Buyers dragged beyond Housing Tribunal’s quick and easy resolutions

Recently, there have been plenty of “judicial review” proceedings mounted by housing developers at the courts of law to challenge the jurisdictions of the Housing Tribunal through what we deem as deliberate frustrations on grounds of legal technicalities, forcing laymen to expend legal fees against the developers’ battalion of lawyers.

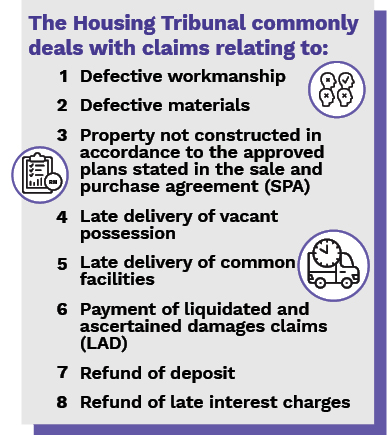

What is the purpose of the Tribunal for Homebuyers Claims, or more commonly referred to as the Housing Tribunal? Established on Dec 1, 2002 through an amendment to the Housing Development (Control & Licensing) Act 1966 (HDA), its purpose is to provide an affordable and expedient route for homebuyers to make claims to the maximum monetary compensation of RM50,000.

To properly understand the type of claims you can bring to the Housing Tribunal, you must understand Section 16N(2) of the HDA inter-alia: “cause of action arising from the SPA entered into between the homebuyer and the housing developer”.

The SPA of the property must be in accordance with Regulation 11 of the Housing Development (Control & Licensing) Regulations 1989 (HDR).

Section 16N(2) of the HDA goes further to provide that this claim must also be brought “no later than 12 months from”:

(a) the date of issuance of the certificate of completion and compliance (CCC) for the housing accommodation or the common facilities intended for subdivision (whichever is later);

(b) the expiry date of the defects liability period (DLP) as set out in the SPA; or

(c) the date of termination of the SPA by either party and such a termination occurred before the date of issuance of the CCC for the housing accommodation or the common facilities intended for subdivision (whichever is later).

Therefore, it can be seen from the provision above that the homebuyer is given a choice to bring a claim that is based on a cause of action arising from the SPA within 12 months of any one of the limbs.

The courts have found that the use of the word “or” must be taken disjunctively, thus giving the homebuyer a choice between the limbs.

The Federal Court in the case of Mary Colete John v South East Asia Insurance Bhd [2010] 8 CLJ 129 referred to the Court of Appeal case of Union Insurance Malaysia Sdn Bhd v Chan You Young [1999] 2 CLJ 517, where it was stated that “with the word ‘or’ … it means, to the learned High Court Judge that it should be read disjunctively. To read it conjunctively, he emphasised, would be doing violence to the word ‘or’.

Section 16N also provides that even if there has been no “physical” SPA entered into between the homebuyer and the licensed housing developer at the time the cause of action accrued, this will not affect or defeat the claim, as long as you can show that there is a “previous dealing” with regards to acquisitioning the property in question.

So, we can see that Parliament has left the Housing Tribunal’s jurisdiction wide enough to protect homebuyers in their dealings with housing developers.

Therefore, the aggrieved buyers can file their claims to the Tribunal for issues referred to above as long as the cause of action arises from the SPA.

Developer challenging Section 16N

This issue was argued in the Court of Appeal recently. A housing developer had appealed against the dismissal of a judicial review by the High Court which maintained the Housing Tribunal’s awards to seven buyers of a high-rise residential development in Johor. The claims were for LAD due to late delivery of vacant possession of their parcels and late completion of the common facilities.

The Court of Appeal on July 6, 2021 unanimously dismissed the developer’s appeal and upheld the decision of the High Court and the award by the Housing Tribunal, in line with what the courts have been interpreting.

Read also

Late delivery of property: Country Garden Danga Bay loses appeal

The Court of Appeal followed the decision of the Federal Court in the Westcourt case which held that: “The Court would further agree that, under Section 16N(2), so long as the claim before the Tribunal concerns a SPA between a homebuyer and a licensed housing developer, and was brought by the homebuyer not later than 12 months from the date of issuance of the certificate of fitness for occupation or the expiry date of the DLP, the Tribunal would have jurisdiction to hear the claim irrespective of the date of the agreement”.

