Higher FY20 profit expected for Sunway REIT

Maintain buy with a lower target price (TP) of RM2: Sunway Real Estate Investment Trust’s (REIT) management targets to grow its property value to RM13 billion to RM15 billion by financial year 2025 (FY25), from RM8 billion at end-FY19, and diversify its asset base by increasing the allocation for service and industrial assets. Broadly, we like the management’s plan so long as the acquisitions are earnings-accretive. A diversified asset base should lower earnings risks, while a larger market capitalisation should increase the REIT’s liquidity (if acquisitions are partly funded by equity). While the management has yet to share its acquisition targets, we believe the asset pipelines of its sponsor (comprising retail, office, education and medical assets) are good candidates for future acquisitions.

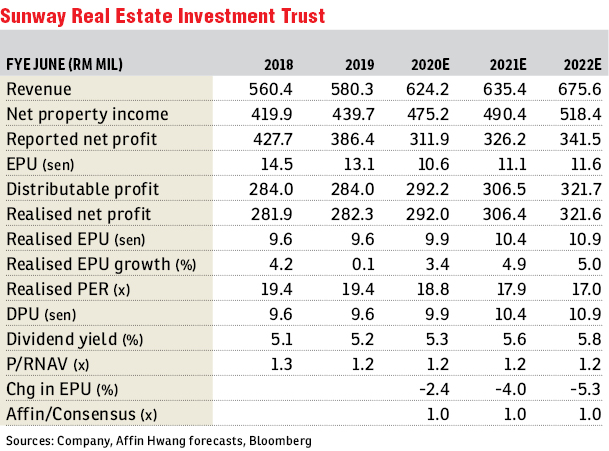

Having incorporated lower contributions from its hotel segment in view of soft market conditions, we lower our FY20-FY22 earnings per unit forecasts by 2%-5% and cut our Sunway Putra Mall revenue assumptions. Despite the earnings forecast revisions, we still expect Sunway REIT to report higher earnings for FY20 (+3.4% year-on-year), driven by contributions from Sunway University, a strong performance of Sunway Pyramid, and a recovery in revenue from Sunway Resort Hotel & Spa (from a low base).

In tandem with our earnings forecast revisions, we lower our dividend discount model-derived TP to RM2 (from RM2.08). We continue to like Sunway REIT for its diversified portfolio, attractive yield (5.3% estimated for FY20), proactive management team and strong pipeline of injections from its parent company, Sunway Bhd.

We like Sunway REIT’s long-term strategy to expand its asset portfolio by up to 88% by 2025. Further expansion in the service and industrial segments should help diversify earnings risks. With a 5.3% distribution yield estimated for FY20, its valuation looks attractive. — Affin Hwang Capital, Oct 24

This article first appeared in The Edge Financial Daily, on Oct 25, 2019.

Click here for more property stories.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.