MUI Properties to buy RM605m Ijok land to rebuild development pipeline

- It said the acquisition is intended to replenish its land bank after completing the RM424.43 million disposal of industrial land in Bandar Springhill earlier this year, which substantially reduced its available land for future projects.

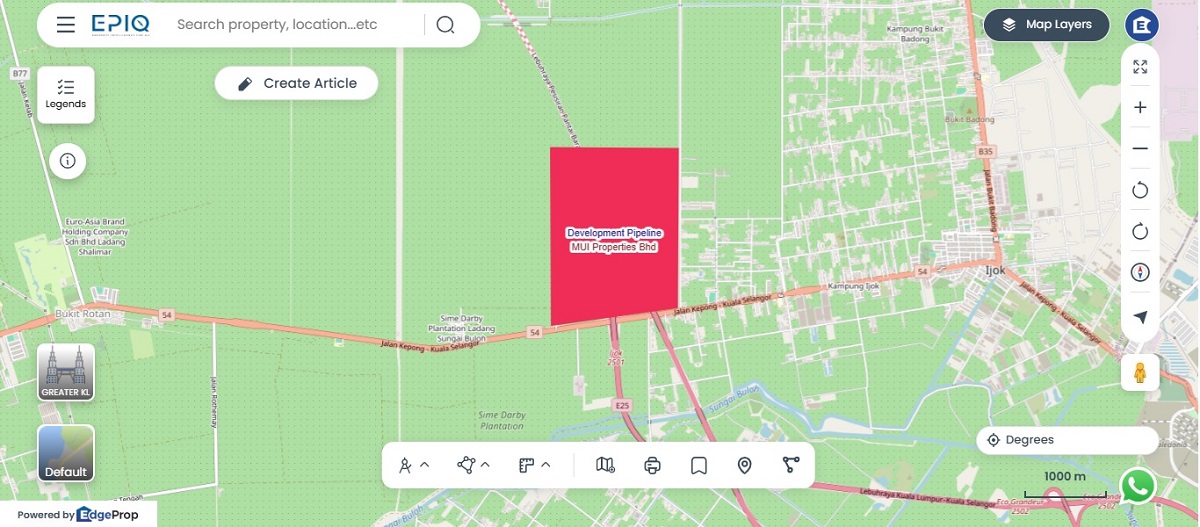

KUALA LUMPUR (Nov 27): MUI Properties Bhd (KL:MUIPROP) is acquiring eight parcels of freehold land in Ijok, Selangor, for RM605 million to rebuild its development pipeline following its recent land sale in Negeri Sembilan.

The group, in a filing with the bourse, said its indirect subsidiary MUI Industrial Estates Sdn Bhd entered into a conditional sale and purchase agreement (SPA) on Thursday to buy the 730.99-acre tract, which comprises industrial-zoned parcels, adjacent to the Kuala Lumpur-Kuala Selangor Expressway (Latar) Expressway and West Coast Expressway.

It said the acquisition is intended to replenish its land bank after completing the RM424.43 million disposal of industrial land in Bandar Springhill earlier this year, which substantially reduced its available land for future projects.

MUI Properties said it currently has only 133 acres in Negeri Sembilan and 0.45 acres in Selangor earmarked for future development.

The acquisition will be funded through a mix of internal funds and bank borrowings, with management estimating that 25% will be paid in cash and the remaining 75% via debt.

A total of 13 of the 19 co-owners of the land, collectively holding 69% of the undivided shares, have signed the SPA. MUI Industrial Estates will be required to obtain a court order to compel dissenting co-owners holding the remaining 31% to sell their stakes under the same terms.

The completion of the deal is subject to multiple conditions precedent, including court orders, the removal of caveats and MUI Properties’ shareholder approval, and is expected to conclude by the second half of 2027.

MUI Properties said the land offers long-term development potential, particularly for industrial and logistics-related projects, given its connectivity to Kuala Lumpur, Shah Alam and Port Klang, as well as its proximity to established industrial parks such as Eco Business Park V and Nouvelle Industrial Park.

The group added that the sizeable tract enables phased roll-out of future projects, supporting its strategy to broaden its property portfolio and enhance recurring income.

MUI Properties received RM63.4 million from its subsidiary West Synergy Sdn Bhd’s RM105.66 million dividend distribution from the Bandar Springhill land sale and used part of it to declare an eight-sen special dividend totalling RM59.27 million in August.

MUI Properties is 72.26%-owned by Malayan United Industries Bhd (KL:MUIIND).

MUI Properties shares closed unchanged at 26 sen on Thursday, with a market capitalisation of RM198.7 million.

MUI Properties swings to net profit in 1Q on land sale boost

Separately, MUI Properties reported that it returned to the black with a net profit of RM108.61 million for the first quarter ended Sept 30, 2025 (1QFY2026), from a net loss of RM11.8 million a year earlier, mainly due to the Bandar Springhill land disposal.

Revenue rose more than tenfold to RM367.14 million from RM34.74 million in 1QFY2025, another bourse filing on Thursday showed.

Earnings per share stood at 14.66 sen, compared with a loss per share of 1.59 sen in 1QFY2025.

Looking ahead, the group said it expects further value uplift for its Bandar Springhill development from land transactions, including the RM80.8 million sale to Antmed Malaysia Sdn Bhd and the land sale to Gamuda.

"These milestone transactions are poised to transform Bandar Springhill into a dynamic high-tech hub, unlocking substantial growth potential through the uplift in industrial land values," it said.

MUI Properties is 72.26%-owned by Malayan United Industries Bhd (KL:MUIIND).

MUI Properties shares closed unchanged at 26 sen on Thursday, with a market capitalisation of RM198.7 million.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.