2017 seen as Kimlun’s earnings transition year

Kimlun Corp Bhd (July 24, RM2.28)

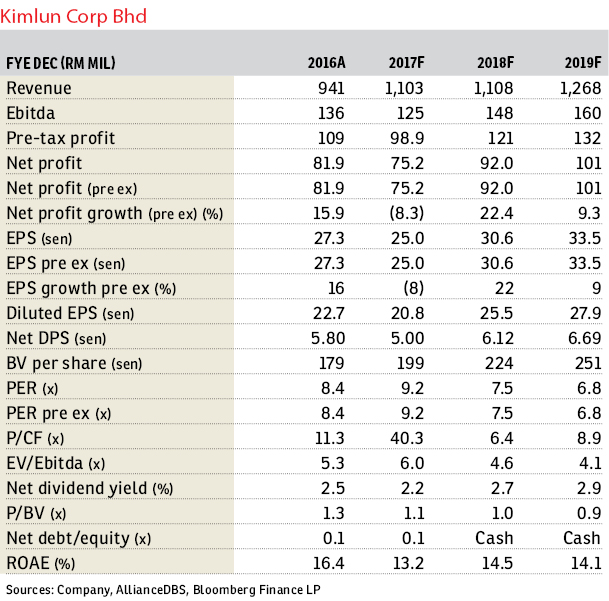

Buy call with an increased target price (TP) of RM3.06: Within our construction universe, Kimlun Corp Bhd stands out as the most direct small-cap proxy for the sector which also boasts an underappreciated manufacturing division. The year 2017 will be a transition year for earnings given the timing of manufacturing orders. Its valuation remains cheap at single-digit price-earnings ratio (PER) on the back of a promising new order replenishment pipeline. It has successfully reinvented itself into a less Johor-centric contractor in the high-rise space and raised its exposure to more infrastructure works.

There has been a series of rating downgrades in March post-analyst briefing. This is on the back that 2017 will be a transition year for earnings due to the timing of recognition of contracts. We think financial year 2018 forecast (FY18F) earnings (about 15% above the consensus) will accelerate as it runs down its peak order book. We also think there is not enough recognition given to its high-margin manufacturing business which will benefit from other transportation projects and its industrialised building system (IBS) business which will benefit from roll-outs of more affordable housing.

Its construction order book stands at RM1.67 billion where the largest project is the Pan Borneo Highway Sarawak project. Its total order book including manufacturing is RM1.9 billion. Besides more new wins for its construction division, we think Kimlun’s manufacturing division is set to capitalise on more jobs from Singapore’s mass rapid transit (MRT), Klang Valley MRT Line 3 and the High-Speed Rail. The award of the RM199 million segmental box girder (SBG) project and the higher adoption of IBS-related works for the affordable housing market will also bolster its new order wins.

Our TP is now set at RM3.06, based on sum-of-parts value which we think better reflects its underlying business model. This is because there is not enough recognition given to its manufacturing business. Its construction business is valued at RM2.32 per share while manufacturing at 74 sen per share.

The biggest risk is its perceived over-reliance on projects in Johor. We think this is mitigated by its stringent bidding process where it only accepts projects from strong clients while also ascertains the saleability of projects.

We understand year-to-date wins for construction have hit RM800 million, while for manufacturing, it is RM40 million. Guidance for new order wins for FY17F given at its March analyst briefing was RM700 million to RM800 million for construction (traditional jobs excluding light rail transit [LRT]), while for manufacturing, it was RM100 million. Our current forecast factors in new order wins of RM950 million for FY17F (RM800 million for construction and RM150 million for manufacturing).

For 2017, Kimlun has only announced one contract win to Bursa Malaysia. It is a RM263 million contract for the construction of one block of office in Plentong, Johor Bahru. While it has a 40% stake in the joint-venture company which won the contract (implying a contract value of RM105 million for Kimlun’s portion), we understand it will do the majority of the work.

We understand the additional new contract wins have come from property-related projects priced at more affordable levels in Johor and Selangor.

Every RM300 million new orders for construction will raise our FY17F net profit by 8%.

Kimlun is also bidding for the tunnel lining segment (TLS) portion and SBG portion, two civil engineering packages of LRT 3. In our view, it is a strong contender for the TLS portion given its prior experience with the MRT lines, but the contract value of LRT 3 may not be very large as the tunnel length is just 2km.

Its current outstanding order book is RM1.9 billion, of which RM1.67 billion is from construction and the balance RM260 million from manufacturing.

At present, our FY17F and FY18F earnings for Kimlun are 5% and 15% above the consensus respectively. We expect second-quarter (2QFY17) results to be unexciting, but we think there is a fair chance that second-half earnings, in particular 4QFY17, could surprise on the upside. This will depend on the timing of recognition for its strong construction wins so far as well as the TLS contract of MRT Line 2. We believe the potentially weaker FY17F earnings have been priced in and the market should look forward to a much stronger FY18F.

Our new TP of RM3.06 assumes: i) a sustainable construction order book of RM1.6 billion and pre-tax margin of 7% valued at a PER of 10 times; and ii) a manufacturing order book of RM200 million on the back of a pre-tax margin of 15% valued at a PER of 12 times. We think this is fairly conservative given its niche positioning in the market — being one of two suppliers of SBG and TLS for the MRT project, while also having a respectable presence in Singapore. — AllianceDBS Research, July 24

This article first appeared in The Edge Financial Daily, on July 25, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.