Kimlun Corp Bhd (Dec 29, RM2.22)

Maintain market perform with an unchanged target price of RM2.27: Last Thursday, Kimlun Corp Bhd announced that it is acquiring two plots of land from Mah Sing Group Bhd for a total consideration of RM36.1 million.

The first commercial titled land located in Taman Sri Pulai Perdana spanning 5.2 acres (2.1ha) is surrounded by a matured township and will be acquired for RM14.2 million (RM63.50 per sq ft [psf]). Meanwhile, the second plot of agriculture titled land located in Meridin East spanning 17.9 acres will be acquired for RM21.8 million (RM28 psf).

We note that the transactions are only expected to conclude in the fourth quarter of 2020 (36 months) unless Kimlun decides to conclude earlier. The land plots are for mixed development purposes.

Given the lengthy timeline of acquisition, we are neutral on the land purchases, as we believe they would only be developed from the financial year ending Dec 31, 2020 (FY20) and contributions would only be felt then.

As no gross development value (GDV) guidance is available, based on a tentative land/gross development value (GDV) ratio of 10% to 15%, we expect the two pieces of land to generate a potential GDV range of RM240 million to RM360 million. Net gearing-wise, it will increase to the 0.12 times level (from 0.06 times as of the third quarter ended Sept 30, 2017), which is still manageable.

Moving forward, we opine that Kimlun will continue to purchase pockets of land bank in Johor if the opportunity arises given their manageable gearing level.

Currently, the outstanding construction order book stands at about RM2.1 billion, providing visibility for the next two years.

Note that year-to-date construction wins stand at RM940 million, making up 94% of our FY17 replenishment target.

Moving forward, we expect construction revenue to pick up pace as major projects move into more advance billing stages. As for the manufacturing arm, Kimlun has secured about RM90 million of manufacturing orders, making up 30% of our targeted RM300 million replenishment.

The replenishment target is backed by potential Singapore manufacturing packages, such as phase 2 of the Deep Tunnel Sewerage System, Mass Rapid Transit (MRT) Circle Line 6 and the North-South Corridor Expressway. The current outstanding manufacturing order book stands at RM350 million, providing visibility for about two years. We anticipate contributions from Klang Valley MRT Line 2 (the tunnel lining segment and SBG to continue picking up pace in 4Q17.

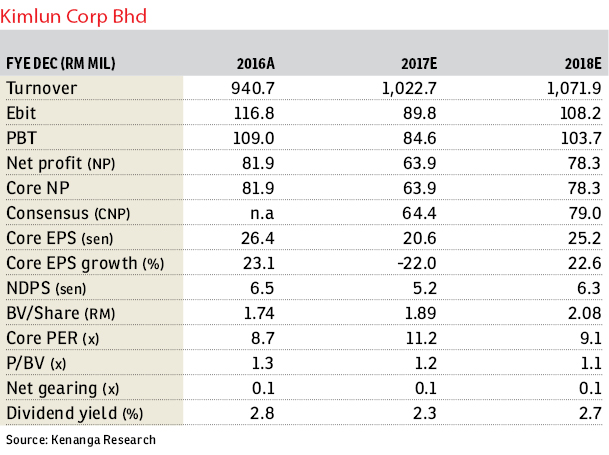

Post-acquisition, we make no changes to our FY17 to FY18 earnings estimates as we only expect developments to take place from FY20. — Kenanga Research, Dec 29

This article first appeared in The Edge Financial Daily, on Jan 2, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Dorsett Residence, Sri Hartamas

Sri Hartamas, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

Golden Sands Seaview Residence

Johor Bahru, Johor

Sejati Residences (Amelia)

Cyberjaya, Selangor

Sejati Residences (Amelia)

Cyberjaya, Selangor

Evergreen Garden Residence

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Lepironia Gardens, Setia Eco Glades

Cyberjaya, Selangor

Trillium, Perdana Lakeview East

Cyberjaya, Selangor

Opus Lake Vicinity @ Perdana Lakeview East

Cyberjaya, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)