What's pending for the property sector?

The unprecedented Covid-19 pandemic will continue to have an adverse effect on global markets and Malaysia’s economic growth. However, with proactive measures taken by the respective ministries, the pandemic appears to be under control. Nevertheless, there have been detrimental implications on the economy and the property market.

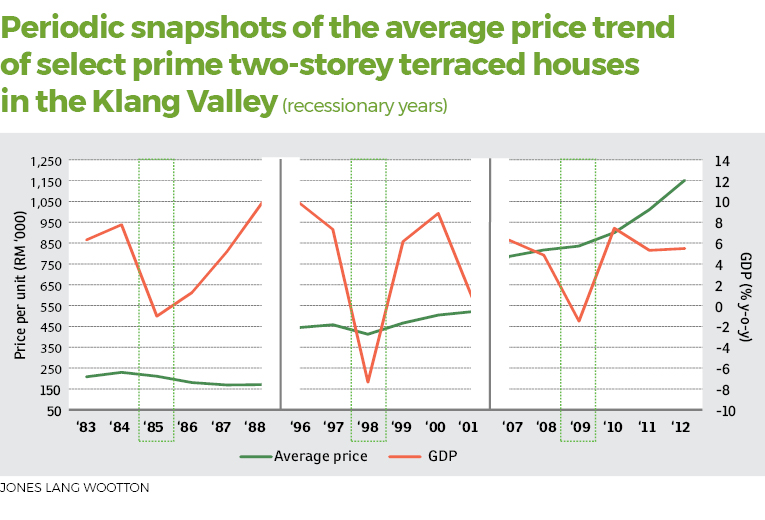

Since the 1970s, Jones Lang Wootton (JLW) has been monitoring the property sector, which included three recessionary periods, caused by many factors that required various remedial approaches resulting in different recovery patterns.

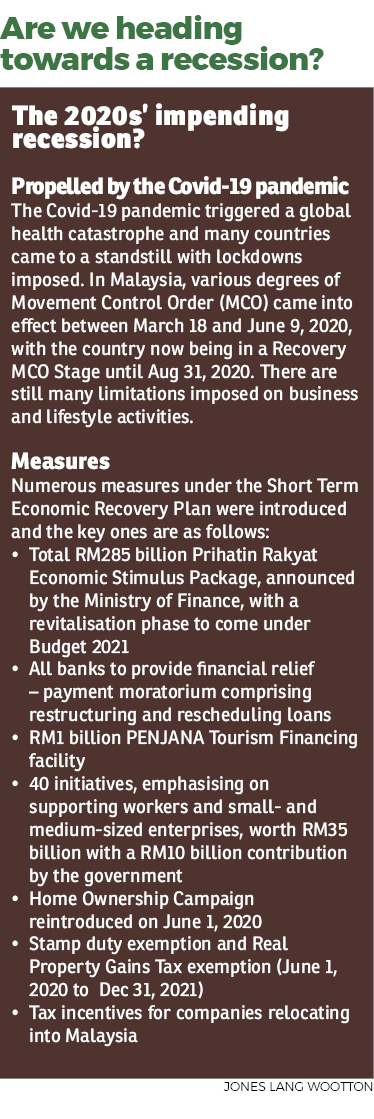

Malaysia’s three most recent recessions (in 1985, 1998 and 2009) demonstrated how important it is for policies to vary according to circumstances; and curtailing the negative impacts of a crisis depends on quickness to react, the ability to be practical and flexible while remaining committed to restoring stability and growth. Taiwan’s economy, for example, has fared relatively well due to the early precautionary measures taken to curb the pandemic and similarly, Malaysia has adopted speedy precautionary measures.

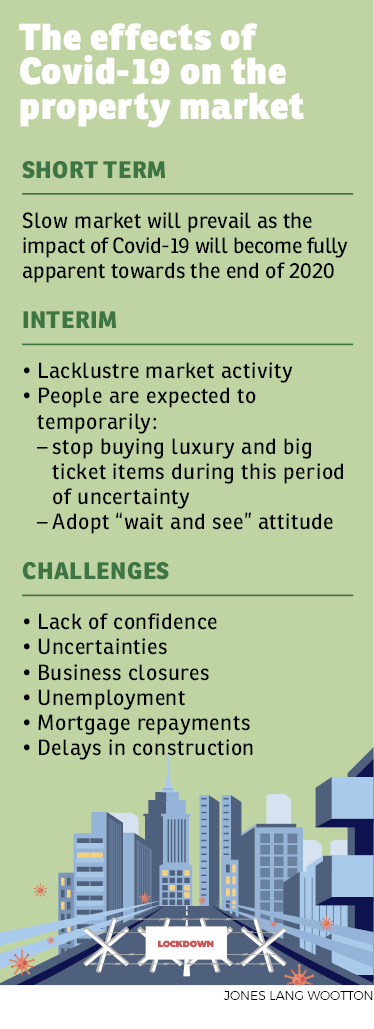

With regards to the property market, which is cyclical in nature, good economic growth often leads to overbuilding, which then subsequently results in a market slowdown and declining market prices. This scenario was already trending in Malaysia with a supply/demand mismatch, poor market sentiment and decreasing affordability levels, which was then compounded further due to Covid-19. As an economic slump is inevitable, further price depreciation and poorer market performance is anticipated.

