KUALA LUMPUR (March 25): Glomac Bhd’s net profit for the third quarter ended Jan 31, 2020 (3QFY20) jumped more than eight times to RM12.14 million or 1.56 sen per share versus RM1.43 million or 0.18 sen per share in the previous year.

The property developer attributed the significantly increased profitability to contribution from higher margin projects, better performance by the property investment segment and overall administrative cost savings during the period under review, it said in a statement today.

Revenue for the quarter, which fell by 6.34% year-on-year to RM74.02 million compared with RM79.03 million previously, was underpinned mainly by its Saujana Perdana at Bandar Saujana Utama, Plaza @ Kelana Jaya, Saujana KLIA and Saujana Rawang developments.

For the nine-month period, net profit rose six times to RM21.19 million from RM3.5 million on the back of revenue of RM187.41 million, down by 2.59% from RM192.4 million a year ago.

Glomac said as at Jan 31, 2020, the group’s balance sheet remained robust with a cash position of RM172.5 million, whilst net gearing stood at 0.28x against its shareholders’ funds of RM1.1 billion.

Going forward, it said the group’s performance is expected to be underpinned by unbilled sales of RM626 million from the continued sales of ongoing high-rise residential projects such as Plaza@Kelana Jaya and 121 Residences.

“On the domestic front, the property market is likely to remain challenging and we will be adversely impacted by COVID-19 and movement control order. Notwithstanding the above, we have taken certain steps and will be taking further steps to circumvent and mitigate the challenges. The Group will continue to strategise to introduce suitable products that will appeal to its market segments.

“Longer term, Glomac commands a strong development portfolio with a potential estimated gross development value of RM8 billion to accelerate its development activities when market conditions improve,” it said.

Glomac ended one sen or 3.51% lower at 27.5 sen, bringing it a market capitalisation of RM213.45 million. The stock has lost some 26% year-to-date from its peak of 38 sen in January.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my. #stayathome #flattenthecurve

Click here to see residential properties for sale in Kuala Lumpur.

TOP PICKS BY EDGEPROP

Rawspace Business Park, Taman Sentosa

Klang, Selangor

Taman Perindustrian Meranti Jaya

Puchong, Selangor

Belvedere Residensi Laguna

Bandar Sunway, Selangor

Jalan Setiawangsa

Taman Setiawangsa, Kuala Lumpur

Ridgefield Residences @ Tropicana Heights Kajang

Kajang, Selangor

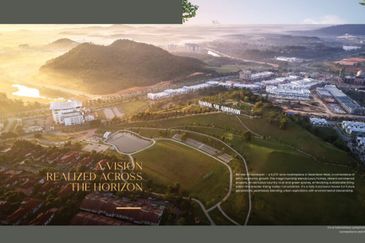

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan