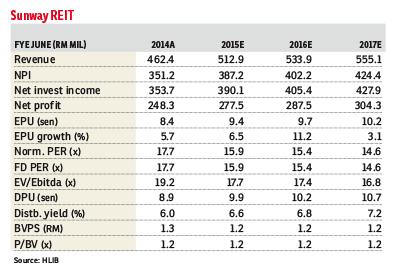

Maintain hold with an unchanged target price (TP) of RM1.60: The first quarter ended Sept 30 2015 (1QFY16) gross revenue of RM121.2 million (+6.5% year-on-year [y-o-y], 5.5% quarter-on-quarter) was translated into normalised net profit of RM64.5 million (+1.6% y-o-y), accounting for 23.2% and 23% of Hong Leong Investment Bank and consensus financial year forecasts, respectively.

We consider this to be in-line as we expect gradual improvement in occupancy rate at Sunway Putra Mall. First interim dividend of 2.12 sen was declared (1QFY15: 2.28 sen).

The retail segment continued to drive Sunway Real Estate Investment Trust (REIT)’s earnings growth, primarily from resilient performance of Sunway Pyramid shopping mall (+4.1%) and SunCity Ipoh (+0.0%) as well as improved performance of newly opened Sunway Putra Mall (+1,746.4%). This has partially offset the marginal decline in performance at Sunway Carnival Mall (-1.1% y-o-y). Despite having moderate growth, management remains cautious on retail outlook on the back of weak consumer sentiment and challenging operating environment for some retailers which could potentially dampen occupancy rates.

Sequentially, occupancy for hotel segment has improved — notably at Sunway Resort Hotel & Spa and Sunway Putra Hotel. However, performance of Sunway Hotel Seberang Jaya has been lacklustre during the quarter owing to soft market demand and intense competition from new hotels.

Data from the Malaysian Association of Tour and Travel Agents show that tourist arrivals and outbound declined by 30% in first half of 2015 despite various measures introduced to encourage tourist arrivals in Malaysia.

The office segment is still in the red (Menara Sunway -2.4%, Sunway Tower -61.3%, Sunway Putra Tower -65.1%) primarily due to non-renewal by anchor tenants. This has been partially mitigated by contribution of newly acquired Wisma Sunway (+100%).

Management shared that office segment will remain a drag in FY16 due to high vacancy rate, anticipated longer time as well as increasingly high cost to secure new tenancies in an oversupply and weak market environment.

Management shared that office segment will remain a drag in FY16 due to high vacancy rate, anticipated longer time as well as increasingly high cost to secure new tenancies in an oversupply and weak market environment.

Sunway REIT has the largest acquisition pipeline amongst Malaysian REITs with strong backing from its sponsor. The REIT is well-diversified across various segments with low tenant concentration, and synergy with its sponsor’s townships. Negatives are that it is still heavily reliant on Bandar Sunway, which will take time to change, and persistent weakness in the office segment due to oversupply of new office space.

Targeted yield is 6.2% based on historical average yield spread of Sunway REIT and seven-year Malaysian government securities. — Hong Leong IB Research, Oct 31

This article first appeared in The Edge Financial Daily, on Nov 2, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Twentyfive.7 Lucent Residences

Telok Panglima Garang, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor