THE Klang Valley residential market saw price growth in 3Q2015, albeit at a slower pace, as homebuyers remained cautious about the current economic and political situation.

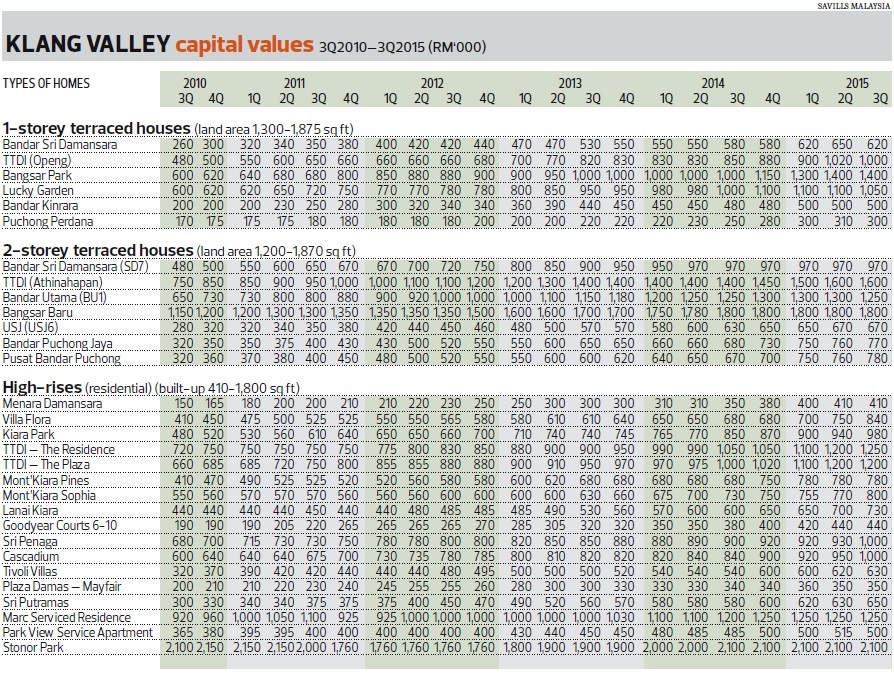

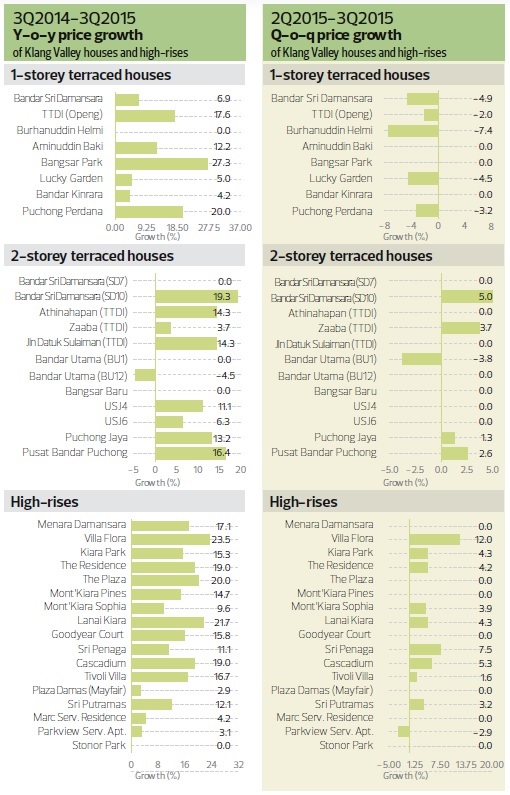

On a quarterly basis, the average price of 1-storey terraced houses declined 2.7% while that of 2-storey terraced houses and high-rises rose 0.73% and 2.55% respectively, notes Nabeel Hussain, associate director of Savills Malaysia, when presenting The Edge/Savills Klang Valley Residential Monitor 3Q2015.

He says several public transport projects have improved accessibility to areas outside the Klang Valley and homebuyers are cashing in on it as they have seen property values there increase over the past five years.

“But this is based on a limited number of units and transactions. Given the huge economic and political impact seen in 2015, we will be cautious and monitor this market for another quarter or two before drawing any conclusions.”

