Sunway REIT in good position to attract investors

Sunway Real Estate Investment Trust (Oct 19, RM1.73)

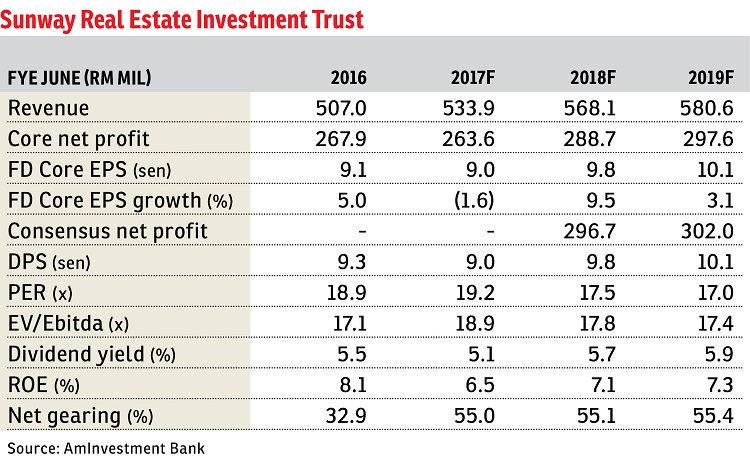

Initiate buy with a target price of RM1.92: Our investment thesis is premised on the steady growth from lease renewals (crown jewel — Sunway Pyramid shopping mall), moderate balance sheet for further potential asset injections, proactive capital management creating immediate value to unitholders and retail being a resilient sector. We estimate a 3.7% distribution per unit (DPU) contraction in Sunway Real Estate Investment Trust’s (REIT) financial year ending June 30, 2017 (FY17) before increasing by 9.6% in FY18 due to the closure of Sunway Pyramid Hotel East for asset enhancement works, cessation of manager fees payable in units with effect from FY17 and higher operating cost assumptions before this normalises in FY18.

In FY18, we forecast 9.5% DPU growth to be driven by normalisation of Sunway Pyramid Hotel East post asset enhancement initiatives and higher contribution from Sunway Putra Mall. Its low gearing offers room for acquisitions. Sunway REIT’s debt-to-asset ratio is at 33.2%, significantly below the 50% statutory limit. Assuming an optimum level of 40%, Sunway REIT has a debt headroom of RM800 million to gear up for acquisitions without the need to engage in equity fundraising.

We like Sunway REIT’s proactive capital management, which allows it to enjoy lower borrowing costs than its peers and create immediate value for unitholders via lower discounting factor. Should there be another round of policy rate cut by Bank Negara Malaysia, there could be further compression on Sunway REIT’s FY17 to FY18 yields. This would make REITs more attractive. In particular, we believe Sunway REIT could be in a good position to attract investor interest, given its stable earnings growth. Yields are decent at 5.3% to 5.7% for FY17 to FY18. — AmInvestment Bank, Oct 19

This article first appeared in The Edge Financial Daily, on Oct 20, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.