Serviced apartment prices under pressure as supply surges

PETALING JAYA (April 30): Luxury serviced apartments in certain locations in the country have seen their market prices reduced by up to 14% amidst rising supply in the market.

Read also

Housing loan applications and approvals surged in 2019

KL residential transactions up 1.1% in 2019

Primary market sales improved amid fewer new launches

Sharp rise in Selangor serviced apartment overhang

MAH: Scheduled hotel openings for this year postponed

Demand for warehouses up but industrial overhang continues to rise

Johor residential property transactions grew in 2019

Penang reduced serviced apartment overhang by 50% in 2019

The 2019 Property Market Report by the Valuation and Property Services Department (JPPH) revealed that the asking prices of serviced apartments priced above RM1 million, such as Laman Ceylon, Hampshire Residences, Pavilion Residences and Platinum Suites in Kuala Lumpur city have contracted by 5% to 14%.

Overall, the serviced apartment sub-sector had recorded 4,180 transactions worth RM2.89 billion in 2019, an increase of 17.6% and 3% from 3,553 transactions worth RM2.8 billion in 2018. This segment also formed 16.3% of the total commercial property transaction volume and 10% of total commercial transaction value.

Although overall prices are stable, certain states that saw significant new supply (such as Johor Bahru, Kuala Lumpur and Selangor) have caused high-end serviced apartment owners to cut asking prices.

In terms of serviced apartment transactions, Kuala Lumpur and Selangor contributed the most to the national market volume each with 48.5% (2,029 transactions) and 30.7% (1,285 transactions).

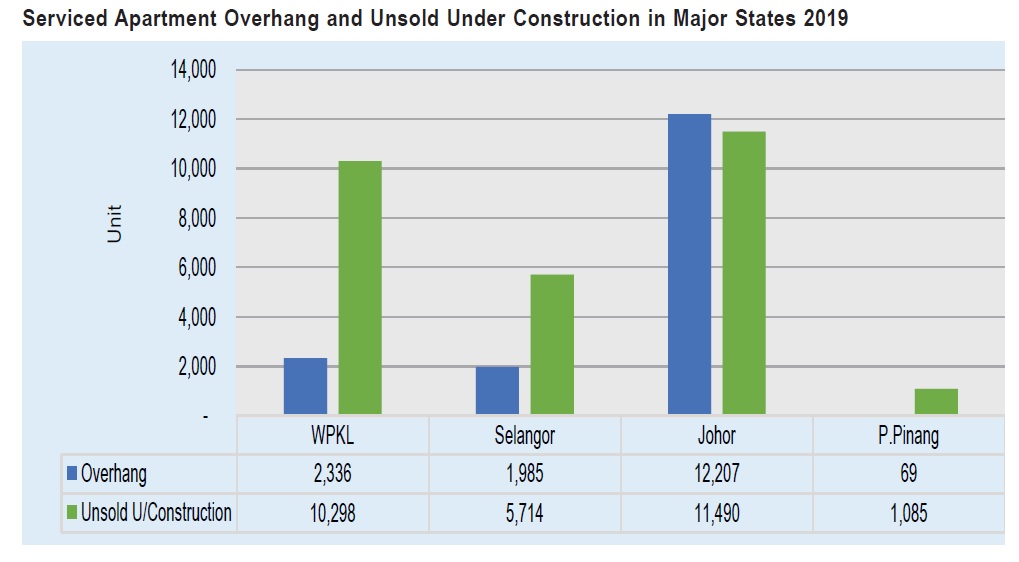

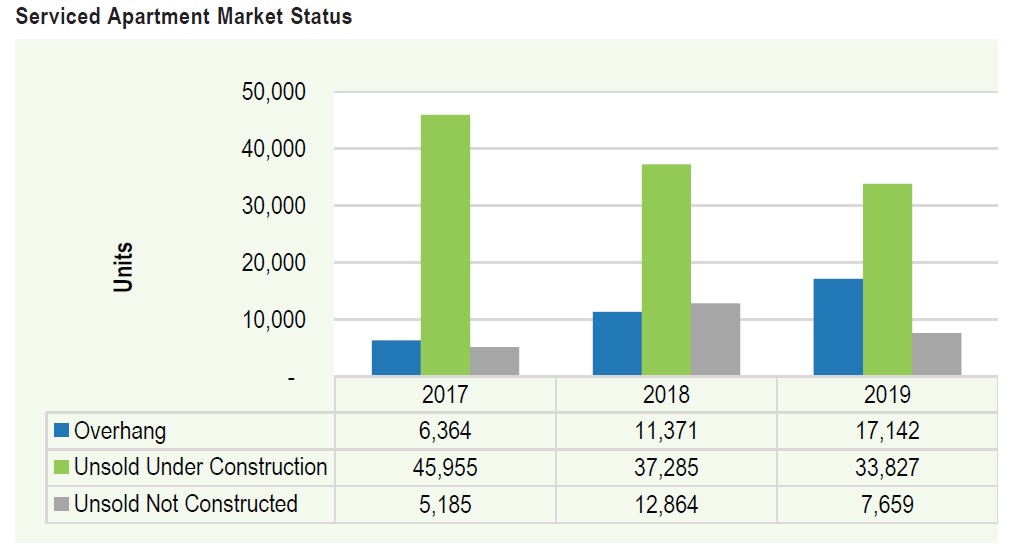

The serviced apartment overhang continued to increase, recording a total of 17,142 units valued at RM15.04 billion, up by 50.8% in volume and 64.2% in value from 2018.

Volume of unsold under construction and not constructed units in this segment however, declined to 33,827 units and 7,659 units, down by 9.3% and 40.5% respectively.

On the supply front, there was a significant increase in completions and construction of new projects in 2019, by 33% (41,452 units) and 31.6% (33,853 units) respectively, whereas new planned supply (NPS) dropped by nearly 30% to 38,362 units.

As at end-2019, there were 250,000 existing serviced apartments units in the country with close to 120,000 units in incoming supply and 180,000 units in planned supply.

EdgeProp Malaysia will be hosting a virtual Fireside Chat titled "The Malaysian property market picked up in 2019! Could this be its last hurrah?" through Facebook Live on May 1 at 2pm.

Join us for more insights from Rehda president Datuk Soam Heng Choon, Rehda vice-president and Selangor branch chairman Zulkifly Garib and Rehda Johor branch chairman Datuk Steve Chong Yoon on the market outlook post-MCO!

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.