Azam Jaya surges 40% on Main Market debut

- The counter opened at RM1 and at one point rose as much as 48.72% to touch its intra-day high of RM1.16.

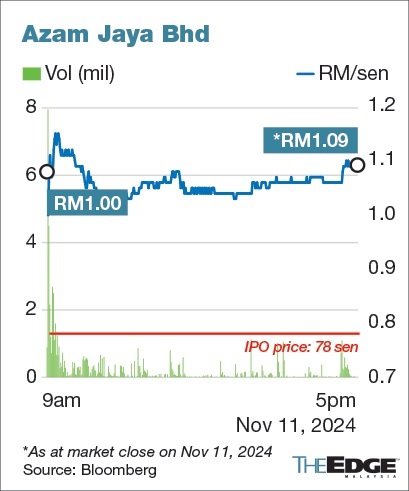

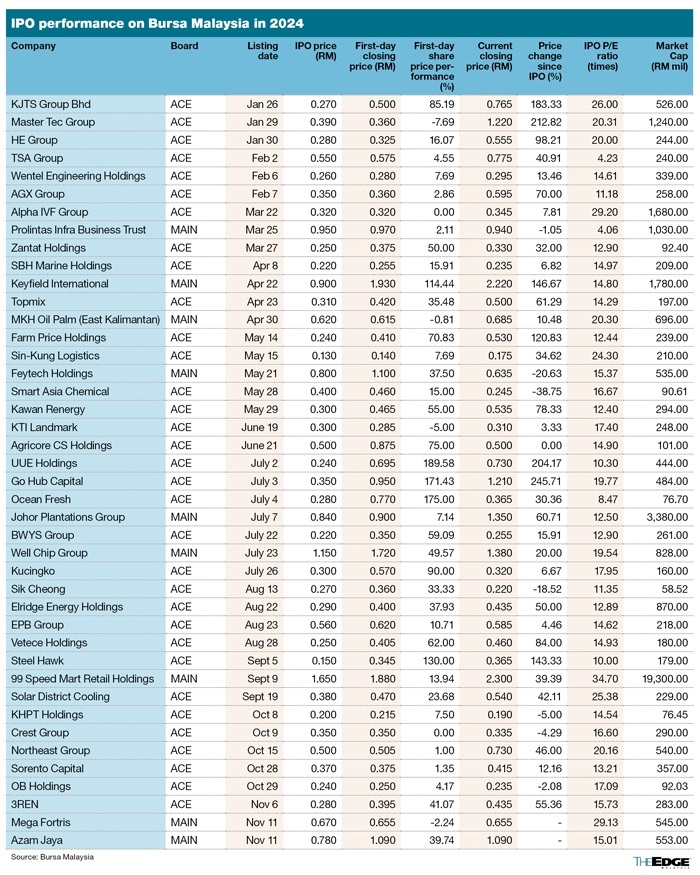

KUALA LUMPUR (Nov 11): Sabah-based Azam Jaya Bhd (KL:AZAMJAYA) ended its debut on the Main Market of Bursa Malaysia on Monday with a closing price of RM1.09, a 39.74% or 31 sen rise from its initial public offering price (IPO) of 78 sen.

The counter opened at RM1 and at one point rose as much as 48.72% to touch its intra-day high of RM1.16.

At the closing price of RM1.09, the company was valued at RM545 million based on its 500 million issued shares post-listing.

The construction firm was the second most active counter of the day, after 68.324 million shares changed hands.

At its closing price of RM1.09, the company was valued at a price-to-earnings ratio (PER) of just under 21 times, based on its profit after tax of RM26 million for the financial year ended Dec 31, 2023 (FY2023).

“As part of our long-term strategies to build on our success, we plan to enhance our construction capabilities, thus strengthening our capacity to take on larger projects,” said Azam Jaya executive director Datuk Jessica Lo Vun Che at the listing ceremony earlier on Monday.

Azam Jaya mainly builds road infrastructure, including roads, highways, bridges, flyovers and tunnels, in Sabah. The company is currently working on eight projects with an unbilled contract value totalling RM1.08 billion.

From the proceeds from the sale of new shares totalling RM61.5 million, Azam Jaya has allocated RM28.4 million as working capital for construction projects and RM20 million to repay bank borrowings.

The company has also earmarked RM8 million to boost construction capabilities and operational efficiencies by acquiring new machinery and equipment, as well as technological upgrades. The rest will be used to defray listing expenses.

Proceeds from the sale of existing shares, amounting to RM39 million, went entirely to chairman Tan Sri Joseph Lo @ Lo Tain Foh and his son Datuk Jonathan Lo Chaw Loong, who is also Azam Jaya’s managing director.

Inter-Pacific is the principal adviser, sole underwriter and sole placement agent for the IPO.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.