Inheritance tax akin to punishing people's savings

The issue of inheritance tax has resurfaced again as one the proposals to enhance the Government’s revenue. However, it may not be fair to property buyers who have worked hard and saved their money for the next generations. The largest component of wealth or estate of the average rakyat is in the form of properties.

As there are no details yet on the proposed inheritance tax, we assume it will capture all classes of assets to be bequeathed to beneficiaries including properties. For the purpose of this write-up, we will focus our arguments against the tax by using property as an example. However, our arguments are also applicable for other classes of assets.

A tax on inflation

Over the long run, property prices are expected to increase due to factors such as inflation, increased demand for properties and scarcity of new properties as land is a limited resource.

Hence, investing in properties is deemed one of the ways to hedge against inflation as the appreciation in property prices is said to be higher compared to the increase in the official inflation rate.

By imposing an inheritance tax on properties, the Government is effectively imposing a tax on the inflation suffered by the house buyer.

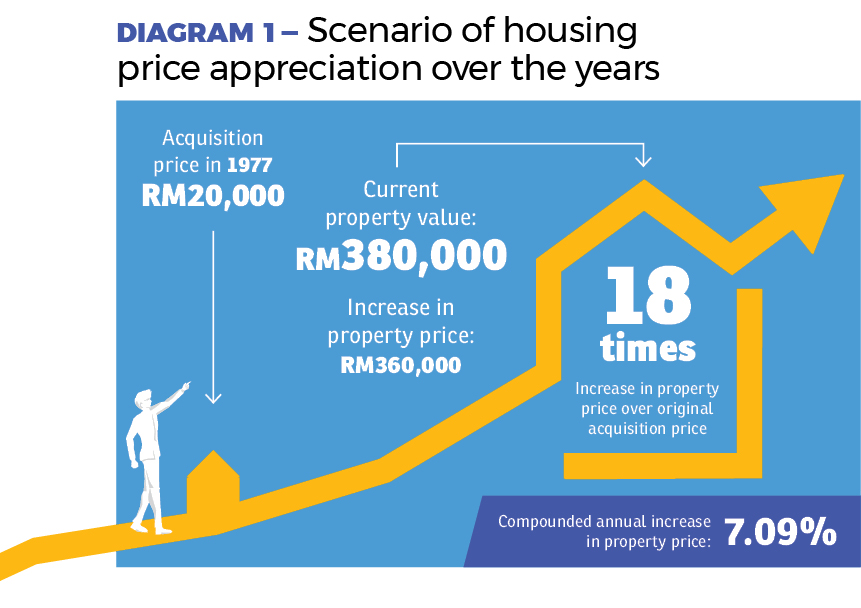

Consider the following example of one who bought a property in 1977 for about RM20,000 (Diagram 1). He subsequently got married and stayed in the same property until his demise in 2020. At the time of his demise, the value of the property is estimated to be RM380,000 and he had left a will for the property to be bequeathed to his wife.

While it may seem very impressive that the said property has increased in value 18 times from RM20,000, we must remember that this increase of RM360,000 was over a span of 43 years.

We have worked out that the compounded annual increase for this property from 1977 to 2020 is 7.09%. However, a large factor for this increase is due to inflation and when we talk about inflation, there is always the “official inflation rate” and the “real inflation rate”.

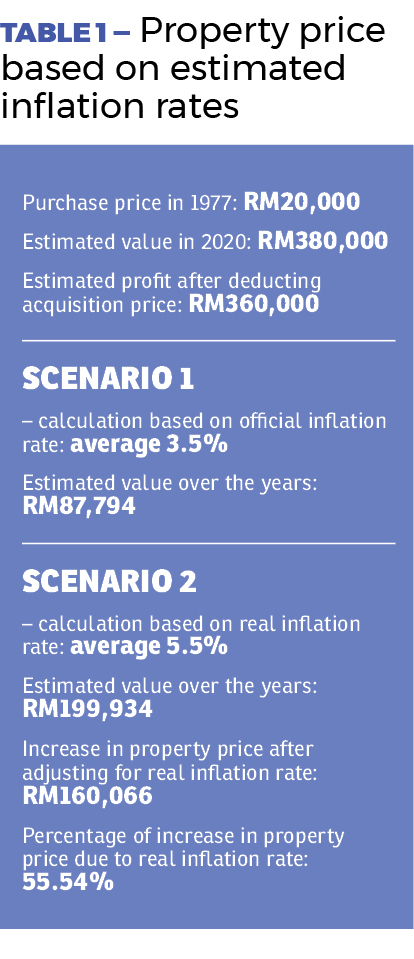

Now consider the impact inflation has on property prices (Table 1).

We do not have the inflation rate of Malaysia from 1977 until 2020 but for argument’s sake, we will use a prudent rate of 3.5%. By compounding this 3.5% rate annually for 43 years, the minimum value of the property from RM20,000 in 1977 would have increased to RM87,794 in 2020.

But is this official inflation rate of 3.5% an accurate representation of what is actually experienced by the rakyat? Ask anyone and they will tell you that there is no way that the real inflation rate is only 3.5% per year. Most people would say a range from at least 5% to 6%, and we will use 5.50% as a mid-point.

