Sime Darby Bhd (Feb 28, RM8.96)

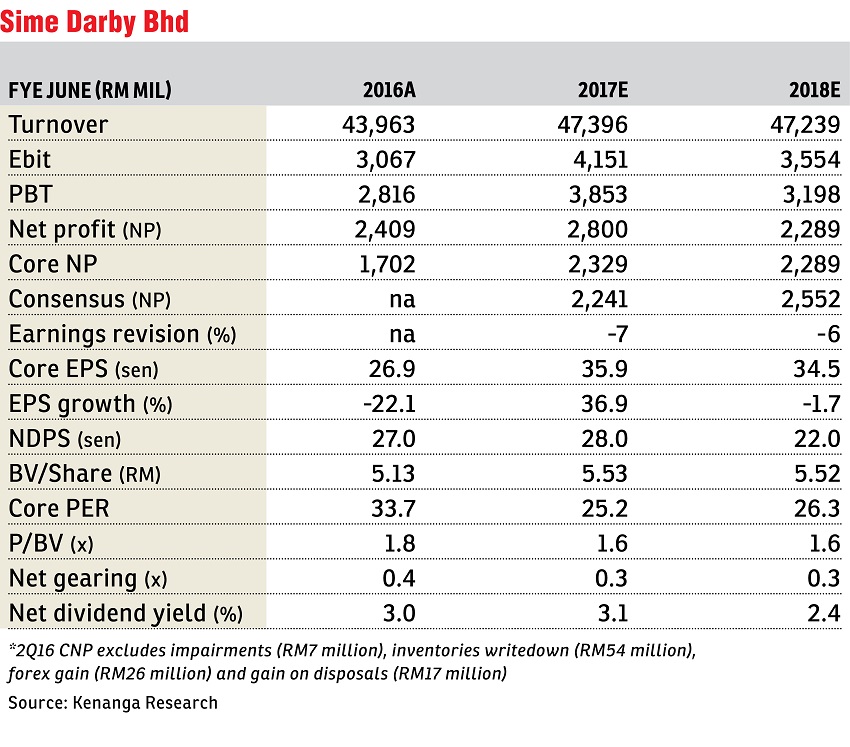

Downgrade to market perform with a lower target price of RM9.50: Sime Darby Bhd’s first half of 2017 (1HFY2017) core net profit (CNP) at RM892 million came in below expectations, making up 40% of consensus’ RM2.24 billion and 36% of our RM2.5 billion forecast.

This was largely due to weaker-than-expected industrial and logistics performance coupled with continued weakness in the local property business.

An interim dividend of six sen was announced, matching its 1HFY2016 dividend, and in line as higher full-year dividend is typically paid in the fourth quarter (4Q). Sime Darby also announced its proposed listing structure for its plantation and property segments, which we will comment on below.

Its 1HFY2017 CNP improved 39% as the plantation segment’s profit before interest and tax (PBIT) jumped 82% thanks to a 32% increase in crude palm oil (CPO) prices to RM2,739 per tonne. Excluding one-off disposals in 1Q of 2017 (1QFY2017) (totalling RM166 million), 2QFY2017 (RM58 million) and 1QFY2016 (RM55 million), its property segment core earnings declined 36% to RM143 million on slower construction progress in its local projects, though we note that Sime Darby recognised its share of profit from the Battersea project of RM95 million (PBIT level) during the quarter.

Excluding its property segment disposal (RM30 million) in 1QFY2017, its motors segment earnings were flat (+2%) as better Malaysia, China and New Zealand performances were offset by weaker Vietnam performance (on higher consumption tax). The industrial segment contribution weakened (-14%) on lower marine contributions. Quarter-on-quarter jumped 1.7 times as the plantation segment’s PBIT doubled, thanks to better CPO prices (+11%) and fresh fruit bunch production (+26%). Its property core earnings also jumped 12 times to RM79 million thanks to the Battersea PBIT contribution (RM95 million) although this was limited by Malaysia property business core loss of RM16 million. The motors segment core earnings weakened 18% on softer Asean ex-Malaysia contribution. The industrial segment’s PBIT improved 8% on better Malaysia and Australia performances.

Sime Darby announced its intention to conduct an internal restructuring and distribution of 100% of Sime Darby Plantation Sdn Bhd and Sime Darby Property businesses, which allows entitled shareholders to maintain the same proportion as their holdings in Sime Darby upon completion. We are “neutral” on the proposed listing structure as we expect limited benefits to existing shareholders aside from potential value creation upon listing, which is targeted for completion by late 2017 to early 2018. — Kenanga Research, Feb 28

This article first appeared in The Edge Financial Daily, on March 1, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

Sunrise Technology Park @ Seskyen 35

Shah Alam, Selangor

Paloma @ Tropicana Metropark

Subang Jaya, Selangor

Sunrise Technology Park @ Seskyen 35

Shah Alam, Selangor