Malaysian Resources Corp Bhd (Oct 12, RM1.31)

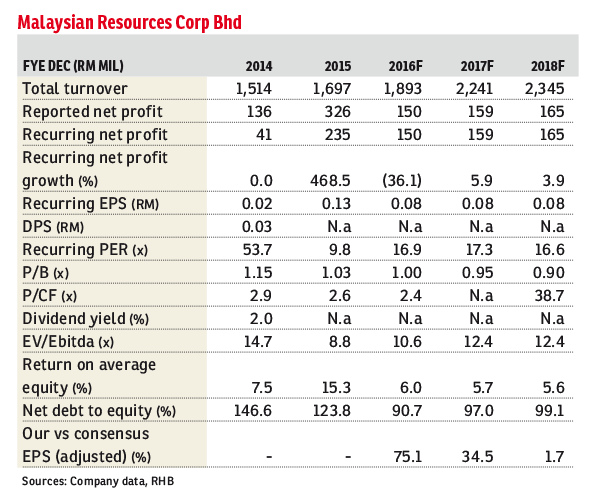

Reiterate buy rating with a target price of RM1.60: Malaysian Resources Corp Bhd’s (MRCB) earnings improvement and financial position should be more visible in financial year 2017 (FY17), underpinned by the potential disposal of the Eastern Dispersal Link (EDL) and other commercial office buildings.

Meanwhile, light rail transit 3 (LRT3) project delivery partner (PDP) fees and stable dividend income from MRCB-Quill REIT (MQREIT) will provide a solid earnings base. Earnings from key operations are driven by RM1.3 billion unbilled sales and an RM2.13 billion construction order book.

A de-gearing exercise via asset disposal is achievable. MRCB’s plan to lower its net gearing to 0.45 times by end-2017 (versus second quarter of 2016 [2Q16]: 1.09 times) is on track. Although the intention to sell the EDL is widely known, we believe the market is sceptical about the timing and management’s execution. We understand that negotiations with interested parties are ongoing, and management hopes to ink an agreement by end-2016 or early 2017.

As the RM1.18 billion debt associated with the EDL has been a drag on the company’s balance sheet and profit-and-loss statement, given an interest rate of 7% for the bond, its removal from MRCB’s books would significantly strengthen its financial position.

This is as net gearing should go down to around 0.3 times after the disposal of Menara Shell is completed. In the pipeline, Menara Celcom would be up for sale in the second half of 2017. The office building is worth about RM640 million and the construction will be completed early next year. More visible earnings turnaround is expected post-EDL disposal. Total LRT3 PDP fees of RM270 million are to be spread over the next 4.5 years. The REIT should also form a strong earnings base for MRCB in the coming years. LRT3 PDP fees have started kicking in since 2Q16, although the amount is small thus far.

As the contribution follows an “S” curve, we expect the contribution to be about RM15 million to RM20 million in FY17. The dividend stream that MRCB would receive from MQREIT should grow to above RM20 million after the sale of Menara Shell and placement exercises are completed. — RHB Research, Oct 12

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Oct 13, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Lorong Naluri Sukma 8/8

Bandar Puncak Alam, Selangor

Sunway SPK Damansara

Sunway Spk Damansara, Kuala Lumpur

Setia Impian, Setia Alam

Setia Alam/Alam Nusantara, Selangor

Taman Tepi Sungai ( Taman Teluk Pulai Indah )

Klang, Selangor