Kerjaya expected to secure more packages for STP 2

Kerjaya Prospek Group Bhd (April 3, RM2.60)

Maintain outperform call with a target price (TP) of RM3.10: Last Friday, Kerjaya Prospek Group Bhd announced that it had secured a housing project worth RM31.6 million from Bina BMK Sdn Bhd.

The scope of works comprises main building works for 32 units of three-storey terrace houses at Eastern & Oriental Bhd’s (E&O) Bandar Tanjung Pinang (Phase 1) in Penang slated for completion by Sept 21, 2018.

This marks Kerjaya’s first win for the year and we are “neutral” on the award as it is well within our financial year 2017 estimate (FY2017E) replenishment target of RM1.6 billion, only making up 2% of our target. Assuming a profit before tax margin of 14%, the project is expected to contribute about RM2.2 million to Kerjaya’s bottom line per annum.

Recently, Kumpulan Wang Persaraan (Diperbadankan) [KWAP] injected RM776 million into E&O’s Seri Tanjung Pinang (STP) Phase 2A for a 20% stake. The RM776 million proceeds will fund reclamation works of about 250 acres (101.17ha) of land, infrastructure costs and working capital.

We believe this collaboration between E&O and KWAP to jointly develop the STP Phase 2A project in Penang would expedite the award process, and is poised to benefit Kerjaya given that E&O has been a long recurring client of Kerjaya.

In addition, we note that Kerjaya is already on-site executing channel dredging works for STP Phase 2 (awarded back in March 21, 2016), which is part of STP 2 reclamation works. Hence, we are optimistic about Kerjaya’s ability to secure more packages for the STP 2 development in FY2017E.

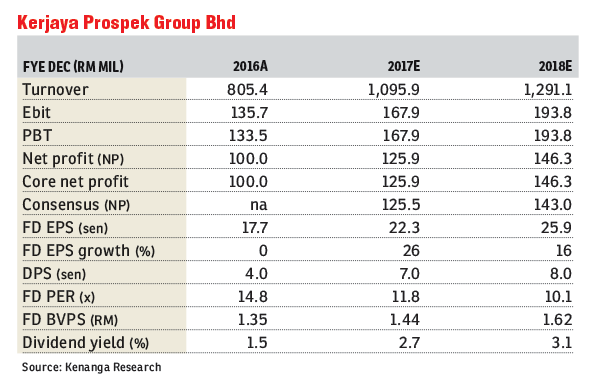

Currently, Kerjaya’s outstanding order book stands at about RM2.7 billion, providing healthy earnings visibility for the next 2.5 years. Post award, we make no changes to our FY2017E to FY2018E core net profit RM125.9 million to RM146.3 million.

We reiterate “outperform” with a higher sum-of-parts-derived TP of RM3.10 (from RM2.64) as we roll forward our construction and property valuations to FY2018E. Our new TP implies 12 times FY2018 price-earnings ratio in line with our targeted peers’ range of nine to 13 times.

While our valuation is at the higher end of our targeted range, we deem it fair considering that Kerjaya’s net margins of about 12% remain superior over peers’ (Mitrajaya Holdings Bhd, Hock Seng Lee Bhd and Kimlun Corp Bhd) average of 9%.

Risks to our call include lower-than-expected replenishment and margins, and delays in construction works. — Kenanga Research, April 3

This article first appeared in The Edge Financial Daily, on April 4, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.