Are we heading towards a recession?

Compared with the Asian Financial Crisis (AFC) in 1998, which was caused by the collapse of the financial system, the Covid-19 era recovery is expected to be a greater challenge as it is health-centric. Furthermore, other risk factors including tensions between the US and China, depressed oil prices and domestic political uncertainty are adding to the challenge. Moreover, it has curbed economic growth on a monumental global scale and as job losses and company closures are inevitable, Malaysia could be heading into a major recession. In addition, the nationwide MCO has accentuated the economic slowdown and major questions include: Will the introduction of the Stimulus Package be enough to protect the economy, business continuity and the people’s welfare, and how bad and how long will the inevitable recession last?

JLW is of the opinion that the prompt measures taken by the government could generate growth sooner than anticipated due to the nation’s strong fundamentals (including a stable financial sector) and moderate stock market performance. In general, business terms suggest it would be beneficial to companies if the financial year is extended to 14 or 15 months to take into consideration the time loss, which to a certain extent has been experienced by the whole world. We can’t regain lost time, but measures could be taken to mitigate intangible losses.

Furthermore, in 2018, RM41.3 billion was spent on “Outbound Tourism” by Malaysian residents and there is a distinct possibility, depending on the duration of international lockdowns, that a significant amount of this form of expenditure may well be ploughed back into the local economy.

Slowdown already underway

Regardless of the Covid-19 pandemic, property market sentiment is already weak.

Prior to Covid-19, Malaysia’s property market was in a slowdown with:

• Overhang of unsold properties

• Swelling oversupply

• Relatively tight lending guidelines for banks

Developers will aim to clear their unsold inventories. Only 1,759 condominium units and 125 houses were launched in 2Q20 in the Klang Valley. More activity is expected in 2H20 due to the re-introduction of the Home Ownership Campaign and incentives provided to stimulate the market.

Imminent impacts in the commercial sector are expected with take-ups, occupancies and rental rates anticipated to decline.

Positive indicators

• Some projects have been financed through equity financing rather than bank borrowings.

• Some developers have entered into joint venture agreements, thus reducing risk factors.

• Exposure to gearing is more manageable compared with previous times.

• There are substantial discounts on property prices, which are already being discounted.

• Consumers’ lifestyles will continue to change for the better.

• Developers will need to reassess buildings (particularly well-being and healthwise).

• Market prices may not decline immediately. JLW foresees that only purchasers/investors who cannot pay their mortgage instalments due to loss of income, could be forced to sell. The numbers, however, will not be as substantial as the AFC when interest rates were relatively high (12.3% in 2Q98 compared with 5.78% as at May 2020), resulting in a “double whammy” for investors.

With the deteriorating global economy and the longevity of the Covid-19 pandemic unknown, the question remains as to whether the Malaysian property market will continue in a prolonged downturn.

Considering the above-mentioned measures and uncertainties, in terms of numbers of retrenched workers and exposure to property mortgage instalments similar to the 1990s, JLW anticipates some foreclosures, resulting in certain property prices declining. This will be more prominent for “rent investment properties” such as short-term rentals, serviced residences and strata offices. However, the extent of this is not expected to create an alarming situation for the property market.

Residential property prices for certain projects which are in an oversupply situation have already registered declines of between 15% and 20% since 2017, and further potential decreases of say, between 10% and 15%, for select projects could occur as the market readjusts. Property investors who may face cash flow problems will become more realistic in their asking prices, and developers, who once refrained from reducing prices of subsequent phases of their projects, may now take the opportunity to reduce prices using the “excuse” of the Covid-19 pandemic. However, due to market resilience, and as observed in past market recoveries following previous crises, house prices will have a gradual rebound. It will become even more important to undertake suitable market research to understand the target market requirements and demand prior to launch. The incentives introduced by the government will also bode well for genuine residential buyers.

For the commercial sector, developers will adopt a cautious approach towards construction due to the expanding oversupply and declining rental rates. Although the Covid-19 pandemic will bring a much needed “breather” to the market, it is plausible for the authorities to freeze planning approvals for select buildings, a practice which was imposed in the past.

To conclude, the pandemic is seen as a catalyst for the changes which have already influenced work and lifestyles, and developers will need to reassess their products in terms of convenience, mobility, flexible and minimalist living, co-working, connectivity and technology, which have played a significant role in shaping and shifting consumers’ attitudes, values and purchasing behaviour.

Stay safe. Keep updated on the latest news at www.EdgeProp.my

This story first appeared in the EdgeProp.my e-Pub on July 17, 2020. You can access back issues here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.