Looking ahead into a lacklustre property sector

Property sector

Maintain neutral: The House Price Index (HPI) grew by 5.3% year-on-year (y-o-y) to 235.4 in the second quarter of calendar year 2016 (2Q16), which is significantly lower than the five-year average growth of 9.3%. Among the key states, the slowest y-o-y growth was recorded in Penang (+4.6% y-o-y to 266.1). Kuala Lumpur HPI growth was better at +6.9% y-o-y followed by Selangor’s +6.6% y-o-y. We believe that the outlook for property price is better in Greater Kuala Lumpur (Selangor and Kuala Lumpur) due to support from the urbanisation factor.

According to the latest property market report released by National Property Information Centre, Malaysian property market transaction value has declined 6.3% quarter-on-quarter (q-o-q) to RM30.8 billion in 3Q16. The lower transaction value is consistent with the fall in transaction volume by 8.5% q-o-q to 76,456 units. Against similar quarter last year, 3Q16 property market transaction value declined 17.9% mainly due to 11% decline in volume. We believe that the data reflects slow demand recovery among consumers due to ongoing concerns on weak ringgit and uninspiring employment outlook.

The latest publication from Malaysian Institute of Economic Research shows that the 3Q16 Consumer Sentiment Index has weakened to 73.6 in from 78.5 in 2Q16. We gather that while household income has improved the employment and financial outlook is still uninspiring. We believe the data suggest that the demand outlook for potential property buyers remains soft in 2017 and they are likely to remain price sensitive.

Loan demand, as measured by “Applied Loan for Purchase of Property” data by Bank Negara Malaysia, showed marginal recovery in October by inching up 2.1% month-on-month (m-o-m) to RM25.2 billion. On a yearly basis, applied loan in October was relatively unchanged while total applied loan as of calendar period ended Oct 31, 2016 (10M16) declined 4% y-o-y to RM242.7 billion. Loan approval rate (approved loan per applied loan) in October improved marginally to 43.7% from 42.7% in September. Nevertheless, it remains 9% lower y-o-y than loan approval rate of 47.7% in October last year.

As a result, “Approved Loan for Purchase of Property” in October was higher by 4.4% m-o-m to RM11 billion on the back of higher applied loan and higher loan approval rate. On a cumulative basis, total approved loan for 10M16 was at RM100.3 billion (-18% y-o-y).

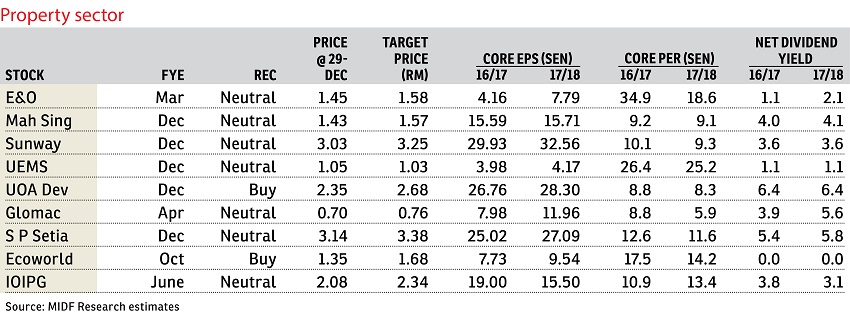

Overall, we think that sales will be at best flattish in 2017. For stock pick, we like UOA Development Bhd for i) minimum 60% sales growth expected in financial year ending Dec 31, 2016 (FY16) to RM1.3 billion against RM800 million in FY15, ii) sturdy balance sheet with net cash of 44 sen per share, iii) highest dividend yield among peers at 6.4% and iv) expectations of positive sentiment following inclusion in FTSE Bursa Malaysia (FBM) Mid 70 Index, allowing mid-cap fund managers to allocate more funds to invest in the company. — MIDF Research, Dec 30

This article first appeared in The Edge Financial Daily, on Jan 3, 2017. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.