Glomac Bhd (Sept 22, 79.5 sen)

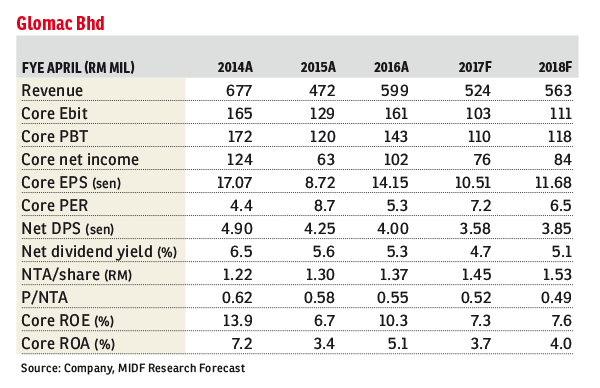

Maintain neutral with a reduced target price of 77 sen: Glomac Bhd’s first quarter of financial year 2017 (1QFY17) core net income (CNI) of RM3.5 million was below expectations as it made up only 5% of both our and consensus estimates. We believe the negative deviation was caused by weaker-than-expected margins. Note that the company’s 1QFY17 core profit before tax margin is estimated at 14.2% against 1QFY16’s 25%. As expected, no dividend was announced for 1QFY17.

We have excluded gain from the Cheras land sale in our CNI calculation. Revenue contribution from the transaction was RM145.6 million, while net profit contribution was around RM82 million.

Excluding the land disposal, revenue was lower by 14% year-on-year at RM105.8 million as certain projects such as Glomac Centro had reached the tail end of recognition. Additionally, the margin was compressed possibly due to higher marketing expenses in order to boost sales in the current challenging environment.

1QFY17 sales of RM31 million made up 5% of management’s target of RM600 million. Stronger sales are expected for the remainder of the year as the company plans to launch properties worth some RM1.05 billion.

Although we expect Glomac to register lower earnings in FY17 against FY16, the company’s effort to lower its gearing in the current challenging environment is commendable. — MIDF Research, Sept 22

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Sept 23, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

SetiaWalk @ Pusat Bandar Puchong

Puchong, Selangor

Vogue Suites 1 @ KL Eco City

Bangsar, Kuala Lumpur

Bangunan Setia 1

Damansara Heights, Kuala Lumpur

Bangunan Setia 1

Damansara Heights, Kuala Lumpur

Seri Mutiara Apartments, Bandar Baru Seri Alam

Masai, Johor

Nusa Cemerlang Industrial Park

Gelang Patah, Johor