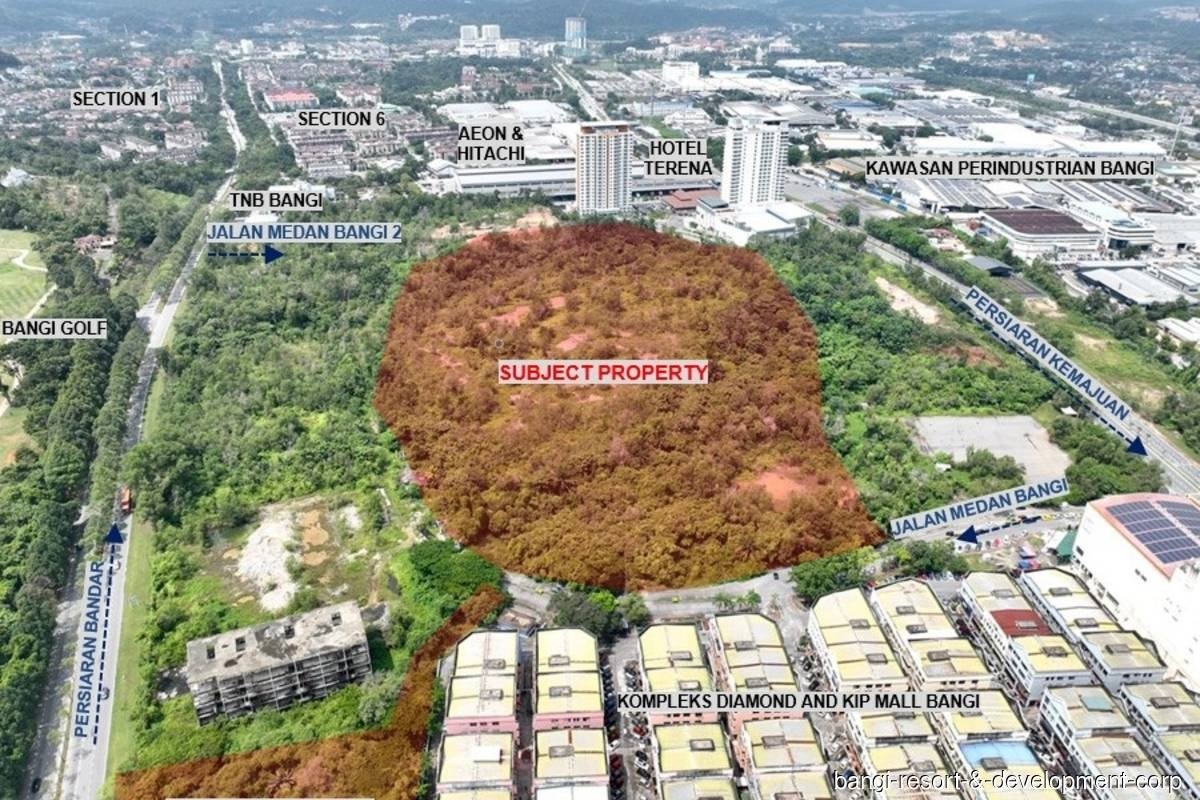

- The land is part of the 60.45-acre Bandar Baru Bangi Business Park Zone 4, Sekyen 9, and nestled right across the road from Bangi Golf Resort, which Bangi Resort & Development Corp owns and operates.

- VPC Realtors (KL) Sdn Bhd is the exclusive agent appointed for the said land parcel.

BANGI (Aug 23): Bangi Resort & Development Corp Sdn Bhd is looking to dispose of a 22-acre commercial land in Bandar Baru Bangi at an asking price of RM300 per square feet (psf).

In a press conference on Tuesday (Aug 23), Bangi Resort & Development Corp director Tan Ban Keat and Soh Chung-Ky said the leasehold land is made up of 13 parcels with sizes ranging from 52,496 square feet (sq ft) to 124,884 sq ft.

The land is part of the 60.45-acre Bandar Baru Bangi Business Park Zone 4, Sekyen 9, and nestled right across the road from Bangi Golf Resort, which Bangi Resort & Development Corp owns and operates.

“We have this land since day-one [of the development of Bangi Golf Resort] or 30 years ago. It is in a very prime location as the surrounding developments are matured now — [with] shoplots, malls, housing areas and industrial properties. It is the crown jewel of Bandar Baru Bangi and easily, the biggest commercial plot available in Bangi, Nilai and Kajang today,” Tan shared.

Tan said that now is the right time to unlock the value of this land, as Bandar Baru Bangi has limited sizeable development land for sale now, and as demand for land is increasing.

“We share the same vision as Bangi’s masterdeveloper — PKNS, which [aims] to develop Bangi into a regional growth centre in the south of Klang Valley. This land is very prime and we have been looking for a good time to let it go, so it can be turned into a significant development in the area.

“We think now is the time as high-rise development is mushrooming in the area, the demand of commercial property is on the rise, and more MNCs [multinational companies] are setting up facilities here in Bangi. The area is pretty matured now and ready for the next growth,” he added.

Meanwhile, Soh shared that the company is not keen to be in a joint venture to develop the land, as the company’s business has been focused on hospitality over the past decades. The company also prefers to sell all 13 plots to a company or a consortium, rather than to different owners, to ensure the land will be properly planned and developed. “We are not in a rush to sell and definitely not [simply] selling to anyone. In fact, the company has zero gearing and our hospitality business is doing quite good," he said.

To explain the asking price of RM300 psf, Soh said: "In 2017, we sold a smaller piece of commercial land located nearby for RM300 psf — that is our benchmark. We are not going any lower than that. If someone sees the potential of the land and knows the location, they will know it is worth the price."

VPC Realtors (KL) Sdn Bhd is the exclusive agent appointed for the said land parcel. The agency's managing director James Wong, in his presentation during the press conference, said the land is located within an area that has been zoned for commercial use and has an allowable plot ratio of 1:5, which makes it suitable for developments including serviced apartment, SOHO, office, hotel, shopping mall, data centre, as well as institutional developments for higher education or medical purposes.

“There is no stipulated building height restriction in the area. What is important is the 5G hub, which will be located at Bangi Resort Hotel and is estimated to complete by end-2022. With the 5G hub, internet connectivity in Bandar Baru Bangi will be improved,” Wong shared. He added that the land is an ex-oil palm estate and hence, possesses good soil profile, which will minimise piling.

He also pointed out that within the 13 plots, there are internal road reserves, which upon amalgamation will result in an additional development land area of about two acres. “In addition to the amalgamation, it will also allow for better planning of a master layout plan for the entire development.”