Notable launches in 3Q2015 include The Park Sky Residence in Bukit Jalil (1,098 units), Novo Ampang in Jalan Ampang (421), 8 Conlay in Jalan Conlay (1,092) and Agile Mont’Kiara (813).

KSK Land Sdn Bhd’s 8 Conlay has set a new price benchmark in the KLCC area. Its 62-storey Tower A consists of 564 branded residences with built-ups of 700 to 1,308 sq ft and priced at an average of RM3,200 psf while its 57-storey Tower B offers 468 units.

Agile Mont’Kiara, the first project in Malaysia by Chinese developer Agile Real Estate Development (M) Sdn Bhd, has a gross development value of RM1.4 billion. The 10-acre residential development comprises five blocks of seven-storey low-density units, two blocks of 17-storey medium-rise units and four blocks of 43-storey high-rise units. Built-ups range from 1,162 to 5,037 sq ft and the selling prices from RM800 to RM960 psf.

Other recent launches targeted at the mass market are Kepong Mas Residences, The Nest @ Jalan Puchong and Penduline @ Bandar Rimbayu, which consists of 2-storey terraced houses.

1-storey terraced houses

Year on year, the prices of 1-storey terraced houses in the Klang Valley saw stable growth — ranging from 4.2% to 27.3% — in 3Q2015, .

The highest growth was seen in Bangsar Park (27.3%), Puchong Perdana (20%) and Abang Hj Openg in TTDI (17.5%).

In Bangsar Park, the average selling price of a 1,875 sq ft unit rose to RM1.4 million from RM1.1 million in 3Q2014 while in Puchong Perdana, the average price of a 1,300 sq ft unit rose to RM300,000 from RM250,000. In Abang Hj Openg, the average price of a 1,760 sq ft unit was

In Bangsar Park, the average selling price of a 1,875 sq ft unit rose to RM1.4 million from RM1.1 million in 3Q2014 while in Puchong Perdana, the average price of a 1,300 sq ft unit rose to RM300,000 from RM250,000. In Abang Hj Openg, the average price of a 1,760 sq ft unit was

RM1 million compared with RM850,000 a year ago.

On a q-o-q basis, the average price of 1-storey terraced houses dropped slightly, especially in Burhanuddin Helmi in TTDI (-7.4%), Bandar Sri Damansara (-4.6%) and Lucky Garden in Bangsar (-4.5%).

The average price of a 1,920 sq ft unit in Burhanuddin Helmi dropped to RM1 million from RM1.08 million while in Bandar Sri Damansara, the average price of a 1,300 sq ft unit dropped to RM620,000 from RM650,000. In Lucky Garden, the average price of a 1,760 sq ft unit dipped to RM1.05 million from RM1.1 million.

Nabeel says 1-storey terraced houses tend to be less speculative products due to their limited supply and their popularity among genuine buyers. Furthermore, the areas in the survey tend to be among the most mature, which means price growth at this time will tend to be limited, percentage-wise.

“Due to a limited supply of 1-storey terraced houses in the primary market, demand for them in the secondary market will continue to remain strong, particularly for units in strategic locations with established amenities nearby,” he says.

