WCT Holdings Bhd (April 27, RM1.63)

Maintain buy with an unchanged target price (TP) of RM1.90: WCT Holdings Bhd’s share price tumbled to a six-week low as market sentiment soured and risk aversion swept the equity market. The risk aversion also instigated an index-wide slump for KL Construction Index constituents.

Note that WCT’s beta is 1.14 times indicating an above-average volatility profile vis-à-vis the overall market. Hence, it is not surprising that its share price slid 10% from the RM1.76 peak in early April to its current price of RM1.63.

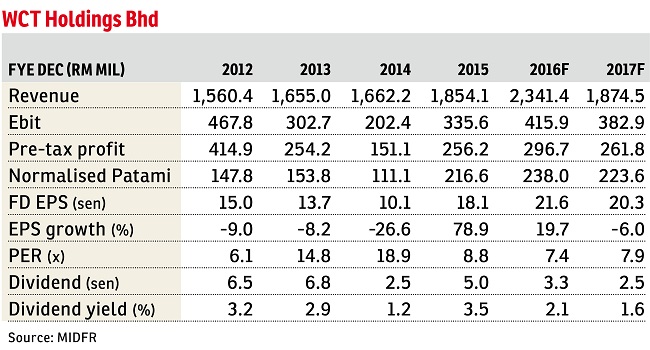

However, WCT is trading at 37.5% discount to its book value of RM2.20 per share, hence presenting an attractive buying prospect. We are expecting its order book to expand to RM1 billion and an improvement of 1.5 percentage points (ppts) of net margin from 13% to 14.5% for financial year ended Dec 31, 2016 (FY16) with its three-year strategic plan.

Additionally, debt reduction of RM2.4 billion through the listings of its construction arm (about RM700 million) and “REITS-able” assets such as Aeon Bukit Tinggi and Paradigm Mall (about RM800 million) is still an achievable strategy awaiting execution.

WCT could pull through this tough time because of its resilient order book of RM5.43 billion. Thus, we reiterate our earnings estimates.

Our channel check reveals that the award for civil engineering packages for Kwasa Damansara and Petronas’ Refinery and Petrochemical Integrated Development is underway for WCT, citing its previous track record and existing project team as evidential catalysts. We surmise the packages will potentially amount to about RM400 million.

The fallow period between the influx of negative news flows for the past months and the start of the earnings seasons in May has left WCT’s share advancement vulnerable to downward pressure. We reckon that this is short-lived and posit to take position in WCT due to compelling risk reward.

We reaffirm our “buy” recommendation with an unchanged sum-of-parts-based TP of RM1.90 per share with an undemanding implied price earnings ratio (PER) of 13 times (in comparison with the mid-cap peer range of 12 to 14 times PER). — MIDF Research, April 27

Sometimes, even the value of your home can be a mystery. Go to The Edge Reference Price to find out.

This article first appeared in The Edge Financial Daily, on April 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Bukit Jelutong Industrial Park

Shah Alam, Selangor

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor

Kampung Baru Sungai Buloh

Sungai Buloh, Selangor

Northpoint Residences

Mid Valley City, Kuala Lumpur

Northpoint Residences

Mid Valley City, Kuala Lumpur