Now, by compounding an annual real inflation rate of 5.50% from 1977 until 2020, the minimum price of the property should have increased from RM20,000 in 1977 to RM199,934 in 2020.

Hence, the net increase in property price after adjusting for this real inflation rate has been reduced from RM360,000 to only RM160,066 and the real inflation rate accounted for about 55.5% of the increase in the property price.

If there were to be an inheritance tax, it is expected to be imposed on the estimated current market value of the estate. Thus, the beneficiaries of such properties are effectively paying a tax on the inflation rate suffered since acquiring the said property.

Taxed even if no economic gain realised

The proposal for the implementation of the inheritance tax is expected to be imposed upon the transfer of legal ownership of assets of the deceased to the beneficiaries. However, in many instances, the beneficiaries may be still residing in the bequeathed properties without realising any economic gain from perhaps the disposal of the properties.

Using our example above, the wife would have to pay an inheritance tax in order to inherit the property of her late husband. If she were unable to, the property would be seized by the Government and she would end up homeless.

A double taxation punishing years of hard work

It is the aspiration of every individual to improve his or her economic condition through saving and investing. To provide a better start for their children, parents would spend prudently and use the surplus savings from their income after paying taxes and other living expenses to invest in assets (including properties) that could yield returns in the future.

By imposing an inheritance tax on all the assets to be bequeathed to their beneficiaries, the Government is effectively punishing this segment of society by taxing them a second time. Why we say “taxing a second time” is these people are just using their surplus savings which were derived from incomes that had already been subject to income tax.

Inheritance tax is effectively sending the message to civil society not to work so hard or to save money for investments but just to have a happy-go-lucky lifestyle and spend all that we earn as we will be taxed again when we die for any assets that we have accumulated from our years of blood, sweat and tears.

No guarantee it will reduce economic inequality gap

The main rationale for the support of inheritance tax is that such a tax can help to improve the economic inequality gap in Malaysia. However, there is no guarantee that such an economic inequality gap can be reduced just by introducing an inheritance tax.

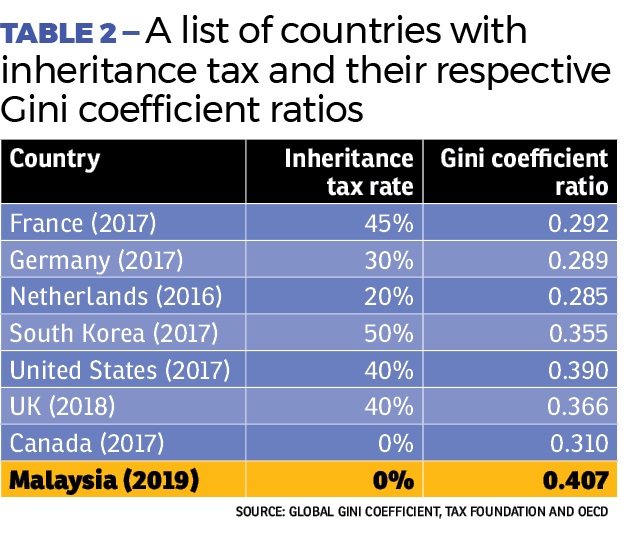

Income inequality is typically measured by using an economic model called the “Gini coefficient ratio”. A value of 0 means perfect income equality where everyone has the same wealth and a value of 1 means perfect inequality where all the wealth is held by one person and everyone else holds none.

As we can see from Table 2 (right), the Gini coefficient ratios of countries with inheritance tax vary by quite a big margin, with Germany’s inheritance tax rate of 30% having lower Gini coefficient ratio of 0.289 versus countries with higher inheritance tax rates such as France with 45% but with a Gini score of 0.292.

On the other hand, Canada, which does not have any inheritance tax, has a relatively low Gini score of 0.310.

This would imply that inheritance tax does not play a key role in reducing income inequality. Otherwise the Gini coefficient ratio should be consistent among countries with inheritance tax.

In addition, the Gini coefficient ratio of Malaysia at 0.407 is almost the same as the United States which has a ratio of 0.390. This means that Malaysia has managed to reduce its income inequality level to that of a developed country like the USA without needing inheritance tax.

There are many factors that have caused this economic inequality gap in any country including Malaysia, such as lack of educational opportunities and loss of jobs due to globalisation and industrialisation. However, inheritance tax is definitely not the “magic bullet” to solve this issue.

Punishment for those who succeed

If a taxpayer had worked very hard and paid all his taxes due and used the remaining money to invest in various assets such as properties, commodities and equities, it would be utterly unfair for these assets to be subject to inheritance tax on the demise of the taxpayer.

It is the aspiration of every rakyat to improve his or her economic condition and to ensure that his or her future generation has a better start in life. Imposing an inheritance tax is akin to punishing those who have managed to succeed. This will only demoralise the future generations and will reduce their motivation to further succeed in life.

As a developing country with the vision to one day join the ranks of fully developed nations, Malaysia must reward its citizens who can improve their own economic conditions as this will ultimately lead to the improvement of the overall economy.

HBA can be contacted at: Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

This story first appeared in the EdgeProp.my e-Pub on Dec 11, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.