PETALING JAYA: The poor performance of property stocks due to the ongoing market sell-off is expected to open up a window of opportunity for substantial shareholders to privatise their listed companies at bargain basement prices, the Star reported yesterday.

The report quoting Kenanga Research said the Bursa Malaysia Property Index’s (KLPRP) poor performance over the past three years has affected the valuations of property stocks down to “distressed levels.”

“The free-fall of property stocks, as captured by the KLPRP’s losing streak of 28.6% in 2018,5.2% in 2019 and 29.1% year-to-date 2020, has forced their valuations to slump to distressed levels with the KLPRP Index currently trading at a 2.5 standard deviation below its historical mean, which is even lower than the trough of 1.5 seen during the 2008 global financial crisis.

“Consequently, a window of opportunities could have opened up for major shareholders to take private their listed companies at bargain basement prices.”

Out of the 94 companies on the KLPRP, Kenanga Research said 48 (or 51%) are presently trading at depressed price-to-book value (PBV) multiples of less than 0.30 times, which fall into the lower-end of the valuation range of past take-over offers.

“With many property stocks already trading at undervalued levels, this could be a signal that it may be timely for such privatisation offers.

“Moreover, it will be cheaper now to fund privatisation deals following interest rate declines.”

The Star said the research house noted that tycoons, namely Tan Sri Lim Wee Chai (who controls Top Glove Corp) and Datuk Tee Eng Ho (business owner of Kerjaya Prospek Group) recently acquired shares of property companies in March.

The research house added that Lim emerged as a substantial shareholder in LBS Bina Group with a 6.81% stake, while Tee has been progressively purchasing Eastern & Oriental Bhd shares, thus raising his stake from 13.95% before March to 21.7% as of mid-April.

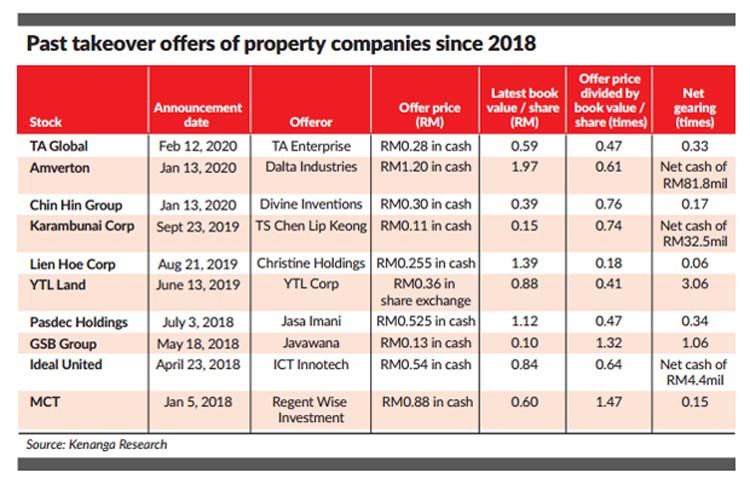

“Over the past two years, 10 listed property companies saw take-over offers priced at PBV valuation range of between 0.18-times to 1.47-times.

“Our study reveals that about half of the listed companies in the KLPRP are presently trading at PBV multiples of less than 0.30 times, signalling that this could be a conducive environment for such privatisation exercises to be undertaken.”

According to the Star, Kenanga Research said smaller companies, namely MCT Bhd (which has a market capitalisation of RM262.3 million), SHL Consolidated Bhd (RM460 million), MUI Properties Bhd (RM133.4 million) and KSL Holdings Bhd (RM569.6 million) could be potential take-private targets.

“Based on our anecdotal study, based on PBV multiple and balance sheet strength, we conjecture that MCT (current price of 18 sen against a net cash per share of 32 sen), SHL Consolidated (RM1.90 against RM1.56), MUI Properties (18 sen against 11 sen) and KSL Holdings (56 sen against 25 sen) could be potential take-private targets.”

Separately, the research house said it is reaffirming an ‘overweight’ call on the property sector based on valuation grounds.

“Our top fundamental picks are Sime Darby Property Bhd and IOI Properties Group Bhd, while we recommend UEM Sunrise Bhd and S P Setia Bhd as potential rebound plays from oversold positions.”

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my. #stayathome #flattenthecurve

Click here to see residential properties for sale in Kuala Lumpur.

TOP PICKS BY EDGEPROP

Bandar Baru Sri Petaling

Sri Petaling, Kuala Lumpur

Residensi Hijauan (The Greens)

Shah Alam, Selangor