MRCB balance sheet seen to improve further in 2H

Malaysian Resources Corp Bhd (Oct 12, 72 sen)

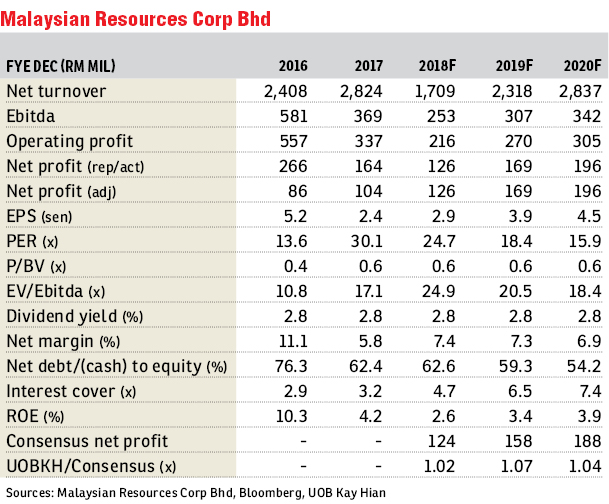

Maintain buy with a target price of 98 sen: Malaysian Resources Corp Bhd’s (MRCB) balance sheet is expected to improve further in second half of financial year 2018 (2HFY18) with earnings enhancement largely due to the disposal of land in Kia Peng, Kuala Lumpur, which is to be concluded in the third quarter of FY18, and significant deleveraging expected from the disposal of its two key non-core assets — the Eastern Dispersal Link (EDL) with an outstanding debt of RM1.02 billion and Bukit Jalil land valued at RM1.1 billion.

The proposed disposals of the two assets could reduce MRCB’s net gearing from 0.69 times to 0.45 times and 0.46 times respectively. Separately, the announced Kia Peng land sale to Pertubuhan Keselamatan Sosial worth RM323 million could reduce MRCB’s gearing by 0.07 times, while the proposed disposals of Ascott Tower and Menara Celcom could reduce MRCB’s net gearing by 0.03 times and 0.01 times respectively. The company is also focusing on cost rationalisation with plans to explore and adopt business management systems like enterprise resource planning to manage resources efficiently (via process automation and to reduce headcounts). Once the cost rationalisation transformation plan sees success, the company will tap its construction business’ value through a potential listing with a minimum market capitalisation target of RM1.5 billion.

For its commercial properties, MRCB will adopt a pre-sell and pre-lease model for bespoke commercial buildings before construction. MRCB is currently in discussions with another party on developing a commercial development project, potentially at Lot F in KL Sentral. Meanwhile, MRCB will continue to emphasise transport-oriented developments at strategic land pockets, particularly in the Klang Valley with an estimated gross development value of RM17 billion for a 10-year development plan.

As a leading and competent bumiputera contractor, MRCB will potentially benefit once the government starts to roll out infrastructure projects (subject to improved government financial positions) whereby most of the government contracts require almost 45% bumiputera contractor participation. Meanwhile, on the status of the light rail transit 3 (LRT3), the new contract is expected to be signed in one to two months, and LRT3 construction activities are expected to accelerate accordingly.

Fewer government infrastructure-related projects are expected to be awarded amid the country’s weak fiscal position. However, MRCB has only a modest to moderate reliance on government infrastructure-related projects and will not be severely affected. Government infrastructure-related projects account for only 23% of MRCB’s external awarded contract value of RM6.2 billion (outstanding order book: RM5.1 billion). On a brighter note, Putrajaya’s nod to proceed with the LRT3 project shall be viewed positively as MRCB will continue as project delivery partner (PDP), although the proposed “fixed contract” mechanism may contribute lower earnings versus the pre-agreed PDP fees. — UOB Kay Hian, Oct 12

This article first appeared in The Edge Financial Daily, on Oct 15, 2018.

Click here for more property stories.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.