Parkson to make gain of RM300 mil from divesting subsidiary

Parkson Holdings Bhd (Sept 14, 81 sen)

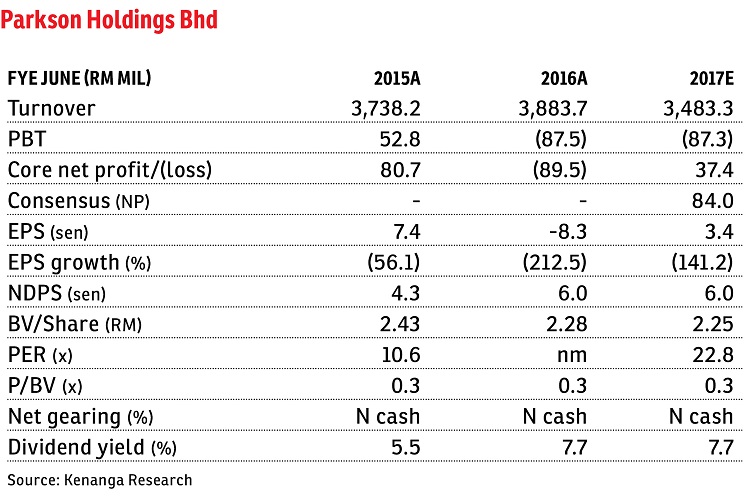

Maintain underperform with an unchanged target price of 70 sen: Parkson Holdings Bhd’s 54.67%-owned Parkson Retail Group Ltd (PRGL) is divesting a wholly-owned subsidiary (disposal property) and the relevant shareholder’s loan for a combined total cash consideration of RM1.4 billion. The sales and purchase agreements are divided into: an equity consideration for RM1 billion, and subsequently selling the loan for RM396 million. PRGL is expected to register a gain of RM549 million of which Parkson’s 54.67% effective stake is RM300 million or 28 sen per share.

For illustration purposes, Parkson Holdings’ book value per share is expected to rise by 13% from RM2.38 to RM2.68 as at June 30, 2016.

The wholly-owned subsidiary owns a property located in the Chaoyang district of Beijing and comprises seven levels above ground for commercial use and three levels underground, which are principally used as car parking spaces. The unaudited net book value of the disposal property was RM628 million as at July 31, 2016. We maintain our earnings forecast as this store registered a small profit of RM800,000 in financial year ended June 30, 2015.

This latest corporate development by Parkson is positive and came in as a pleasant surprise to the market. More importantly, this latest move is seen as a positive step in its efforts to eradicate stores, which are loss-making and a drag to earnings. The disposal also means that the group can cease to invest resources in a business operation which had been loss-making and thus liberalising resources of other business operations of the group.

There are plans to close the FMI Centre (Myanmar), where the store is located, for redevelopment and the impending closure has affected sales. However, the landlord has not confirmed the timing for redevelopment. Looking ahead, we expect Parkson to continue facing a tough operating environment on the back of weak consumer sentiment due to the economic slowdown. Coupled with intense competition from online shopping and oversupply of retail space, we believe it will take a longer period of time for Parkson to reverse its declining trend in same store sales growth. No change to our earnings forecast. Our target price is 70 sen. Reiterate “underperform”. — Kenanga Research, Sept 14

This article first appeared in The Edge Financial Daily, on Sept 15, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.