Therefore, as the law stands today, to put it simply, homebuyers can bring their claims not later than 12 months from the CCC being issued or expiry of the DLP (which would be three years from them taking vacant possession of their units) or the date of termination of the SPA by either party (which will have to have occurred before the date of issuance of the CCC), as long as their claims arise from the SPA between the homebuyer and the housing developer.

HDA – a social legislation

The HDA is designed to protect purchasers and is a social legislation. This is reflected in the Federal Court’s decision in cases such as Ang Ming Lee & Ors v Menteri Kesejahteraan Bandar, Perumahan dan Kerajaan Tempatan & Anor and Other Appeals [2020] 1 MLJ 281 which held that the protection of homebuyers must be the “paramount consideration” in matters concerning developers and purchasers.

The Federal Court further stressed the importance of the HDA being a social legislation in the recent case of PJD Regency Sdn Bhd v Tribunal Tuntutan Pembeli Rumah & Anor and Other Appeals [2021] 2 MLJ 60, stating that the HDA provides in no uncertain terms, and that it exists “for the protection of the interests of purchasers and for matters connected therewith” in Peninsular Malaysia.

“[29] The social significance of the statute is further borne out by the words of Suffian LP in SEA Housing Corp Sdn Bhd v Lee Poh Choo [1982] 1 MLRA 148; [1982] 2 MLJ 31; [1982] CLJ 305 (‘SEA Housing case’) at p 34:

‘It is common knowledge that in recent years, especially when the government started giving housing loans, making it impossible for public servants to borrow money at 4% interest per annum to buy homes, there was an upsurge in demand for housing, and that to protect homebuyers, most of whom are people of modest means, from rich and powerful developers, the Parliament found it necessary to regulate the sale of houses and protect buyers by enacting the Act. …’

[30] It appears that even since 1982, housing developers have continued to devise ingenious, and if we may say so, devious schemes to overcome the protections afforded to purchasers by the scheme of the HDA 1966… How is the concept of social legislation relevant to the weeding out of such practices?”

This social legislation has indeed been put to the test by many “ingenious” ways that have actually affected the protection accorded to the homebuyers.

There remain uncertainties and gaps in the legislation, which, we believe, have been intended to make the legislation flexible enough to allow for more protection for homebuyers. Yet it leaves lots of wiggling room for housing developers too, a point which has not gone unnoticed by the courts as indicated in the Federal Court case of Westcourt Corp Sdn Bhd v Tribunal Tuntutan Pembeli Rumah [2004] 4 CLJ 203, where the court provided that:

“The Court would concur with the Court of Appeal that the jurisdiction of the Tribunal is as provided in Section 16N(2) of the Amendment Act. The provision of the Section, and of Sections 16N(3) and 16O(1) thereof, show that the Tribunal’s jurisdiction is loosely prescribed. This reflects the Parliament’s intention to provide a simple forum for homebuyers to file their claims.”

Judicial reviews to be exercised in the ‘rarest of cases’

In the case of Hazlinda Hamzah v Kumon Method of Learning Centre (Court of Appeal, Putrajaya [Civil Appeal No. W-04-78-2004] on March 6, 2006, Gopal Sri Ram JCA remarked that the Tribunal for Consumer Claims has several provisions to protect consumers from defective goods and services and to give claimants speedy reliefs.

The Parliament, in establishing the Tribunal, conferred it with extraordinary powers to do speedy justice for consumers. “As such, its awards should not be struck down save in the rarest of cases, where it has misinterpreted some provision of the Act in such as to produce an injustice.”

Despite this strong statement, too many Tribunal awards are taken on judicial reviews and some are quashed (or varied).

It makes you wonder if the above and other relevant cases and statutory provisions related to housing laws and the Parliament’s intention to protect house buyers are ever brought to the judges’ attention at the judicial review proceedings.

This article is intended to offer an insight of the case authorities and is not intended to be nor should it be relied upon as a substitute for legal or any professional advice.

Datuk Chang Kim Loong is the Hon Secretary-general of the National House Buyers Association (HBA) and Claudia Silva is one of HBA’s volunteer lawyers. HBA could be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

This story first appeared in the EdgeProp.my E-weekly on Aug 6, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.