Overhang residential units of RM500k-RM700k form second-largest segment

- Nevertheless, he noted that increased demand and market shifts have led to an overall reduction in overhang units in 3Q2023, with a 22% decrease year-on-year from 3Q2022.

PETALING JAYA (Dec 19): At 15%, residential units priced between RM500,001 and RM700,000 form the second largest group of overhang properties, said CBRE | WTW Malaysia group managing director Tan Ka Leong.

While it has been expected that the biggest number of overhang units, at 28%, are those priced RM1 million and above, it was surprising to see that the next largest group are of those between RM500,001 and RM700,000, he said during his presentation at the recent CEO Series 2023 (Economy & Business Forum), organised by Rehda Institute here.

“I think a lot of developers are looking at a price bracket of about RM500,000 to RM700,000, and thinking it’s a sellable product, but the statistics don’t really tell that story. So, developers, when you plan for the pricing of the product, I think we need more in-depth studies as to what actually contributed to this,” Tan said.

Nevertheless, he noted that increased demand and market shifts have led to an overall reduction in overhang units in 3Q2023, with a 22% decrease year-on-year from 3Q2022.

Office usage expected to increase

Tan also noted that for purpose-built offices in the Klang Valley, occupancy rates have declined from 83.2% in 2017 to 78.9% in 2023, but office usage is expected to increase over the next year as companies tighten their hybrid working policies.

Older buildings are expected to suffer, as more organisations move to self-owned premises, as they seek newer, future-proof buildings.

“Tenants want green-certified buildings, transit-oriented developments in prime locations, and flexible layouts for their office spaces. We're also seeing a number of older office buildings being repurposed as hotels or aged care facilities,” Tan pointed out.

CAGR of residential properties has increased

In exploring the trends of the residential property market, Tan noted that, between 2018 and 3Q2023, the compound annual growth rate (CAGR) of residential properties in the Klang Valley has seen an overall increase of 5%.

“It’s interesting to see that the non-landed’s [CAGR] has superseded the landed, at 8% compared to 2%,” he said.

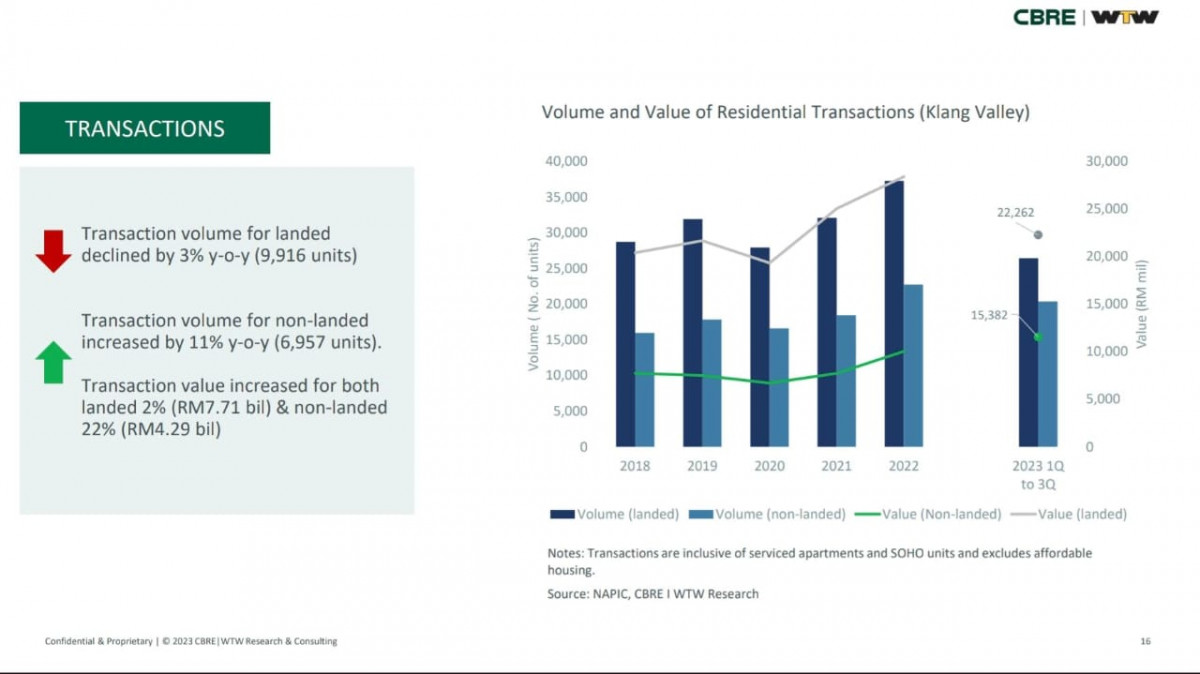

Although transaction values for landed property have increased by 2% to RM7.7 billion, transaction volume has decreased by 3% to 9,916 units. In comparison, non-landed transaction values have increased by 22% to RM4.29 billion based on a transaction volume of 11% increase to 6,957 units.

Land scarcity and affordability are leaving most residents with no choice but to accept non-landed housing options, Tan observed.

Construction sector projected to grow

Meanwhile, Socio-Economic Research Centre (SERC) executive director Lee Heng Guie said the rate of residential overhang could be a major concern for the construction and property sectors, “but at least every year we’re seeing that they’re adjusting steadily. That will give support to your overall property sector and construction”.

In his presentation he projected a growth of 6.8% next year for the construction sector, supported by all the strategic infrastructure spending. He highlighted that most major infrastructure projects, such as the East Coast Rail Link (ECRL), the Johor Bahru-Singapore Rapid Transit System, and the Pan Borneo Sabah Highway are on track towards their completion dates.

Notable upcoming projects for 2024 include a Johor-Singapore Special Economic Zone, for which a memorandum of understanding is expected to be signed next January to kickstart development and construction plans.

“All these will create a lot of activities in the construction, housing, and property sector,” said Lee.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.