Matang expands durian footprint with RM18.2 mil land acquisition in Tangkak

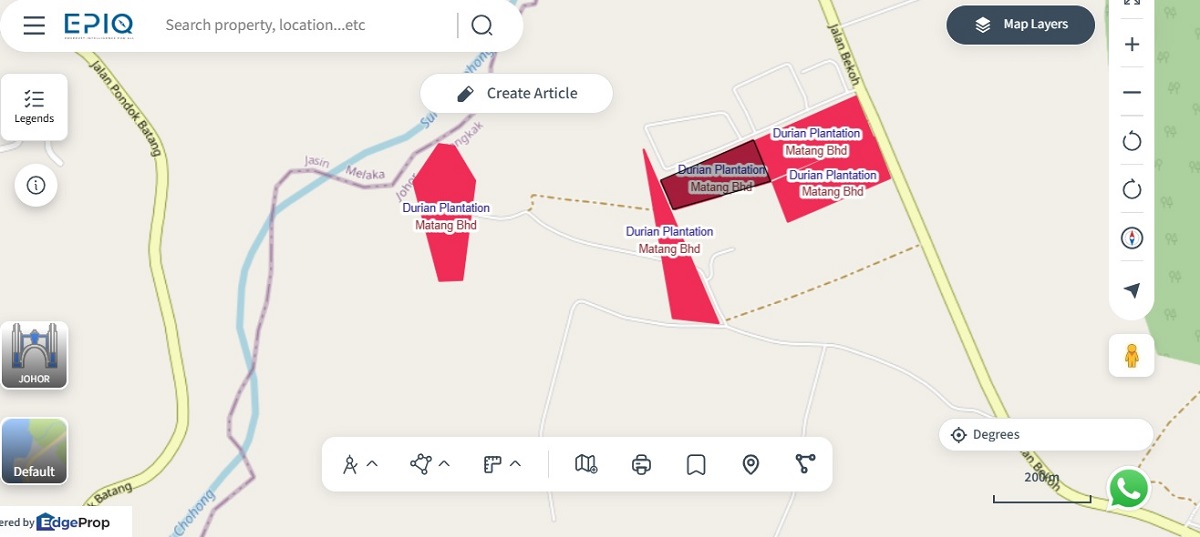

KUALA LUMPUR (Feb 8): Plantation company Matang Bhd (KL:MATANG) said on Friday its unit is expanding its durian plantation footprint through the acquisition of 10 adjacent parcels of agricultural land in Tangkak, Johor, for RM18.2 million in cash.

The group's wholly-owned subsidiary Matang Agriculture and Plantation (Segamat) Sdn Bhd, has entered into two separate sale and purchase agreements with Ophir Quarry Sdn Bhd and Kwong Ming Mean for the acquisition of the land parcels, which are currently cultivated with durian trees.

Upon completion, Matang’s total plantation land bank will increase to 1,170.02 hectares from 1,150.38 hectares, representing an addition of 19.64 hectares, or about 1.71%.

The land parcels are planted with durian varieties including Musang King, Black Thorn, IOI and Kampung, with trees ranging from one to nine years. The surrounding area is predominantly agricultural, mainly comprising oil palm and fruit tree cultivation.

The proposed acquisition is expected to generate additional revenue and profit through the consolidation of durian production from the subject lands’ mature yielding plantations, the group said in a filing with Bursa Malaysia.

Matang said the acquisition price of RM18.2 million represents a premium of RM196,042.48, or 1.09%, over the independent market valuation of RM18 million. The purchase consideration will be funded via internally generated funds and the remaining proceeds from the group’s private placement exercise completed in 2021.

As at end-September 2025, Matang had cash and bank balances, as well as short-term funds of RM78.71 million, with zero borrowings.

Currently, the group operates about 121.03 hectares of durian plantations across its Segamat and Yong Peng estates, accounting for approximately 10.7% of its total plantation land allocation.

“The durian sector has proved to be an emerging growth pillar for Matang as the industry continues to gain attention for its premium export potential, particularly in China and regional markets,” Matang said.

It added that the group is actively exploring downstream opportunities, including durian paste processing, to enhance value creation from future harvests.

Meanwhile, Matang is also evaluating agri-tech and data-driven farming solutions to optimise resource allocation, monitor tree health and improve yield consistency across both its oil palm and durian estates.

Shares of Matang closed half a sen or 6.25% lower at 7.5 sen on Friday, giving it a market capitalisation of RM179.2 million. The stock is down more than 6% year to date.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.