Hua Yang Bhd (Jan 21, RM1.81)

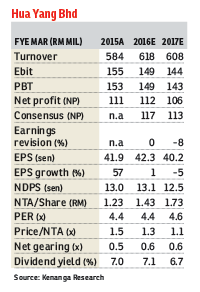

Maintain outperform with a target price of RM2.20: Hua Yang’s nine months ended Dec 31, 2015 (9MFY16) core net profit of RM88.7 million came in within expectations, accounting for 79.5% and 76.5% of our and streets’ full-year estimates, respectively.

The core net profit growth of 10% was underpinned by steady revenue growth of 4%. The growth in revenue was mainly attributable to the steady progressive billings of its ongoing projects and completion of selected phases of Taman Pulai Indah and Taman Pulai Hijauan, Bandar Universiti Seri Iskandar (pictured) as well as FLEXIS @ One South.

However, its 9MFY16 sales of only RM255.4 million were behind our and the management’s targets of RM482.1 million and RM500 million, respectively, and only RM80.6 million worth of sales were achieved as the situation has not improved since the beginning of FY16, due to tighter lending criteria from banks.

As expected, the group declared a five sen single-tier interim dividend. For the full year, we are still expecting a total dividend of 13 sen, which implies a yield of 7.1%.

As highlighted in our previous report dated Jan 12, we anticipated management to scale back some of its planned launches worth about RM650 million in FY16.

As it turned out, the management did scale back and lowered its sales target for FY16 by 20% from RM500 million to RM400 million, indicating that market conditions will remain highly challenging even in the affordable housing space.

As it turned out, the management did scale back and lowered its sales target for FY16 by 20% from RM500 million to RM400 million, indicating that market conditions will remain highly challenging even in the affordable housing space.

Following the management’s move in lowering its FY16 sales target by 20% to RM400 million, we also lowered our FY16 to FY17 expected sales by 22% to 23% to RM372.1 to RM409.2 million as we pushed back some of the launches accordingly.

While there are no changes to our FY16 expected net profit of RM111.6 million backed by its unbilled sales of RM530.5 million, our FY17 expected net profit is reduced by 8% to RM106.1 million.

Nonetheless, at current levels, the stock is trading at an undemanding valuation of FY16 to FY17 expected price-earning ratio (PER) of 4.4 times to 4.6 times and still offers a highly attractive dividend yield at 7.1% to 6.7%, respectively, compared with its peers’ average of 7.5 times and yield of 5.6%. — Kenanga Research, Jan 21

This article first appeared in The Edge Financial Daily, on Jan 22, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Kawasan Industri Desa Aman

Sungai Buloh, Selangor

Laman Anggerik, Nilai Impian

Nilai, Negeri Sembilan