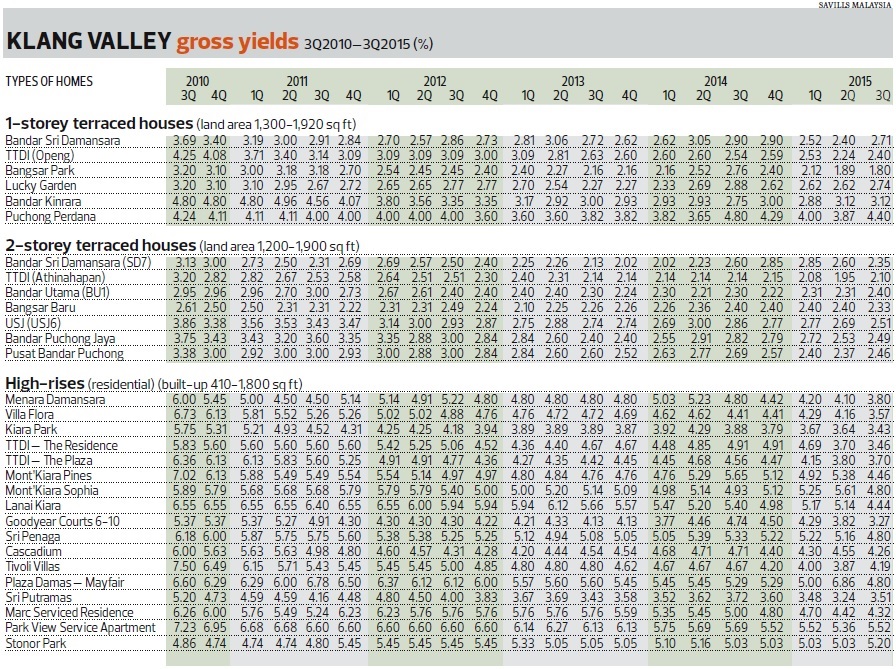

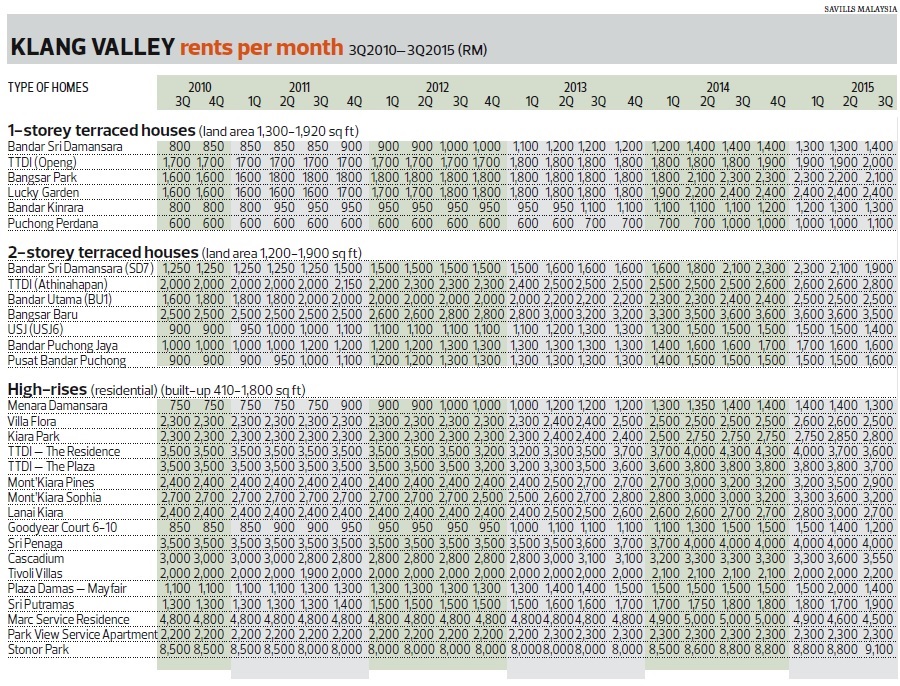

Rents were stable overall y-o-y. Most places saw average monthly increases while in some places they were unchanged. The exception was Bangsar Park where the average monthly rent for a 1,875 sq ft unit dropped to RM2,100 from RM2,300.

TTDI Openg, Bandar Kinrara and Puchong Perdana showed average monthly rent increase by 10% to 18%. For example, the monthly rent of a 1,760 sq ft unit in TTDI Openg rose to RM2,000 from RM1,800.

2-storey terraced houses

Nabeel reckons that demand for 2-storey terraced houses will remain strong. Price growth in this segment ranged from 3.7% to 19.3% but in BU12 in Bandar Utama, prices dropped 4.5% y-o-y.

SD10 in Bandar Sri Damansara, Pusat Bandar Puchong and Jalan Datuk Sulaiman in TTDI experienced yearly price growth of 19.3%,16.4% and 14.3% respectively.

For a 1,650 sq ft unit in Bandar Sri Damansara (SD10), the average price rose to RM1.05 million from RM880,000 while for a 1,400 sq ft unit in Pusat Bandar Puchong, it increased to RM780,000 from RM670,000. In Jalan Datuk Sulaiman, a 1,900 sq ft unit was transacted at RM1.6 million compared with RM1.4 million y-o-y.

However, the average price of a 1,650 sq ft unit in BU12 in Bandar Utama dropped to RM1.05 million from RM1.1 million y-o-y.

