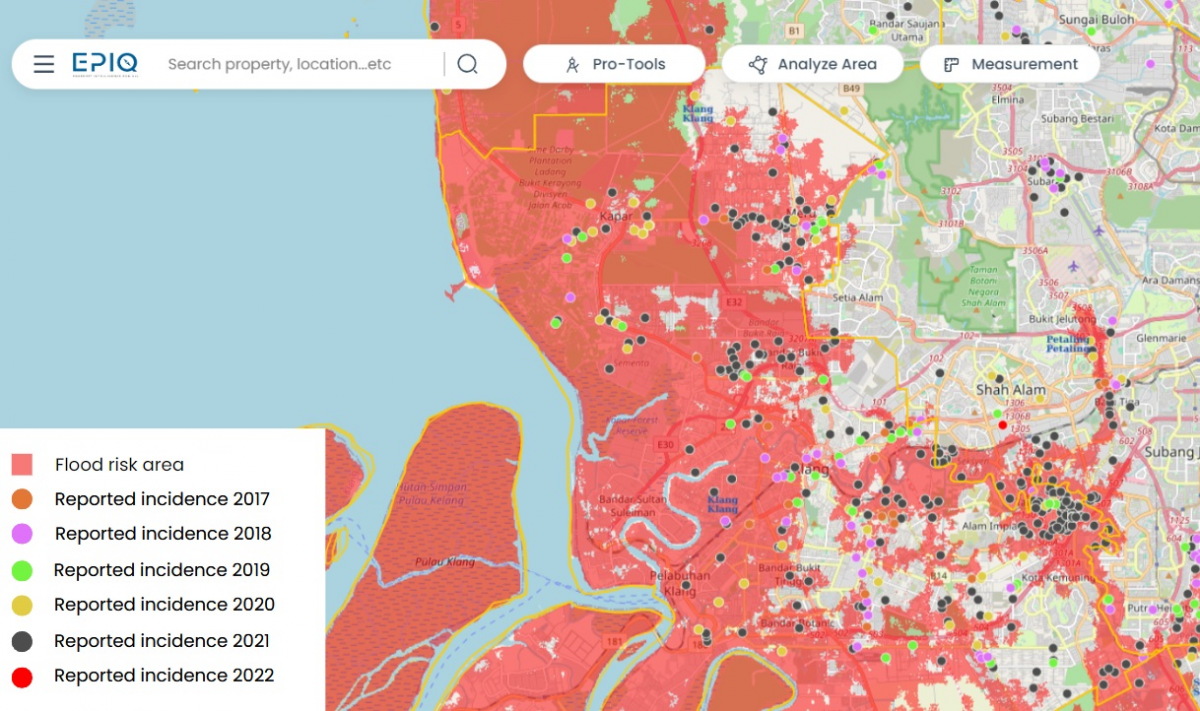

Data from EPIQ indicates that Klang has the highest reported incidence of flood events (from 2017 to the present). The area is particularly vulnerable during the Northeast Monsoon and periods of heavy rainfall from November to March.

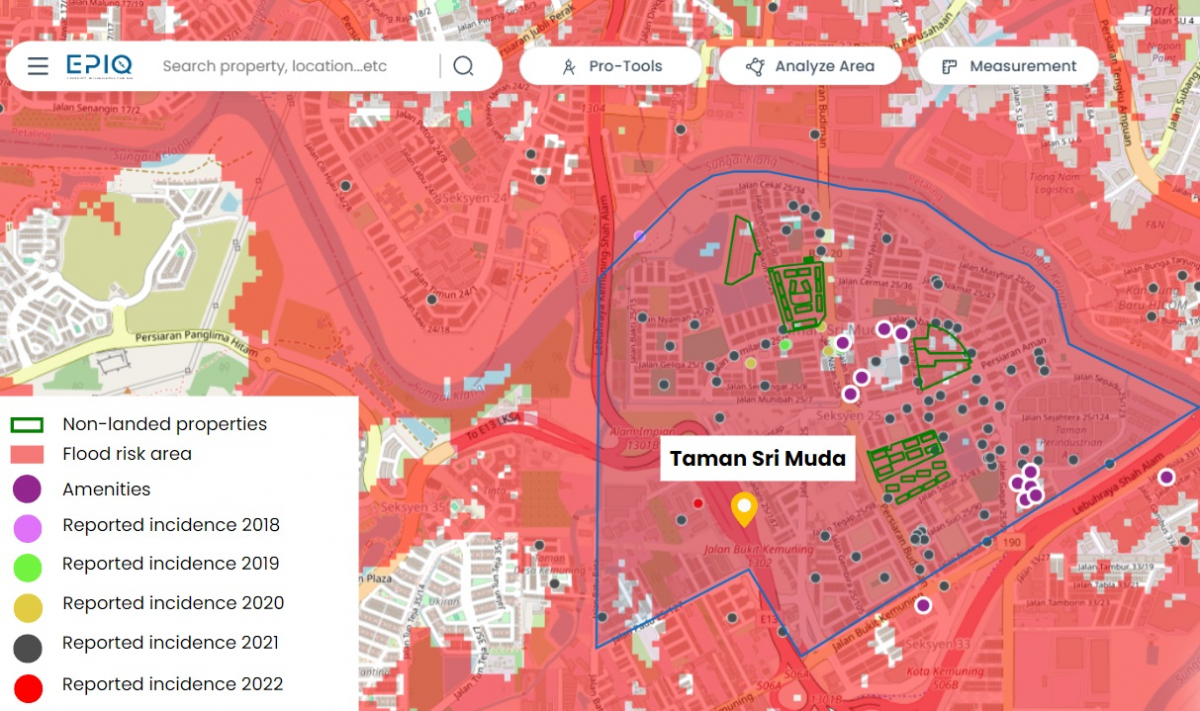

The devastating impact of the great flood on Taman Sri Muda

Taman Sri Muda, located in Shah Alam, was one of the hardest-hit areas during the massive flooding that swept across several states in Peninsula Malaysia in December 2021.

Thousands of homes were severely damaged, with floodwaters contaminating entire residential areas. The intensity of the disaster and the large-scale devastation have significantly affected property prices in that area.

To assess the impact of flooding, we analysed residential property prices in Taman Sri Muda and compared them with nearby non-flooded areas, using data from sale transactions on EdgeProp. This analysis included all types of homes, from luxury properties to affordable housing, covering the period from 2019 to 2023.

(Given the economic disruptions caused by the pandemic between 2020 and 2022, note that property prices may have been influenced by factors beyond flooding. Hence, the information in this article serves only as a general guide.)

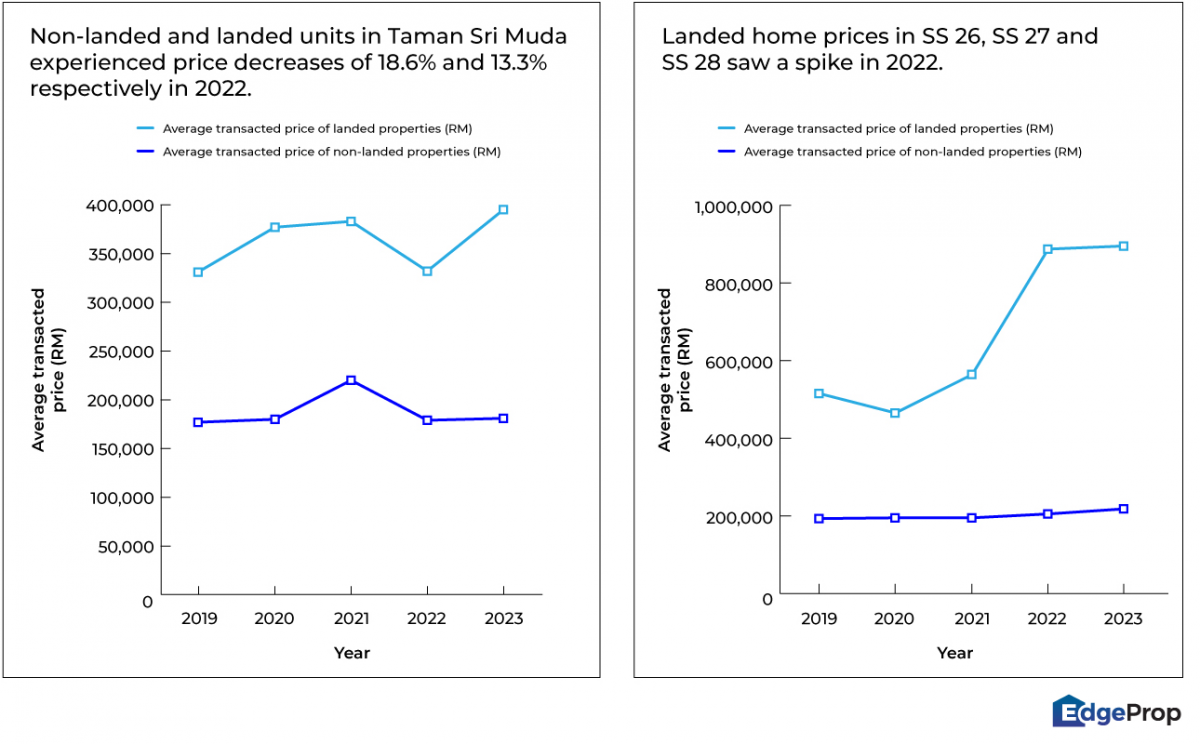

Taman Sri Muda: The rise and fall of property prices

In the years leading up to the 2021 flood, property prices in Taman Sri Muda were actually showing positive growth. The average transaction price of non-landed properties in the area increased from RM177,000 (RM210 psf) in 2019 to RM220,000 (RM252 psf) in 2021. Following the catastrophic flood, the average price dropped 18.6% to RM179,000 or RM216 psf in 2022, marking a 14.3% decline from its 2021 peak.

In 2023, the average transaction price rose marginally to RM181,000 from the year before. The 1.12% increase could probably be due to transactions of bigger-sized units, because the average price psf continued to decline by 12% to RM190.

Landed properties saw a similar rise from RM331,000 (RM309 psf) in 2019 to RM383,000 (RM333 psf) in 2021. However, the 2021 flood that submerged large parts of the neighbourhood drastically reversed this trend, with prices falling to RM332,000 (RM298 psf) in 2022.

However, unlike non-landed properties, their landed counterparts rebounded to RM313 psf in 2023, with an upswing at RM395,000 in average transacted price.

Steady growth in Seksyen 26, 27 and 28 of Shah Alam

In contrast, the nearby areas of Seksyen 26, Seksyen 27 and Seksyen 28 of Shah Alam, which were not affected by the floods because of their more favourable geographical locations, experienced steady and even robust growth during the same period. These neighbourhoods saw non-landed property prices rise steadily from RM195,000 (RM271 psf) in 2020 to RM205,000 (RM324 psf) in 2021. With no decline in the aftermath of the 2021 flood, the upward trend continued, with prices reaching RM218,000 by 2023.

However, in terms of price psf, a steady downward trend was observed, with prices sliding from RM285 in 2019 to RM280 in 2021. Post-2021 flood, it did continue to decline to RM263 in 2022, but the 6.1% drop was less than half of Taman Sri Muda's 14.3%. And unlike Taman Sri Muda’s flat growth, the non-flood areas here recovered to RM274 in 2023.

The situation was even more striking for landed residences in these areas, where prices skyrocketed from RM564,000 in 2021 to RM887,000 the following year — a 57.3% surge.

By 2023, the price had stabilised at RM895,000 (RM374 psf). This sharp rise, particularly after the 2021 flood, suggests that buyers may have been shifting their attention to non-flood-prone areas, boosting demand and consequently driving up property values in Seksyen 26, 27 and 28.

Flood preparedness vital for real estate growth

The comparison between Taman Sri Muda and its neighbouring areas illustrates the profound impact that natural disasters and geographical risks can have on property prices.

While Taman Sri Muda was once a thriving community with rising property values, the flood in 2021 disrupted this growth, causing a sharp decline in prices and a slower recovery. On the other hand, Seksyen 26, 27, and 28 of Shah Alam, which are located in areas not prone to flooding, benefited from a surge in demand, leading to sustained and substantial growth in property values.

This trend highlights the importance of geographical location and disaster preparedness in real estate investment. Properties in flood-prone areas may experience significant price volatility after a major disaster, with long-term repercussions for homeowners and investors. Conversely, areas that are perceived as safe from natural disasters tend to attract more buyers, resulting in higher demand and property appreciation.

Property developers embrace sustainable flood mitigation

As Malaysia faces escalating flood threats, property developers are actively seeking strategies to safeguard their projects. These efforts not only shield properties from flooding but also promote environmental sustainability.

Wetlands, like swamps, marshes, and mangroves, serve as natural flood buffers, absorbing excess rainfall. Some developers have integrated these ecosystems into their projects, creating green spaces that slow water flow and prevent flooding.

The sponge city concept, which emphasises urban environments that can absorb and retain rainwater, is gaining traction. Developers are adopting sponge city design principles to mitigate flood risks and build more sustainable, resilient communities in Malaysia.

Government allocates RM600 million to combat flash floods

The government has allocated a significant sum in the Budget 2025 to address the urgent threat of flash floods in the capital and other cities. The National Disaster Management Agency (Nadma) will receive RM600 million to prepare for potential floods, with half of that amount earmarked for immediate response.

To bolster relief efforts, the government has allocated a RM20 million matching grant to government-linked entities to support flood victims.

(Read also: Budget 2025: Biggest ever allocation to reinvigorate economy)

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.