Cahya Mata seen to benefit from mega infrastructure projects

Cahya Mata Sarawak Bhd (Dec 6, RM3.78)

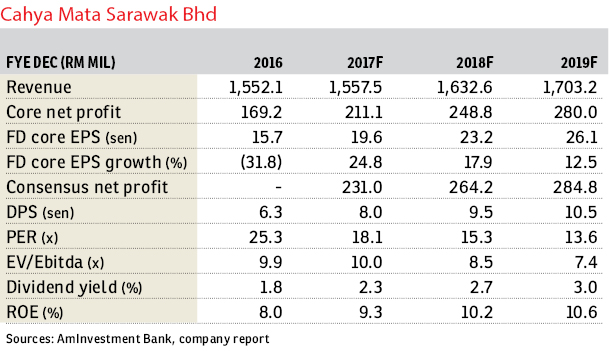

Maintain buy with an unchanged fair value (FV) of RM4.45: We maintain our “buy” call, forecasts and sum-of-parts (SOP)-based FV of RM4.45 for Cahya Mata Sarawak Bhd (CMS).

This follows the extension of its state road concession contract by six months from Jan 1, 2018 to June 30, 2018, based on the existing terms and conditions, with an estimated sum of RM87.7 million.

The extension is a stop-gap measure pending the negotiation and finalisation for the renewal of the concession on a longer-term basis.

We maintain our SOP-based FV as the six-month extension will only add one sen to it to RM4.46.

However, if CMS is able to secure the renewal for the concession for another 15 years based on similar terms and conditions, our calculation shows that this could fetch a net present value of 35 sen (based on a discount rate equivalent to CMS’s weighted average cost of capital of 8.9%), potentially boosting our FV by 8% to RM4.80.

We continue to like CMS for: i) the strong demand for cement and building materials underpinned by various mega infrastructure projects in Sarawak; ii) its steady growth of construction and road maintenance works including the Pan Borneo Highway project awarded to CMS (joint venture with Bina Puri Holdings Bhd); and iii) sustained demand from its property development both in Kuching and Samalaju, and potential land sale of its current undervalued land banks. — AmInvestment Bank, Dec 6

This article first appeared in The Edge Financial Daily, on Dec 7, 2017.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.