However, the average price of a 1,650 sq ft unit in BU12 in Bandar Utama dropped to RM1.05 million from RM1.1 million y-o-y.

Q-o-q, price growth in most areas remained flattish but dropped 3.8% in BU1 in Bandar Utama. The highest price growth was seen in SD10 (5%), Zaaba in TTDI (3.7%) and Pusat Bandar Puchong (2.6%).

In Bandar Sri Damansara, the average selling price of a 1,650 sq ft unit in SD10 appreciated to RM1.05 million from RM880,000 while that of a 1,800 sq ft unit in Zaaba rose to RM1.4 million from RM1.35 million. In Pusat Bandar Puchong, the price of a 1,400 sq ft unit increased to RM780,000 from RM760,000 q-o-q.

Nabeel says apart from the existing 2-storey terraced houses, newly launched units in new townships across the Klang Valley also enjoyed overwhelming response.

“Two-storey houses priced below RM800,000, in particular, are still considered affordable, which is why demand for them continues to be strong. Even in areas like Semenyih, which was considered peripheral two to three years ago, prices have exceeded RM650,000,” he remarks.

Rents for 2-storey terraced houses in most areas remained stable. The monthly rent in some areas appreciated y-o-y, such as in TTDI Athinahapan (12% to RM2,800), BU1 (4.2% to RM2,500) and Pusat Bandar Puchong (6.7% to RM1,600). Rental growth in Bandar Puchong Jaya remained unchanged at RM1,600.

Among the areas that saw a decline in monthly rent were Bandar Sri Damansara (-9.5% to RM1,900), Bangsar Baru (-2.8% to RM3,500) and USJ 6 (-6.7% to RM1,400).

High-rise homes

In 3Q2015, price growth for high-rises in the Klang Valley ranged from 2.9% to 23.5%.

For example, Villa Flora in TTDI saw the highest average price appreciation of 23.5% with a 1,248 sq ft unit fetching RM840,000 in 3Q2015 compared with RM680,000 in 3Q2014.

The Plaza in TTDI saw a price growth of 20% with the transaction value of, for example, a 1,800 sq ft unit rising to RM1.2 million from RM1 million y-o-y.

Q-o-q, the average price growth of high-rise homes remained flattish, although they rose in Villa Flora (12% to RM840,0000), in Sri Penaga in Bangsar (7.5% to RM1 million) and in Cascadium (5.3% to RM1 million).

Nabeel notes that besides location, well-maintained condominiums continued to gain in popularity, such as Cascadium and Sri Penaga. Both are close to amenities such as the Bangsar Shopping Centre.

Newer properties, such as One Menerung, are priced well over RM1,000 psf and offer only large units, which means their price can easily exceed RM2 million or even RM3 million, Nabeel points out.

The increase can be partly attributed to the proximity of the properties to the upcoming MRT1 Pusat Bandar Damansara station, he adds.

Of the 17 high-rise residential developments covered by the monitor, only seven enjoyed rental growth y-o-y. It was unchanged for the others. Monthly rent in The Residence, for example, slid to RM3,600 from RM4,300.

Nabeel says as more residential developments come into the market in the Klang Valley, the overall supply of units for rent will increase, leading to greater competition for tenants.

Looking ahead

Although the Klang Valley property market was generally slow in the first nine months of 2015, more activity is expected going forward. There will be more new launches, especially mass market housing schemes, as the public becomes more comfortable with the impact of GST and inflation.

“In the primary market, we can see more developers concentrating on reducing their inventory. New developments that offer attractive packages, such as the full absorption of legal fees or stamp duty and rebates as well as lucky draws for luxury cars and holiday packages, will continue to attract homebuyers,” says Nabeel.

In the secondary market, buyers continue to hunt for value purchases. As a result, the price disparity between the primary and secondary markets, especially in prime locations, has narrowed.

“Over the past few months, asking prices in the secondary market have increased relative to bank valuations, indicating that homeowners have become aware of this difference. Over time, however, we are concerned that this may lead to potential buyers going back to the primary market, [which means a reduction in activity in the secondary market], where one can enjoy a lower cost of entry to homeownership. This is another phenomenon that will have to be monitored over the coming quarters,” Nabeel concludes.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Jan 18, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Ryan & Miho @ Section 13

Petaling Jaya, Selangor

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor