KL Kepong 1Q core net profit within estimates

Kuala Lumpur Kepong Bhd (Feb 13, RM25.28)

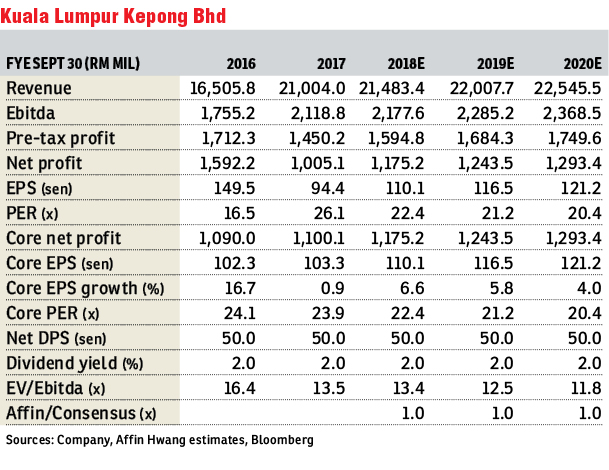

Maintain hold with an unchanged target price (TP) of RM24.57: Kuala Lumpur Kepong Bhd (KLK) reported a lower revenue in the first quarter ended Dec 31, 2017 (1QFY18) by 5.5% year-on-year (y-o-y) to RM5.2 billion due to lower contributions from the plantation, property and investment holding divisions but partially offset by a higher contribution from the manufacturing division.

For 1QFY18, KLK’s fresh fruit bunch (FFB) production was down by 2.6% y-o-y to 223,200 tonnes, while the average selling prices of crude palm oil (CPO) and palm kernel were lower at RM2,581 per tonne (1QFY17: RM2,720 per tonne) and RM2,488 per tonne (1QFY17: RM2,648 per tonne) respectively. The decline in prices was partly attributable to a post-El Nino FFB production recovery that resulted in high CPO inventories.

On the back of a lower revenue, KLK’s profit before tax for 1QFY18 declined by 6.5% y-o-y to RM441.5 million. After excluding the surplus on disposal of land and other one-off items, 1QFY18 core net profit declined by 21.4% y-o-y to RM310 million, which accounted for 26.4% and 25.8% of our and the street’s FY18 forecasts. This was within expectations. No interim dividend was proposed for the first quarter.

Sequentially, KLK’s 1QFY18 revenue increased by 0.6% quarter-on-quarter (q-o-q) to RM5.2 billion on a higher contribution from the plantation and investment holding divisions. Margins for earnings before interest, taxes, depreciation and amortisation improved by 0.8 percentage point q-o-q to 11%, mainly due to better margins for the manufacturing division. 1QFY18 core net profit, after excluding one-off items, increased by 23.2% q-o-q to RM310 million.

We make no major changes to our FY18 to FY20 estimates for core earnings per share (EPS) and maintain our 12-month TP on KLK of RM24.57. This is based on an unchanged 22 times price-earnings ratio on FY18 EPS. We maintain our “hold” rating on the stock. — Affin Hwang Capital, Feb 13

This article first appeared in The Edge Financial Daily, on Feb 14, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.