Seven top developers dominate 70% of local market share - PublicInvest Research

PETALING JAYA (June 18): With increasing consolidation in the property sector, the market is seeing the industry being dominated by a few players with landbank that carried an estimated gross development value (GDV) of close to RM100 billion, said Public Investment Bank Bhd (PublicInvest Research).

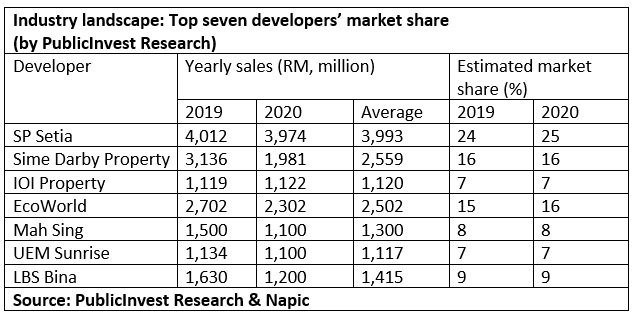

In a research note today, PublicInvest Research estimated that the top seven Malaysian developers have more than 70% of the local market share, out of more than 1,000 property developers.

"This is evident by the market share dominated by a few companies that currently focus on improving quality and cost advantage of scale. Industry concentration is often, although not always, a sign that an industry may have pricing power and rational competition," said PublicInvest Research.

Nevertheless, it noted that property players are riding on a cyclical recovery and are on stronger footing despite a few months of zero revenue due to lockdown restrictions.

The research house described 2020 as a painful year for the property sector as residential property sales slided by 9% and 8.6% year-on-year (y-o-y) to RM65.9 billion and 191,354 units respectively, primarily due to pandemic lockdowns.

However, the investment bank noted that pent-up demand from government initiatives such as the Short-term Economic Recovery Plan's (PENJANA) RPGT waiver and Home Ownership Campaign (HOC) 2020 are driving sales with demand momentum still encouraging despite MCO2.0.

"As such, most property developers are even expecting better sales in this year, as conditions are still conducive for property buying, notwithstanding unemployment risks," said PublicInvest Research.

It noted that residential property sales improved y-o-y in 1QCY21, with transactions increasing by 26.1% y-o-y but eased by 6.0% quarter-on-quarter (q-o-q).

“Unsold stocks also showed positive signs, decreasing by 0.3% q-o-q 1QCY21 due to fewer launches," said PublicInvest Research.

"Despite the pandemic pains, property developers, especially the bigger names, have proven to be strong and muddled through the crisis. While some developers had written down their assets given the difficult operating environment, this nevertheless puts them on a clean slate to ride on the potential post-pandemic recovery.

“More importantly, these players had the balance sheet strength to undertake such an exercise despite years of sectoral weakness," said the report.

The research house expected the sales momentum to continue into 2H2021 (if not better) as the inoculation process sped up. "Based on new launches of late, we note that the appetite for properties is still good, with some launches taken up within days," noted PublicInvest Research.

Meanwhile, the investment bank has upgraded the property sector call to 'Overweight' as the sector rides on recovery hopes and has outperformed the benchmark FBM KLCI by more than 5% year-to-date.

This is primarily on positive tailwinds of low mortgage rates, impending economic recovery, HOC initiatives and various stimulus measures by the government, namely the Prihatin Rakyat Economic Stimulus Package (PRIHATIN) and PENJANA, said PublicInvest Research.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.